High Inventory, PVC Market Waiting for Demand of “Spring Breeze”

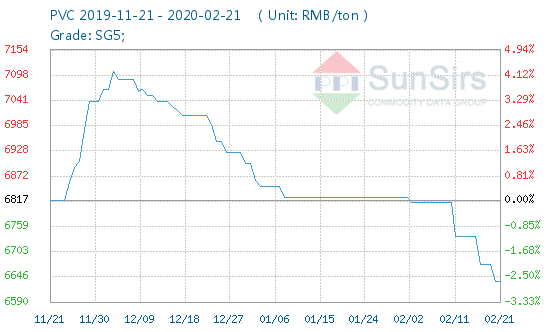

The average price of mainstream PVC in China was 6612.5 RMB/ton on February 23, down 0.94% from 6675 RMB/ton at the beginning of the week (17th), and up 4.13% compared with the same period last year. The PVC commodity index on February 23 was 83.79, unchanged from the previous day, down 16.21% from the highest point of 100.00 (2011-Sept-05), and up 43.80% from the lowest point of 58.27 on December 20, 2015 (note: cycle refers to 2011-Sept-01 till now).

Products aspect, PVC has high inventory at present. The spot price is falling with obvious benefit-returning behavior. PVC production enterprises are plentiful. Under low start-up rate and inventory pressure, some enterprises actually have a loss. Meanwhile, although there is a ease of local logistics, it is still hard to stimulate demand as downstream is slow to resume especially for construction industry, who may delay to April.

Under such weak market, the enthusiasm of enterprises into the market is low, and the attitude of the middle traders is negative. The pressure of shipment is greater and PVC spot market trading is weak with limited transaction. In addition, there are some production enterprises not reporting. The market is interwoven with long and short position. It is hard to change the weak condition of PVC market.

As of February 21, the mainstream quotation range of domestic PVC is 6,350-6,600 RMB/ton. At present, the mainstream PVC5 calcium carbide in Changzhou is around 6,220-6,360 RMB/ ton. The PVC5 calcium carbide in Hangzhou is around 6,200-6,360 RMB/ ton, and the mainstream price of PVC calcium carbide in Guangzhou is around 6,180-6,220 RMB / ton.

Futures aspect, PVC main V2005 contract fell slightly, closing at 6315 RMB/ton, more than the previous trading day +55 RMB. Volume: 103,052 hands, + 19,215 hands; Holding position: 207442 lots, +14539 lots; base difference: -45 RMB, -85 RMB; 5-9 price difference: -80 RMB, +25 RMB.

Industry chain aspect, the recent rise in crude oil prices, facilitating ethylene market to rise. Therefore, it is expected that ethylene prices will remain a narrow range next and it do not rule out the possibility of rising.

As for Calcium carbide, its factory price slightly increased. The downstream customers calcium carbide procurement enthusiasm is general and calcium carbide supply is tight. In the short term, calcium carbide will small fluctuated.

Industry aspect, there are two kinds of rubber and plastic products rising in the commodity price rising and falling list in the 7th week of 2020 (Feb.17-21). The top two rising commodities are PET (0.81%) and LLDPE (0.49%). There were 9 kinds of commodities that declined on a month-on-month basis, 1 of which dropped more than 5%, accounting for 6.3% of the monitored commodities in this sector. The top 3 products were styrene-butadiene rubber (-6.19%), styrene-butadiene rubber (-4.58%) and HDPE (-4.03%). The overall decrease rate is -1.25% this week.

Market Forecasting aspect, toodudu PVC analysts think PVC industry is in the low season. Coupled with the slow return of downstream enterprises, demand is difficult to improve. ThePVC market weakness in a short time is hard to change. It still need to pay attention to the macro and downstream enterprises return to work.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com.

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024