A chemicals industry crystal ball: Forecasting a dozen key products

It is difficult to write about chemicals markets without drawing on a myriad of gloom-and-doom metaphors. Outlooks dimmed after European suppliers (in some chemicals sub-sectors) saw offtake volumes plunge at alarming rates in a relatively short period of time in late Q3 and early Q4.

Producers of various feedstocks and raw materials continue to lose market share to vastly cheaper Asian imported material. Values have yet to find bottom levels while – in some business segments – differentials to the tune of €2000/ton continue to exist between Asian and European prices.

However, there may be small glimmers of hope on the horizon… Some buyers have been actively destocking expensive inventory since September. At the same time, the Asian and European run rates for some chemicals are being turned down due to poor economics and low demand. Is it possible therefore, that the European market could hit the sweet spot of less availability and a surge of restocking early in 2023?

Free white paper download:

A chemicals industry crystal ball: Forecasting a dozen key products

Trade flurry in China

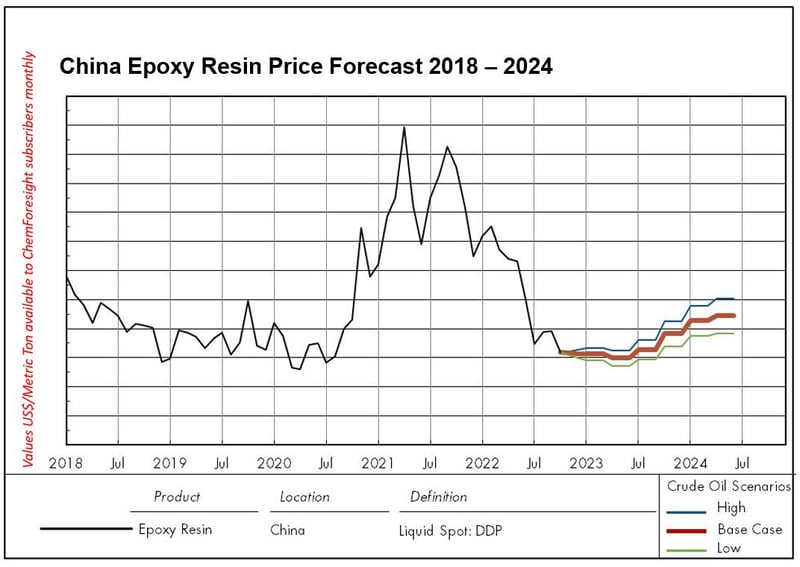

China’s epoxy resin markets, for example, were subject to a brief but intense flurry of trading activity just before the Golden Week holiday (1 – 7 October), which caused a short spike in pricing. ‘The same could happen again just before the Chinese New Year on 22 January 2023,’ comments business manager Jennifer Hawkins.

If Germany caps industrial sector natural gas prices at €70/MWh,

will other European countries follow suit?

Tecnon OrbiChem Business Manager Jennifer Hawkins

‘Germany’s newly created Gas Price Commission is proposing the government cap natural gas prices at €70/MWh for the industrial sector and other European countries may follow with similar measures. This could help some of the region’s businesses regain a competitive edge. At the least, it may provide customers with an incentive to favour security of supply over cheaper material.

To take an example, ‘epoxy resins values could strengthen during this period, but it is likely to be short lived as shaky consumer confidence will undoubtedly drag them back down. The European epoxy resins market could find it is back where it started and all those well-worn expressions to describe prevailing pessimism may once again be hard to resist,’ says Hawkins.

Source: Tecnon OrbiChem

The full white paper A chemicals industry crystal ball: Forecasting a dozen key products includes insight from Tecnon OrbiChem’s global team of consultants across a range of chemicals products. The chemical families covered in this first ChemForesight focus 2022 white paper are phenol, chlor-alkali and caustic soda, key polyurethanes raw material TDI, the monomer methyl methacrylate (MMA), PET, acrylonitrile, acetic acid, vinyl acetate monomer (VAM), ethylene and maleic anhydride.

We have created a dozen graphs that show everything from the dramatic cascades to the ebbs and flows of prices for each of these chemicals in at least one key trading region globally – that’s West Europe, the US, Asia and/or China. The graphs show the volatility of price changes over time, while the commentary provided by our team of consultants – which is updated on a monthly basis for our ChemForesight service – provides a steer for chemical buyers for the coming quarter – and beyond.

Vast datasets underpin the graphs and price predictions and the datapoints are accrued through regular discussions between our consultants and a roster of producers, industry contacts and market participants. How Tecnon OrbiChem founder Charles Fryer formulated the logarithms that support the ChemForesight predictions is outlined in our prior blog post Supply chain visibility: Price forecasts aid procurement & planning.

For a demo of ChemForesight and/or more information on how our chemicals intelligence data platform OrbiChem360 can bring visibility to supply chains relevant to your business – and aid planning and procurement – email us at info@orbichem.com

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024