Early August, The Polyethylene Market Pulls Back to The Rising Trend

In August, the polyethylene market price of the three major brands rose to 100250 yuan per ton. East China LLDPE showed a trend of first rise and then retracement, LDPE, HDPE is a cyclical upward trend. Among them, LDPE rose most significantly, with an overall increase of 2.75% in early August. Upstream procurement is still tight, the overall spot market transactions have improved, the polyethylene market stopped falling back up.

According to todudu monitoring data, in August 2019 LLDPE (East China Street 7042) August 1 ex-factory average price of 716.67 yuan / ton, August 12 average price of 723.33 yuan / ton. 7233.33 yuan / ton, up 0.93%. This period was 2.60% higher than July 1st. Center.

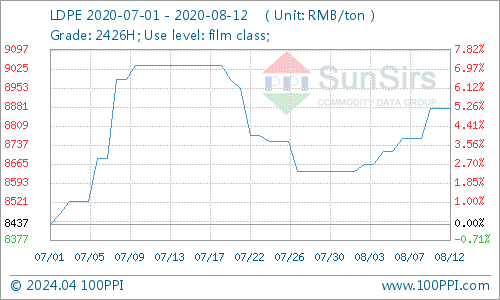

The average ex-works price of LDPE (2426H) in East China was RMB 8,637.50/mt on August 1, and RMB 8,875.00/mt on August 12, up 2.75% during the period, and up 5.19% from July 1st.

The average ex-factory price on August 1 was 8100.00 yuan/ton, and the average price on August 12 was 8200.00 yuan/ton. The rate of increase during the period was 1.23%, up 4.90% from July 1st.

July market first up and then down

In early July, polyethylene rose sharply, continuing the trend of June. Crude oil continued to oscillate at high levels, supporting the market. The continued rise in linear futures actually boosted market confidence. In addition, the centralized maintenance of petrochemical enterprises has not yet been completed, and the daily output of petrochemical products is still at a low level, with little burden on spot supply. Petrochemical companies continued to raise ex-factory prices, while satin fabrics, due to lower prices in the previous period, rose most significantly, from RMB 250 per ton to RMB 550 per ton. Costs continue to rise, the market rises, traders have a positive mindset, the trend is mainly up.

At the end of July, polyethylene lacked the power to continue to rise, and entered a downward channel. In the second half of the month, Zhongtian and Sinopec resumed work to drive the start-up rate back up, and market supply increased compared with the previous period. At that time, the downstream industry was in the off-season, affected by social and public health events, the start-up rate was low. Downstream demand was average and market enthusiasm was low. Supply was adequate as most purchases were small orders and replenished as needed. Dalian futures fell sharply, affecting spot market behavior. Selling prices of factories in key areas also declined, and market transactions were dominated by low levels. Traders had an overall mindset and followed a downward trend.

Early August, the polyethylene market pulled back to the upward trend

In August, the polyethylene market pulled back due to reduced downstream demand. Earlier in the month, sales of petrochemicals were under pressure and mills in some regions raised prices to boost market sentiment. Linear futures were rising, which favored the market. During this period, crude oil gradually rose, which gave some support to the market. After the price increase in key areas, merchants chased the price increase, and downstream enterprises just took the goods, and the market trading atmosphere was positive. At present, port inventory is still at a low level, and 2-barrel oil inventory is also at a low level. In the short term, the market supply pressure is not big. However, with the trial operation of the new device and subsequent arrangements for the maintenance of petrochemical plants, it is expected that production will gradually resume and market supply will increase.

Ethylene market down since August upstream

Due to the decline in raw material prices, the support for the PE market is limited. The overall ethylene is on a downward trend. Asian ethylene market prices fell. As of 11th, CFR Northeast Asia closed at $755-765 per ton, CFR Southeast Asia closed at $695-705 per ton. European ethylene market prices fell. As of 11th, in the European ethylene market price, FD Northwest Europe closed at $702-709/mt, CIF Northwest Europe closed at $692-700/mt. Ethylene prices rose in the US. As of 11th, the price was between $385 and $403/mt. Overall, the Eurasian ethylene market is on a downward trend, and the U.S. ethylene market was also down sharply in the early part of the year. Now the overall demand in the ethylene market is rebounding a bit and the trading atmosphere is average.

PE market after the market or maintain high shock

At present, the international crude oil trend is limited support for the market. Raw material ethylene mainly fell, linear futures continue to turn green, the market is unfavorable. In addition, the new device is expected to be put into production in August, the petrochemical plant maintenance is expected to be completed, the market supply will increase. If downstream demand remains insufficient and no follow-up measures are taken, growth in the PE market may be hindered. However, demand for agricultural films is improving, and port stocks and petrochemical stocks are low. In the short term, favorable support still exists. There is little pressure on supply. The PE market is expected to continue to be highly volatile.

If you have any questions, please feel free to email todudu at tdd-global@toodudu.com

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024