Chlor-alkali markets: What’s happening in 2024?

The global chlor-alkali industry is locked in turbulent times.

As efforts by producers to mitigate the sector’s long-term availability issues have—and continue to—come to fruition, geopolitical wranglings and economic issues have become the main drivers for commerce. And, that sales of a chlor-alkali derivative to European buyers might constitute anti-competitiveness indicates discord at the market’s core.

The European Commission is assessing whether imports of chlorine’s major downstream product PVC infringed the rights of European producers to carry out business competitively.

This perfect storm of medium to long and short-term conflicts will be explored at the upcoming World Chlor-Alkali Conference in Singapore. Last year, almost 200 chlor-alkali-focused chemicals professionals gathered over two days of presentations and networking sessions. The 27th Tecnon OrbiChem and I.C.I.S World Chlor-Alkali Conference will take place at the ParkRoyal Collection Pickering Hotel in Singapore on the 27th and 28th June.

This year, a range of speakers—including experts from ResourceWise company Tecnon OrbiChem and from I.C.I.S—will present on a diverse range of subjects.

Boom and Bust in the chlor-alkali sector

Back in mid-2020, the chlor-alkali sector was on its knees. One Chinese caustic soda price index had dropped to the lowest point seen throughout the entire decade between January 2014 and January 2024. That price was just $169/ton (excluding VAT).

Of course, among the 25 caustic soda price indexes our chemical intelligence platform OrbiChem360 features, the highest quoted at that time was several hundreds of dollars higher.

And certainly, Chinese caustic soda’s lowest price today isn’t quite so low as then. However, the highest price point during 2023 was a staggering $2500/ton, seen at a time when price indexes were exceptionally high in Europe and North America. But so far in Q1 2024, the highs—though significant—have not exceeded $1000/ton more than the lowest Chinese price.

All Eyes on Chlorine

During the first months of a recovery from a recession, it is chlorine prices that recover first. We saw an overall price improvement for chlorine post-2020. Then actually, there was a rapid rise in its price during 2021. The recovery, it appeared, was in progress.

Soon after however, mitigating factors related to the geopolitical landscape—namely Russia’s war against Ukraine—began to exert a greater impact on prices than the business cycles we have come to understand the chlor-alkali sector by.

That is not to say that the business cycle approach to understanding how the chlor-alkali, chlorine and its derivatives markets operate, are not relevant. Our analysts’ eyes remain on the chlorine trade flow graphics and capacity versus output line charts within our platform. When we begin to see consistent price upticks, we will inform you.

