Retreat of Western investment in – and reliance on – China

For several decades until last year, China was regarded as the workshop of the world. Businessmen and women flocked there to have the production of computers, fashionable clothing, electro-domestics and toys undertaken in an increasingly welcome business environment.

It is a megatrend that is rapidly changing. It is not only the severe lockdowns to combat Covid-19 that have changed the mood. There has also been a slump in the housing market, with property companies over-stretched financially, and a crackdown on hi-tech companies such as Alibaba that were becoming too powerful.

And while global foreign direct investment in China hit a record high in 2021 – according to the United Nations Conference on Trade and Development Investment Trends Monitor – foreign fund managers are now viewing such changes with dismay. And the flow of capital from the West into China has gone into reverse…

This post is an excerpt of the Tecnon OrbiChem white paper:

Retreat of Western investment in – and reliance on – China

A shifting, adapting, evolving chemical value chain

Complete the form below the post to access the full white paper free of charge.

Chinese shares in Hong Kong and New York have lost $21trn in value over the past year. The value of Rmb-denominated financial assets held by foreigners dropped by Rmb1trn ($150bn) in Q1 2022. Investment groups have become wary of potential risks from increased regulation and slowing growth.

A live audience to the World Economic Forum Annual Meeting in Davos, Switzerland this May – entitled History at a Turning Point: Government Policies and Business Strategies – indicated overwhelmingly that globalisation is currently in retreat, and not advancing.

Such sentiment in a newly post-covid/Russo-Ukraine war-impacted world is perhaps unsurprising sentiment. Especially given the Wall Street Journal’s recent focus on tech giant Apple’s global production diversification plans and Financial Times editorial on China’s foreign investment fading.

‘…BASF is investing $10bn in China. To remain the world’s No.1 chemical company, it has no alternative’

Charles Fryer, Tecnon OrbiChem founder and senior advisor

But not all companies have, or dare to have, such a pessimistic view. Many companies have worked for decades to establish themselves in China and are still expanding, hoping that the present slowdown is temporary.

Time & treasure invested

As an example, BASF has spent time and treasure in building up its manufacturing in China. Now, increasing costs of energy in Europe, and uncertainty on supply of natural gas from Russia, are making BASF consider expanding its involvement in China. BASF is investing $10bn in Zhangjiang in southern China. BASF has no alternative to expanding in China – the world’s largest chemical market – if it wants to remain the world’s No.1 chemical company.

It appears that investors in China will divide into two strands. Companies like BASF with an established presence are likely to continue with a policy of engagement and expansion. On the other hand, financially-driven companies – that have accessed the Chinese market through Hong Kong for example – are likely to reduce their exposure to what they see as growing risks. Businessmen and women needing workshops are likely to look increasingly to south and southeast Asian countries to have their goods made cheaply and reliably. They will also be looking closer to home, seeking to onshore to a domestic location.

Broadening port problems

Tecnon OrbiChem comprehensively covered congestion at Chinese ports driven by inability to load and unload cargoes following the government’s zero-covid lockdown, especially in Shanghai. Albeit with different triggers, similar issues are impacting the port of Hamburg in Germany. As the country’s largest, it is key to distribution of cargoes coming from overseas to Central and Eastern Europe.

The country’s Die Welt newspaper reports dozens of container ships await entry to the port, with large freighters delayed up to 14 days. Hamburg’s port logistics company (HHLA) says imports from the Far East are not being transported quickly enough by truck and train to the hinterland, causing a cargo container traffic jam.

And, it says additional problems are on the horizon as dockers contemplate a strike amidst ongoing wage negotiations. The last time there were major strikes in the port of Hamburg was in the late 1970s. ‘If it comes to that, we’ll have a super meltdown in Hamburg,’ one shipowner told Hamburg’s daily newspaper the Abendblatt.

Containing a crisis

Daniel Richards, associate director at business management consultancy Maritime Strategies International based in London, UK, agrees that port congestion is getting worse in Europe.

‘For end-users of container shipping services, the situation in Europe remains chaotic and costly. Congestion within and outside North European ports has worsened over the first half of 2022, in contrast to improvement in the previous hotspots on the US West Coast.

