Market demand is weak and PVC market prices are lower

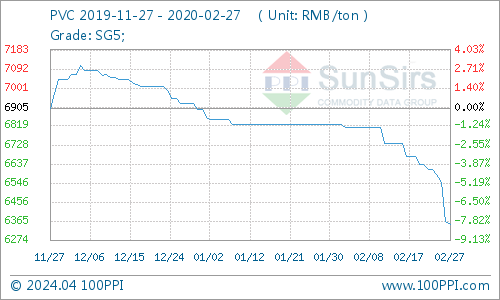

1. Price trends

According to the monitoring data (calcium carbide SG5 ex-factory average price) of Tuo Duodu, the average price of domestic mainstream PVC was 6,350 yuan/ton on February 27, down 4.33% to 6,637.5 yuan/ton compared with last Thursday (20th). The same period last year. Up 0.79%. On February 27, the PVC raw material index was 80.46 points, down 0.16 points from yesterday, down 19.54% from the cycle high of 100.00 points (2011-09-05), and up 38.08 points from the September 2011 low. On December 20, 2015 it was 58.27 points. %. (Note: The period is from September 1, 2011 to present)

P2: Market Analysis

P2: Market Analysis

Product side: Although the resumption of work in PVC downstream product companies has improved recently, the start-up rate is low, some workers are unable to be fully employed, and part of the construction industry has not yet started. Back to work. In addition, some areas of logistics and transportation are still not smooth. Overall, downstream demand is still low. PVC pressurization is very difficult. PVC stocks are still at a high level. The number of remanufacturers has increased. Goods supply is sufficient. Consumers only need to buy. Many companies are keeping a certain amount of inventory before the holidays. Not too picky. To summarize, the supply and demand situation in the PVC market remains high. There is some pressure on businessmen to ship goods. Market weakness has become the norm and is difficult to change for some time. As of February 27, the domestic PVC mainstream price range is 6000-6450 yuan/ton. At present, the mainstream price of Changzhou PVC5 calcium carbide is around 6200-6360 yuan/ton, and the range of Hangzhou PVC5 calcium carbide is around 6200-6350 yuan/ton. Guangzhou PVC ordinary calcium carbide mainstream price is around 6220-6240 yuan/ton. Can discuss the deal.

Futures: PVC main contract V2005 closed slightly lower at 6,295 yuan/ton. Compared with the previous trading day, the volume of 82,030 lots, positions 15,275 lots,-45 yuan. 5-9 spread-75 yuan, 0 yuan.

Industry chain: The recent rise in crude oil prices is favorable to the ethylene market. Therefore, industry insiders expect ethylene prices will continue to fluctuate in a narrow range, not excluding the possibility of rising. In terms of calcium carbide, ex-factory prices rose slightly, downstream customers are generally enthusiastic about calcium carbide procurement, and the supply of calcium carbide is tight. Calcium carbide market fluctuates slightly. Crude oil prices fell for four consecutive days due to the recent global epidemic. The overlapping of market risk factors will increase the volatility of crude oil. In the long run, market overreaction may also increase risks. The market is likely to oscillate at low levels in the near term, and the possibility of continued bottoming cannot be ruled out. As crude oil prices remain low, Business Analyst data analysts expect ethylene prices to remain range-bound. In terms of calcium carbide, ex-factory prices rose slightly, downstream customers are generally enthusiastic about calcium carbide purchases, and the supply of calcium carbide is tight. Calcium carbide market fluctuated slightly.

Industry:According to the price monitoring of commercial institutions on February 27, 2020, butyl rubber (1.01%) and styrene butadiene rubber (1.01%) are the top three products in the three major commodity price increases. High-density polyethylene (0.45%). Five products declined compared to the previous month.ABS (-4.14%) ranked among the top three products, PA6 (-2.28%) and natural rubber (-1.11%). The average daily increase or decrease was-0.37%.

3、Market Outlook

Todudu PVC analysts believe that the current start rate of PVC manufacturers is increasing, while the downstream demand is low, the market is generally trading. PVC prices are expected to remain weak in the short term.

If you have any questions, please feel free to contact todudu (tdd-global@toodudu.com).

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024