Anti-dumping of downstream product

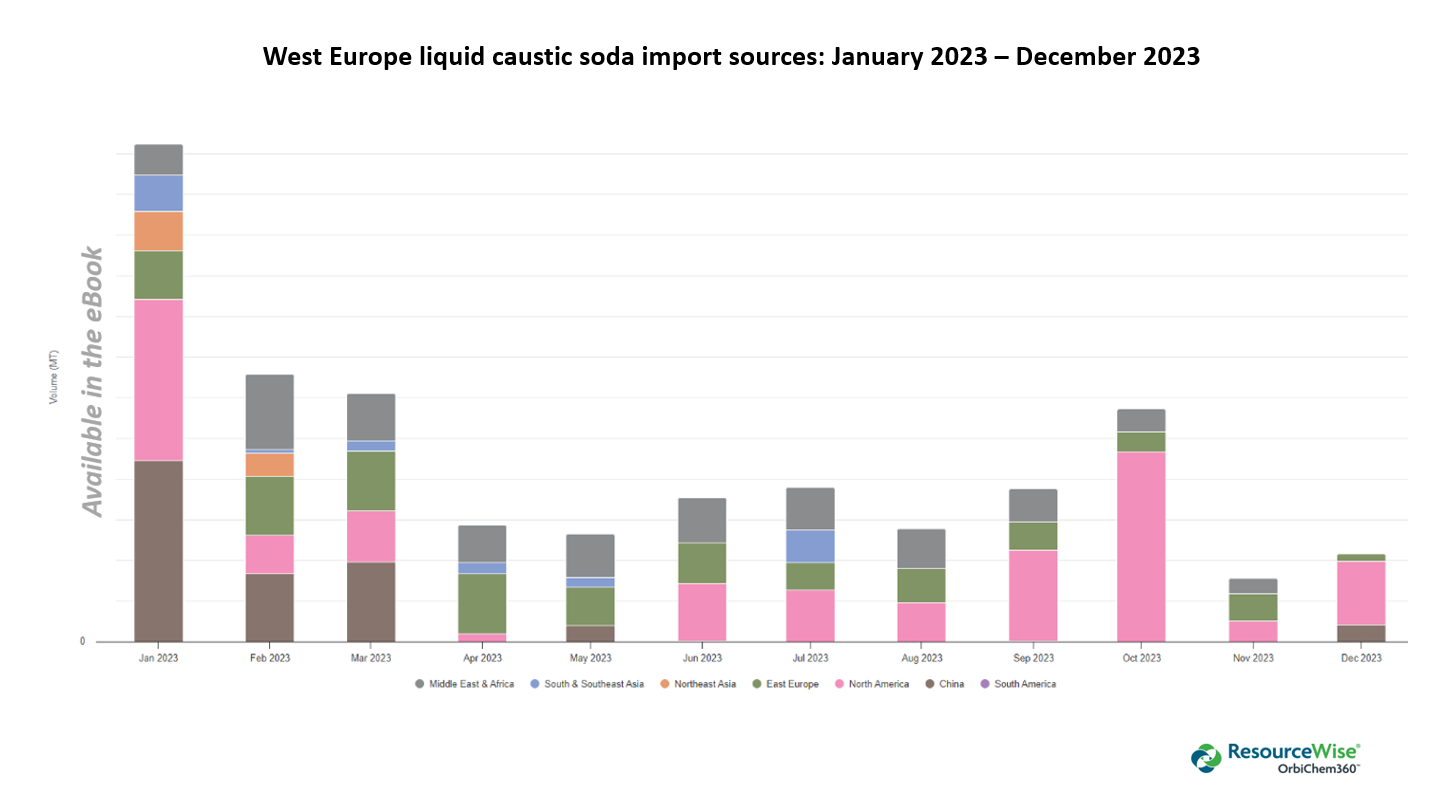

That anti-dumping investigations progress at a time when China’s caustic soda capacity has grown rapidly will likely hamper export aspirations held by producers there. The country’s supply glut is emerging under an umbrella of dwindling global trade and commerce coupled with precarious shipping and transportation landscapes.

And already, the anti-dumping investigation is having some impact. Our Europe-based chlor-alkali expert Hira Saeed outlines the knock-on effects in our free-to-download eBook. The eBook also contains insights from our China-based consultant Lulu Zhao.

What looming caustic soda crisis?

So much for the looming caustic soda shortage, you may be thinking… Caustic soda—also known as sodium hydroxide—is key to vital manufacturing subsectors. They include pulp and paper, pharmaceuticals, and alumina. It is also an important chemical in the growing electric battery industry.

So, when the inevitable happens, namely when the current downturn ends and recovery begins—as it has without fail for centuries—will chlor-alkali’s downstream consumers face rising prices and lack of availability?

Saeed first explored what she perceived at that time as the chemical sector’s next global shortage ahead of the June 2022 World Chlor-Alkali Webinar—an event Tecnon OrbiChem co-organizes with I.C.I.S.

Of course, a great deal has happened since Q1 2022, causing extreme demand destruction in many industry sectors. Demand destruction occurs when persistently high prices for goods or products lead to permanently lower demand for it.

When asked about the current state of the “looming shortage”, Saeed had this to say: “There will still be a need for more caustic soda capacity at some point in the future.

“A leading factor will be widespread use of electric vehicles with lithium-ion batteries. This however, may happen a little later than originally thought as the current economic climate has pushed green initiatives back.

“The US will be short on chlorine in the next couple of years, especially with recent capacity shutdowns. We will have to see how the anti-dumping process pans out before we can be sure how the US will manage its chlor-alkali supply chains,” adds Saeed.

For more insights on the drivers and impacts on business in the global caustic soda and chlorine sectors, download the eBook.

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024