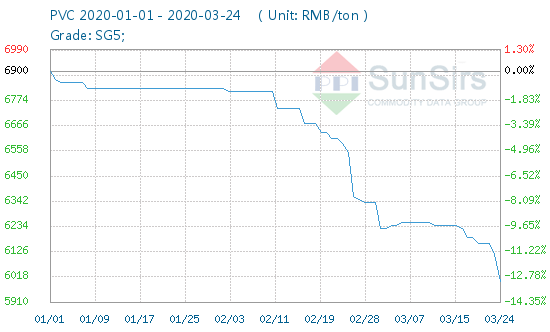

Both Spot And Future Price of PVC Goes Down (March 25)

March 24, PVC domestic average price (calcium carbide method SG5 before) mainstream ex-factory average price of 6000 yuan / ton, down 1.84% from the previous trading day, down 4.99% from the same period last year.

On March 24, the PVC Commodity Index stood at 76.03, down 1.43 points from yesterday, down 23.97% from the cycle high of 100.00 points (September 5, 2011), and up 30.48% from the December 20, 2015 low of 58.27 points. (Note: The period is from September 1, 2011 to the present)

Products: The domestic PVC market continued to fall on Tuesday. PVC futures continued to fall, and spot prices fell accordingly. Overseas, affected by the continued decline in the oil market and overseas public health incidents, PVC demand fell sharply, which had a greater impact on PVC exports, and business confidence is poor.

Downstream PVC companies in Korea have resumed work and demand has slowed down, but still maintains a rigid purchasing process. For most manufacturers, trading is limited and transportation is difficult. Currently, PVC supply side is slightly abundant and inventories remain high. Manufacturers have lowered freight rates, but actual trading is average. As the trading center moves downward, manufacturers begin to initiate maintenance to control costs. In the short term, there are no obvious positive signs in the domestic and international PVC markets, and futures and spot prices have fallen frequently. The market is overall sluggish and weak.

As of March 24, the domestic PVC mainstream price range of 5800-6200 yuan / ton. At present, the mainstream price of PVC 5-type calcium carbide in Changzhou area is around 5730-5900 yuan/ton. Hangzhou PVC 5-type calcium carbide shipment range is 5750-5900 yuan/ton. Guangzhou PVC ordinary calcium carbide mainstream price at 5780-5800 yuan / ton or so, the actual transaction is negotiable.

Futures: PVC2005 contract opened at 5740 yuan / ton, the highest price of 5795 yuan / ton, the lowest price of 5575 yuan / ton, closing price of 5680 yuan / ton. Compared with the last trading day, the volume decreased by 125 yuan/ton to 227, 756 lots, and the position decreased by 3, 152 lots to 112, 483 lots. V2005 futures continued to fall, touching a 5-day low of 575 yuan per ton.

Industry chain: Crude oil rebounded, but it is also difficult to reverse the long-term downturn in oil prices. Crude oil is expected to maintain the trend of impact in the near future, not excluding the possibility of further investigation. The likelihood of a significant contraction in economic activity caused by a public health epidemic is unlikely to support ethylene prices, so business analysts expect ethylene prices to remain within a narrow range for the rest of the year.

In the case of calcium carbide, for example, the market for calcium carbide saw minor fluctuations at the end of March. At the end of March, calcium carbide prices in the Northwest fell slightly.

Industry: Natural rubber (0.21%) was one of the highest gainers in March in the March 24, 2020 list of rubber and plastic products. There are 12 kinds of raw materials declining from the previous year, and there is one kind of raw material with a decline of more than 5%, accounting for 6.3% of the raw materials monitored by the industry. Down before the product is styrene-butadiene rubber (-5.07%), butadiene rubber (-4.99%), polystyrene (-4.56%).

Market Forecast: Todudu PVC analysts believe that PVC futures prices are currently on a downward trend, and the spot market is also on a downward trend. There are no obvious positive signals at home and abroad, and the PVC market is expected to continue to fall in the short term.

Please feel free to contact toodudu and tdddu-global@toodudu.com.

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024