The Positives Were Limited, and the PE Market Continued to Drop This Week

Price Trends

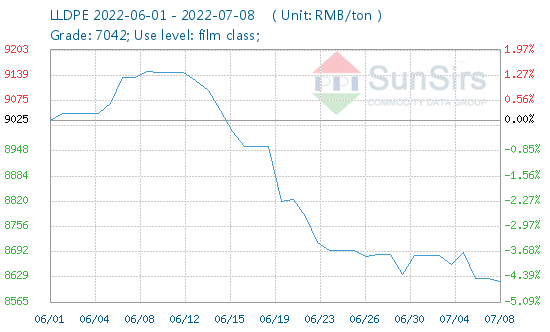

According to Todudu data monitoring, the domestic LLDPE (7042) price was RMB 8682.86 per ton on July 1, and the average price was RMB 8611.43 per ton on July 8, down 0.82% compared with the same period on June 1. 4.58%.

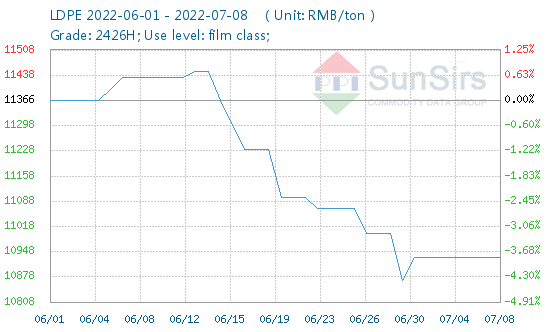

According to the data of Tudou.com, the average price of LDPE (2426H) ex-works on July 1 was RMB10,933.33 per ton, and the average price on July 8 was RMB10,933.33 per ton. Prices remained stable during the period, down 3.81% from June 1st.

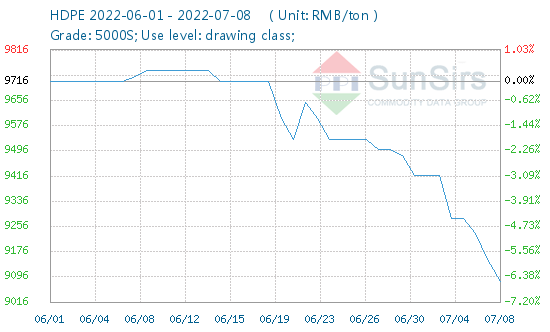

According to the monitoring of TuoDu data, the average price of HDPE (5000S) ex-works on July 1 was RMB 9,416.67 per ton, and the average price on July 8 was RMB 9,150.00 per ton, up 2.83% in the same period. Than on June 1, down 5.83%.

Analyzing Review

At the beginning of July, most of the domestic PE market prices were on a downward trend. The three main varieties continued to weaken this month, in addition to some of the decline, prices basically remained stable. Among them, LLDPE and HDPE declined, and LDPE remained stable. There was not enough favorable market support. Earlier this month, international crude oil prices began to fall, and its cost had a significant negative impact on the market. Some petrochemical companies cut their ex-factory prices by RMB 50-300 per ton. The downstream was cautious and still maintained emergency purchases with low enthusiasm to enter the market. The market lacked positive support, traders were in a general mindset, and prices mainly fell.

July 8, PE futures 2209 opened at 8248, the highest 8396, the lowest 8396. query price of 8241, the closing price of 8357, the early settlement price of 8168, the settlement price of 8335, up 189, turnover of 414,794 hands, positions 339,066 hands.-14964 lots. (Quotation unit: yuan / ton)

Market Outlook

Currently, the trend of international crude oil prices is still uncertain, and the positive market costs from higher oil prices are limited. Ex-works prices of most petrochemical companies have declined, indicating that market sentiment is at normal levels. In addition, downstream demand is weak and purchases remain largely demand-based. Due to the poor market conditions, companies often lowered their estimates. In the short term, PE spot market is expected to remain weak.

If you have any questions, please feel free to email todudu at tdd-global@toodudu.com

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024