Prospects for China PE Market in 2024

In recent years, the global economic growth rate has slowed down. At the same time, limited improvements have been made to global issues such as inflation and geopolitical conflicts, leading to increased risks in commodity operations. In addition, factors such as OPEC+ production reduction policies have led to high crude oil prices, and the PE industry, as a downstream product of petrochemicals and coal chemicals, has been affected by many negative factors. The market situation in 2023 is facing numerous obstacles. Can the price of PE be revitalized in 2024, and will the three-year low point in the middle of last year reappear? This analysis takes you forward to the trend of PE in 2024.

Currently, China is still in a period of rapid expansion in the PE industry. According to statistics, the total number of new PE production units in 2023 is about 5 million tons/year or more, with a production capacity growth rate of over 20%. After the previous year, it has once again entered a peak period of production. In 2024, it is expected that the expansion scale will be over 8.8 million tons per year. At that time, China’s annual PE production capacity may reach 48.57 million tons/year, and the growth rate of production capacity will continue to reach new highs.

With the continuous increase of production facilities, domestic production has significantly improved. Compared to the total domestic production of about 29.7 million tons in 2022, the national PE production in 2023 increased by 8.38% to approximately 32.19 million tons. The continuous accumulation of supplier forces has formed a long-term drag on the spot price market, making it difficult to find favorable conditions on the supply side.

On the other hand, under the high growth rate of 20% in domestic PE production capacity, the annual production growth of 8.38% seems to be not well matched. The reason for this phenomenon is that under the high-speed expansion cycle of the PE industry, local resource surplus forces internal adjustments within the industry. The industry consensus in 2023 is to rotate and reduce the production load of the equipment, thereby squeezing out marginal production capacity and sharing supply pressure. In fact, as early as 2022, there has been an increase in rotational production reduction operations among refining enterprises. In 2023, reducing enterprise burden has become an important means for the industry to avoid operational risks and has become popular, resulting in a new low in the operating rate of PE enterprises last year.

The growth rate of PE demand is not only difficult to match the ultra-high supply growth rate, but also in the current macro context of global economic slowdown, downstream enterprises have a reduced willingness to expand and fewer investment opportunities. In addition, due to the sluggish consumption of end products, downstream PE enterprises have been concerned about their prospects and have also joined the low load operation team.

Last year, the country actively introduced a series of policies to promote consumption. Among them, although policies such as home appliance subsidies and exemption of purchase tax for new energy vehicles directly benefit PE consumption, downstream enterprises of PE are generally operating steadily and have weak market confidence. The average operating rates of downstream PE, including plastic weaving, injection molding, and BOPP film, in 2023 were 41.65%, 57%, and 61.80%, respectively. The limited increase in factory orders essentially creates a drag on the demand side of PE.

With the continued increase of domestic production facilities, the diversified layout of the PE industry is gradually deepening, and the process of industrial integration is gradually improving. The discourse power of China’s PE industry in the international arena is strengthening. The combination of domestic PE price advantage and the gradual satisfaction of domestic consumer demand undoubtedly laid a good foundation for expanding PE exports. However, due to insufficient overseas purchasing capacity and interference from factors such as exchange rates, tariffs, and shipping costs, the growth of PE exports in 2023 was slow, with an annual export volume of only about 1.37 million tons. The export window period within the year is generally short and scattered, making it difficult to achieve significant volume increases. It is expected that China’s PE export market will continue the pattern of last year in 2024.

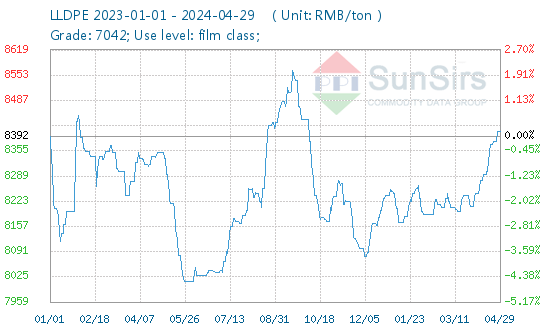

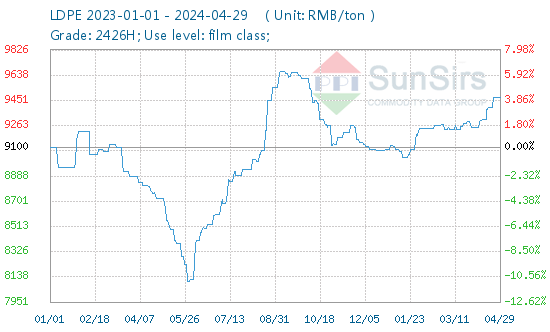

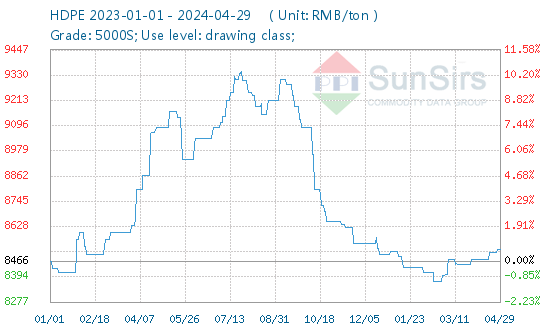

According to the Commodity Market Analysis System of toodudu, the PE market has recovered after a decline in 2023. As of December 31, last year, the mainstream quoted price for T30S (wire drawing) by domestic manufacturers and traders was 7,650 RMB/ton, a decrease of 2.65% compared to the average price at the beginning of the year.

Although the economic recovery force is expected to be strong in the first half of the year, PE prices have fallen to a low point due to weak realities such as energy decline. The Chinese side will digest all the negative news until the end of the year. Due to the impact of the traditional peak demand season and the recovery of the energy sector, the market rebounded significantly in the third quarter. However, due to the long-term weak support from the supply and demand side, there was significant upward resistance in the PE market in the fourth quarter, and the overall performance was characterized by a slow fluctuation.

Overall, in recent years, various international forces have occasionally disrupted the energy market and smooth shipping, coupled with the slow pace of global disinflation, and the recovery of the macroeconomic environment still needs time. Many factors have made it difficult to find a favorable situation for the PE market. At the same time, the biggest resistance to the domestic PE market comes from the mismatch between supply and demand, and the competition among local enterprises is becoming increasingly fierce. It is expected that the PE price trend in 2024 may be difficult to rise or fall.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com.

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024