Chlor-alkali 2022: Key factors driving China’s markets

Caustic soda production drops sharply in Q4 2021 due to China's dual control policy. The impact of this policy on specific chemical value chains is discussed extensively by Tyrone Arcana Consulting in its whitepaper, China's Energy Policy and Its Impact on Chemical Production. /p China's caustic soda export prices have remained low for several years, below $350 from 2020 through the first half of 2021. However, with the implementation of the dual regulation policy by the Chinese government in September 2021, the export price soared to around $600 per ton.

The immediate knock-on effect of this policy was a drop in manufacturer starts in Jiangsu province. 2021 capacity fell from around 90% at the beginning of September 2021 start year to 20-30% by the end of the month. It was not until October 2021 that caustic soda production in China gradually returned to normal.

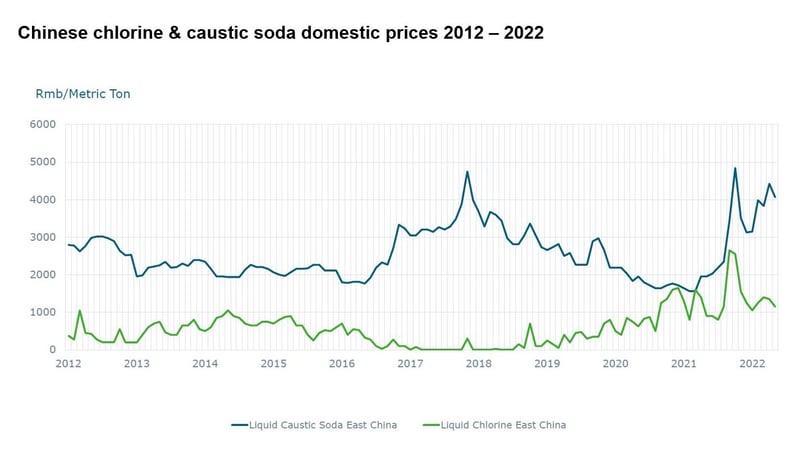

Supply, Demand, Capacity and Trade Like the US, China is one of the few countries that gets its prices through goat market transparency. As you can see from the chart, prices for caustic soda and chlorine have tended to change in the same direction over the past decade. Compared to the end of last year, prices have been more volatile.

pSource: sky dragon mystery

pSource: sky dragon mystery

Liquid Alkali

In 2021, total exports of liquid caustic soda increased sharply by 84% to more than 1 million tons. However, due to container shortages and rising ocean freight costs, total solid caustic soda exports in 2021 2020 declined by nearly one-third annually (full chart available for download).

In the first four months of 2022, China's liquid caustic soda exports more than doubled from 2021. However, solid caustic soda exports are on a downward trend. Australia has been China's largest export destination for six consecutive years. Notably, exports to Indonesia increased tenfold in 2021 compared to 2020. India imported caustic soda from China from 2016 to 2020, but India did not import caustic soda from China in 2021.

Source: Tecnon OrbiChem

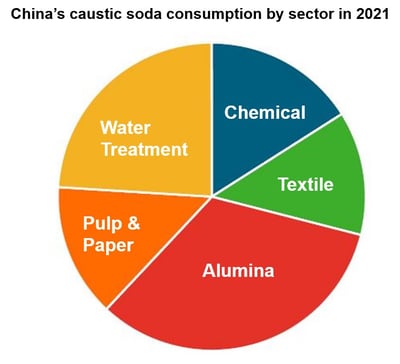

Alumina is the largest application of caustic soda, followed by pulp and paper. However, production by Chinese textile companies has increased in 2020 and 2021, driven by returns from overseas orders. However, COVID-The popular OMIC wave in Southeast Asia and the revival of textile production may intermittently create uncertainty about the future of China's textile industry.

Total mechanical paper and board production was 136 million tons in 2021, up 7% from 2020. The fact that a new paper mill is due to come on stream in South China in the second half of 2022 is an indication of how China's paper industry will grow across the board this year.

pSource:Tecnon OrbiChem

pSource:Tecnon OrbiChem

Total synthetic detergent production is expected to be 10 million tons in 2021, a 7% decrease from 2020. Synthetic detergent production in 2022 is expected to be the same as in 2020 or to decline slightly again. In the next few years, China's caustic soda demand is expected to remain stable or grow with economic growth.

While demand for paper, chemicals and emerging industries is expected to increase, demand for alumina is expected to be relatively limited due to the negative impact of green production policies on industrial productivity.

Looking ahead to 2021, total caustic soda consumption in China is expected to reach 37 million tons. Consumption in 2022 is expected to slow to a modest increase from last year. The chart below (left) shows the quarterly forecast supply and demand. As a result of the energy consumption control policy, the operating rate of China's caustic soda producers dropped to around 60% in October last year. This resulted in a lower utilization rate in China in the fourth quarter of 2022, but this year's regulatory policies appear to have eased, which could lead to a utilization rate of around 80% in 2022.

Source: Tecnon OrbiChem

New caustic soda production facility in China is scheduled for construction in 2022 to come on stream in the second half of this year. The planned expansion has been hampered by zero new government crown measures and, in some cases, changes to the branding schedule. In 2021, China's caustic soda production will exceed 38 million tons, up 6% from 2020, despite the impact of the epidemic. This growth is driven by capacity expansion and consumption flows.

Total caustic soda production is expected to be around 40,000,000 tons. Liquid caustic soda exports are expected to be higher in 2022 due to low domestic demand in China, but demand from Southeast Asia, the European Union, and Ukraine will increase due to Russia's sovereignty violations. China's chlorine production capacity is expected to gradually increase in 2016 to reach 41 million tons by the end of 2022.

This blog post was inspired by the demonstration in the video below. It was inspired by Tecnonon. One of OrbiChem's contributions to the Chlor-Alkali 2022 webinar organized by 6 ICISS in collaboration with partner ICISSSISSS.

To access Lee's full presentation, simply fill out the form below and you will receive an email with a link to the eBook.

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024