Containers initially destined for Russia and Ukraine were offloaded early at other destinations, occupying space at ports and slowing operations. Average freight rates remain multiples of pre-pandemic levels for many importers and exporters.

‘A slowing world economy and increased vessel deliveries from 2023 are expected to bring the cost of containerised cargo back down to earth, but in the meantime supply chain participants should continue to expect a bumpy ride this summer as cargo volumes rise on a seasonal basis,’ Richards adds.

Adapting, shifting evolving supply solutions

What’s happening as the consequences of wider politico-economic decision-making and unforeseen events like the pandemic is essentially a scramble to maintain everything as it is by doing everything differently due to circumstance beyond individual or corporate control.

Trade routes in southern Europe are changing, Die Welt further reports. More and more goods are being brought to European markets from the Mediterranean – instead of via the larger ports in Northern Europe. Among other things, the disruptions to global transport routes since the beginning of the pandemic make the shortcut through the relatively small ports on the Mediterranean seem attractive to logisticians.

As the situation worsens, the HHLA has promised to resolve the congestion and currently has additional container warehouse space under construction. In 2021, China’s shipping company Cosco announced a $1.5bn vessel investment to relieve growing pressures on fleets. However – in the context of wider supply chain issues and growing interest in deglobalised value chains – these moves may prove mere sticking plaster attempting to stem a hemorrhage.

