The Positives Were Limited, and the PE Market Continued to Drop This Week

Price trend

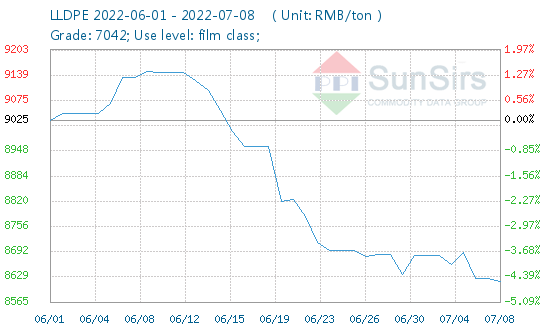

According to the data monitoring of toodudu, the domestic price of LLDPE (7042) was 8,682.86 RMB/ton on July 1, and the average price on July 8 was 8,611.43 RMB/ton, a decrease of 0.82% during the period, a decrease of 4.58 compared with June 1. %.

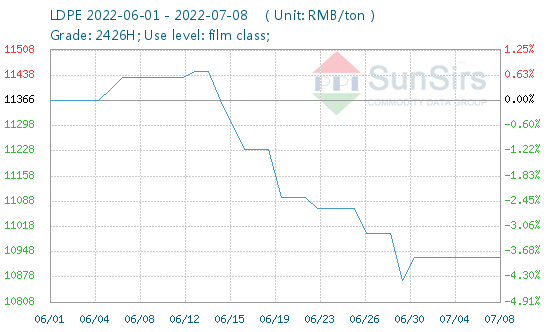

According to the data monitoring of toodudu, the average ex-factory price of LDPE (2426H) on July 1 was 10,933.33 RMB/ton, and the average price on July 8 was 10,933.33 RMB/ton. During the period, the price remained stable, down 3.81% from June 1.

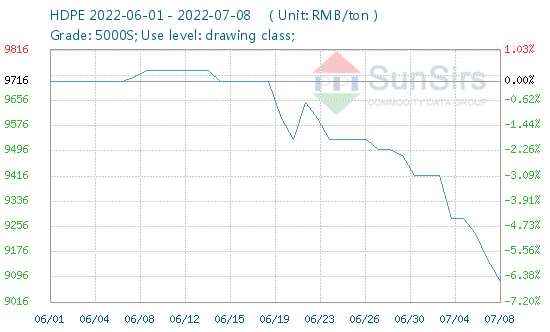

According to the data monitoring of toodudu, the average ex-factory price of HDPE (5000S) on July 1 was 9,416.67 RMB/ton, and the average price on July 8 was 9,150.00 RMB/ton, with a decrease of 2.83% during the period, which was lower 5.83% than that on June 1.

Analysis review

At the beginning of July, the domestic PE market prices were mostly lowered. During the month, the three major varieties continued to weaken, and the prices fell steadily. Among them, LLDPE and HDPE were lowered, and LDPE remained stable. The market’s favorable support was insufficient. At the beginning of the month, the international crude oil price oscillated downward, and the cost brought obvious negative to the market. Some petrochemical companies lowered their ex-factory prices by 50-300 RMB/ton. The downstream was cautious and still maintained just-needed purchases, and the enthusiasm for entering the market was not good. The market lacked favorable support, and the merchants’ mentality was general, and the prices were mostly lowered.

On July 8, the opening price of PE futures 2209 was 8,248, the highest price was 8,396, the lowest price was 8,241, the closing price was 8,357, the previous settlement price was 8,168, the settlement price was 8,335, up 189, the trading volume was 414,794 lots, the open interest was 339,066 lots, and the daily increase position was -14,964 lots. (quotation unit: RMB/ton)

Market outlook

At present, the trend of international crude oil prices is uncertain, and the benefits brought by the cost to the market are limited. The ex-factory prices of petrochemical enterprises are mostly falling, and the market mentality is general. In addition, the downstream demand is weak, and the procurement is still maintained on demand. The market is not good enough, and the quotations of merchants are mostly lowered. It is expected that the spot market of PE may still be weak in the short term.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024