China PE Spot Prices Showed a Gradual Decline in October

One month after the double holiday, the plastics industry showed a negative trend. Macro level, the dollar strengthened in October, the U.S. economic data eye-catching. The market is worried that the Fed is still expected to raise interest rates. On the cost side, increased diplomatic efforts in international geopolitical conflicts have greatly eased tensions. Export restrictions in Venezuela were also eased. Crude oil prices are expected to weaken due to increased market supply and pressure volatility. Meanwhile, downstream plastics companies have little willingness to actively stabilize inventories, consumption lags behind and market momentum is weak. Plastic futures prices fell sharply due to the impact of reduced consumption and cost fluctuations.

According to Todudu product market analysis system, as of October 26, the monthly average spot price of each product from low to high, in order of PP (drawing)-3.13%, PVC-3.14%, LLDPE-. 3.17%.

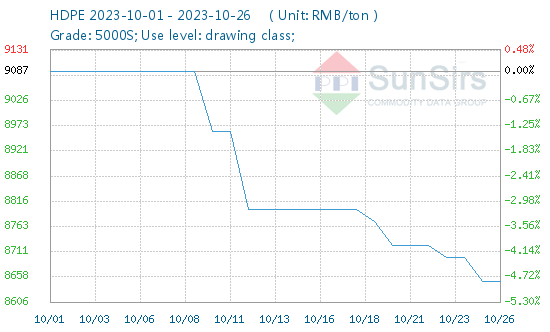

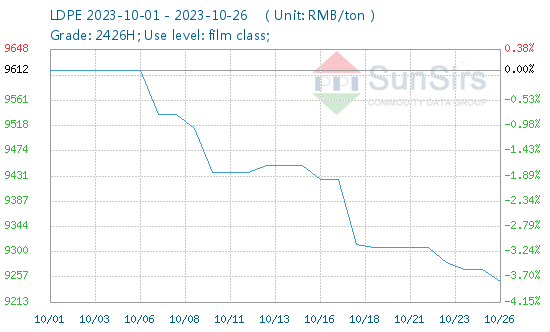

Since October, polyethylene spot prices have gradually declined. According to Doudou Commodity Market Analysis System, on October 26, the benchmark price of LLDPE was RMB 8,171.43 per ton, down-3.17% in range. Other types of polyethylene products also declined to varying degrees. On the cost side, the international crude oil market shook down, and the support for polyethylene raw materials weakened. In order to reduce inventories, petrochemical companies lowered their ex-works prices and traders followed suit. Market demand was lower than expected this month, and the market bought cautiously. Demand for agricultural films during the peak season was sluggish, and market purchases were dominated by rigid demand. Demand for packaging film is expected to improve during the e-commerce festival, but no significant growth is expected for the time being. In order to promote transactions, merchants often sell at discounted prices and offer profits to promote transactions. On the futures front, PE 2311 closed at 8028 on Oct. 26 and settled at 7963. The market was weak and volatile, with no impact on spot prices. At present, PE market demand is low and cost is weak. The market is expected to remain weak in the short term.

In October this year, the plastic futures and spot market three materials weakened at the same time. Macro-wise, the external economic environment is limited to improve. With the future increase in crude oil supply, the cost support role of plastics may weaken. At present, the collective enterprise start rate is high and stable, with sufficient product supply. With the rapid cooling of the peak season for plastics, terminal enterprises have been stocking up for stocking up. In summary, the bearish outlook for plastics futures centers on low costs and low demand. Market guidance for PE and PP plastics is expected to remain unchanged in the near term and the market is likely to remain weak. PVC may recover due to rising futures.

For any queries, please feel free to contact toodududu (tdd-global@toodudu.com).

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 20, 2024

June 20, 2024  June 18, 2024

June 18, 2024