Epoxy resin spotlight

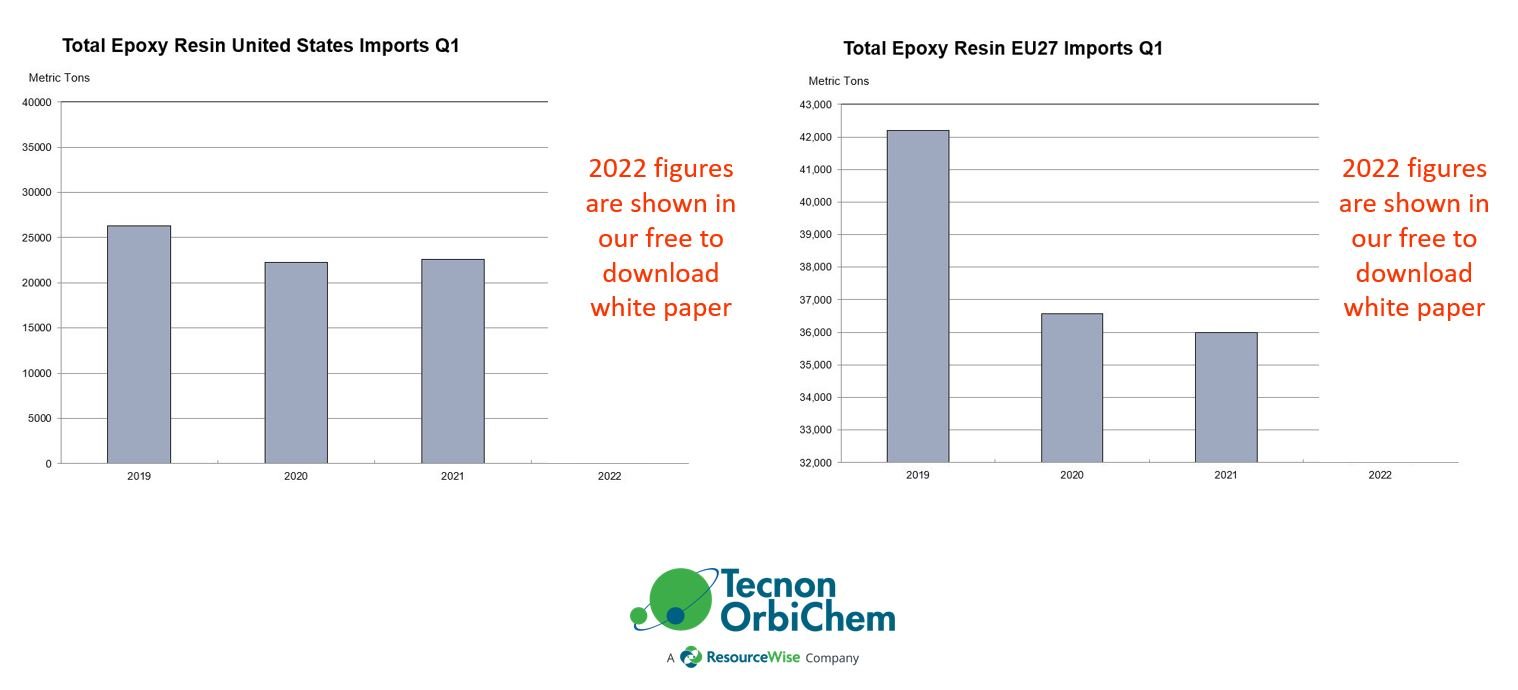

Business manager Jennifer Hawkins says imports of epoxy resins to Europe in Q1 2019 were 42,204 tons, and as expected these were down by 13.3% and 14.7% compared to the same period in 2020 and 2021 respectively.

‘Q1 2022 imports did pick up again, but they are still down compared to the same period in 2019.

Globalisation was put on hold for two years, but it appears to have been creeping back in the first half of 2022 – distressed margins and slowing demand in Europe are forcing customers to widen their search. In the US, Q1 2019 imports were 26,308 and these dropped by 14-15% in 2020 and 2021, but in Q1 2022 they have increased again

More indepth analysis of epoxy resin market trends – plus full Q1 2022 import figures for the US and Europe – is available in the white paper which you can access by filling the form at the end of the blog post.

Speedier, more reliable supply chains

The Future of Globalisation panel discussion livestreamed from this year’s World Economic Forum Annual Meeting featured Procter & Gamble’s Europe president Loic Tassel.

He said the company was ‘re-regionalising’ its supply chain and ‘looking at a more regional supply chain set up than previously’.

‘The price to pay or time to wait for some of our product from China to Europe is no longer compatible with our industry which is called fast-moving consumer goods,’ Tassel added.

Going forward, he said ‘90% plus of what we are selling in Europe will be produced in Europe – a profound change which will be a lasting one – until the end of this decade.’ Tassel stressed it was not a pause or contrast to globalisation, but on supply the regional reliability of transport and the supply chain is going to play an increasing part.

Meanwhile, the board chairman at healthcare firm Roche, Christoph Franz, told the Swiss Broadcasting Corporation the company is seeing more localisation of value creation. And Franz expects more companies will investigate the risks of globalisation and ‘attribute different values to supply chain security going forward’.

Chemicals shipping: Long-view

The chemical tanker market has been less disrupted by the Covid crisis compared to the container shipping system, with smoother loading and unloading procedures.

But a bottleneck in chemicals shipping could emerge in a few years’ time.

‘Many chemical tankers are somewhat old, at 17-18 years, and will need to be replaced when they reach 25 years’ according to Gina Fyffe, CEO of Integra Petrochemicals, a trading and shipping company based in Singapore.

‘It takes four years from placing an order for a chemical tanker to having it in service. This means that shipping companies must decide within the next few years to place orders for new tankers, if they want to stay in business’ she adds.

Fuel choice dilemma

But companies are not placing orders at present, because of the uncertainty on propulsion units that will be needed over the next 25 years. Ships use predominantly low sulphur fuel oil as bunker today, but there is uncertainty whether such fuel will be available in sufficient quantities, long into the future, as the world progresses to sustainable fuels.

Maybe there will be a switch to new fuels, but which? Methanol, ammonia and dimethyl ether are possibilities, being usable in present engines, with modification. But which will prevail? In the end maybe hydrogen will be favoured, but this requires new engines and different on-board storage.

If the way does not become clear shortly, allowing orders to be placed for new ships, a shortage of chemical tankers could emerge within a few years as old vessels reach the end of their life.

Access the full white paper for analysis of movement with orthoxylenes & phthalic anhydride, methyl methacrylate, unsaturated polyester resin, maleic anhydride, PVC, acetic acid & VAM, PET & polyester and biomaterials. The white paper also shows epoxy resin imports to US and Europe in Q1 2022.

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024