Caustic Soda Ran under Pressure in 2020, and the Price Continued to Decline

Price trend

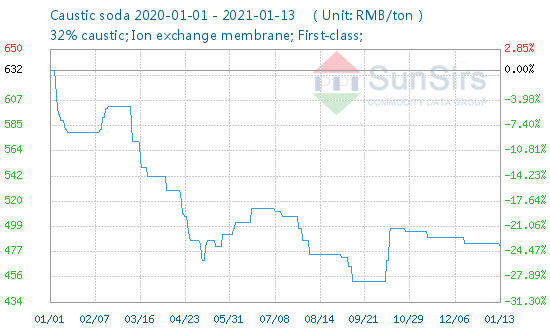

According to the monitoring data of toodudu, the average market price of caustic soda at the beginning of the year was 632 RMB/ton, the average price of caustic soda at the end of the year was 485 RMB/ton, and the price of caustic soda fell 57.23%.

2020 is not an easy year for caustic soda, and the price has dropped to the bottom. According to data from toodudu, caustic soda was on a downward trend throughout the year, with prices rising only in February, May, June, and October. And the entire annual price was lower than the two years of 2019 and 2018, the price of caustic soda was trending difficult.

Analysis review

The price of caustic soda was mainly weak and stable in January. The overall performance of the domestic caustic soda market was calm, and the demand side continued to be weak. There was no positive support for the caustic soda market. The supply expectation had decreased. The market players mainly were waiting and seeing, and the market trading atmosphere was general. Lack of demand support, the domestic caustic soda market continued to operate at a low level before the Spring Festival.

In February, due to the impact of the epidemic, the downstream enterprises were under-operated and demand for caustic soda was limited. Logistics had not fully recovered, and companies had difficulty selling goods. The overall demand for caustic soda was not much. The overall operation of the domestic market was mainly flat.

In March and April, the overall domestic caustic soda market did not change much. The downstream printing and dyeing, chemical fiber, chemical and other industries of caustic soda remained flat, and the market demand did not change much. The sales of chlor-alkali companies were flat, and the transportation wa better than before. However, many places were showing a wait-and-see attitude, downstream demand performance was average, and market transactions were flat.

As the weather warmed in May and June, the domestic alumina production started at about 76%, and the downstream demand for papermaking, printing and dyeing remained just in demand. The overhaul of caustic soda devices and the lack of spot stocks continued to support the market. On the macro level, the tank truck accident caused strict inspections on the production and transportation of domestic hazardous chemicals, and the start of small, small and micro downstream enterprises were affected.

In July, August, and September, domestic liquid caustic soda prices were basically stable, the upstream price was strong, the downstream demand was weak, and the rise was weak. Changes in terminal demand were limited. The price of liquid caustic soda in various places remained weak and stable. In the main producing area of Shandong, the price fell to a low level, and the overall supply exceeded demand. The weakening of downstream demand caused prices to weaken. The overall supply of caustic soda exceeded demand, and demand had not yet shown signs of improvement. On the whole, downstream demand could not well drive the price of caustic soda.

October is the traditional peak season, and there is a certain degree of support on the demand side. October is also the peak period for maintenance. Shandong Jinling unexpectedly shut down 100,000 tons of equipment. And during the National Day holiday, due to the transportation of liquid chlorine on the highway, some chlor-alkali enterprise products were unsalable, and the installation load of some chlor-alkali enterprises was reduced. All of these supported some manufacturers to increase the price of caustic soda.

The downstream procurement demand of caustic soda in November and December was general. The ex-factory price of caustic soda remained stable on the whole, with little change in the cost aspect, and the operation was mainly stable and small. The downstream procurement demand was general, and there was a certain resistance to the price of caustic soda.

Market outlook

The price of caustic soda in 2020 was lower than that in 2018 and 2019. The operating rate of the largest downstream alumina industry in caustic soda had been at a low level since February 2019. Weak profits had hit the enthusiasm of alumina companies to start operations, and demand for caustic soda continued to be sluggish. The paper industry was booming, but with the application of pulp lye recovery technology and the increase in the use of wood pulp, the industry’s alkali consumption had declined, and the increase in demand was not obvious. The overall supply of caustic soda is sufficient, and the ex-factory price of caustic soda is generally stable, with little change in cost. However, the prices of liquid caustic soda and caustic soda have been at a low level since 2015. While the overall supply of caustic soda is sufficient, the price of caustic soda may continue to operate under pressure, depending on the downstream market demand.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024