PVC Finally Increased After The Holiday

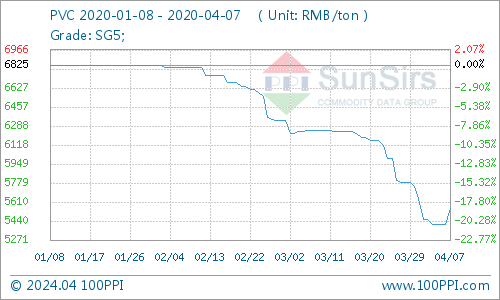

On April 7, the domestic PVC mainstream average price (calcium carbide SG5 ex-works) was 5,500 yuan per ton, up 2.54% from the previous trading day, down 15.43% from the same period last year.

On April 7, the PVC Raw Materials Index was at 70.33, up 1.75 points from yesterday, down 29.67% from the cycle high of 100.00 points (Sept. 5, 2011) and up 20.70% from the previous day's low. 58.27 points on December 20, 2015 (note: the period is from September 2011 to January 2005).

Products: After the Ching Ming Festival, the domestic PVC market faced price increases. With the recent sharp rise in PVC futures prices, spot prices are also on the rise. In the first quarter of this year, the PVC market is not good, prices continue to fall, corporate profits fell sharply. Industry mentality is not optimistic, most take a wait-and-see attitude.

In April, PVC enterprises have entered the spring maintenance. On the supply side, PVC prices rose due to the reduction of market production and social inventory. On April 7, PVC offers across the region rose to varying degrees, and some manufacturers did not report production disruptions. The mentality of buying up rather than down increased the enthusiasm of downstream buying, improved the overall trading sentiment in the market, and eased some of the selling pressure. Manufacturers price increase mentality is obvious, PVC market finally ushered in the long-awaited rising market.

However, the current market supply is still significantly loose, domestic end demand does not increase, overseas export orders decreased. Whether the PVC market can continue to rise in the future depends on the recovery of the downstream market. Demand side. According to doodle data monitoring, as of April 7, the domestic PVC mainstream price range of 5350-5750 yuan / ton.

At present, the mainstream price of PVC5 calcium carbide in Changzhou is 5450~5550 yuan/ton, and the price range of PVC5 calcium carbide in Hangzhou has rebounded to 5430~5530 yuan/ton. The mainstream price of PVC calcium carbide in Guangzhou is around 5,500~5,530 yuan/ton. The deal is negotiable.

PVC contract 2009 PVC contract Futures: Shock high opening, continued to rise. The market opened at 5405 yuan/ton, with a high of 5495 yuan/ton and a low of 5390 yuan/ton. The market closed at RMB 5,490/mt, up RMB 185/mt or 3.49% from the previous session. Volume decreased to 185,067 lots, and positions increased by 660 lots to 185,225 lots.

Import and export: According to the latest data released by the Customs, from January to February 2020, China imported 89,200 tons of pure PVC powder and exported 61,700 tons. Among them, 99,500 tons were imported from January to February 2019, 10,300 tons less than that of January to February 2019, a decrease of 10.35%. Exports in January-February decreased by 93,800 tons and 32,100 tons respectively, up 34.22%.

Industrial chain: On April 2, the price of the U.S. WTI crude oil futures market rose sharply, with the price of the main contract rising by $5.01 to $25.32 per barrel. Brent crude oil rose sharply from 5.20 dollars per barrel to 29.94. dollars. Both WTI and major crudes recorded their biggest one-day gains, both exceeding 25%. The business community believes that global demand is the determining factor for oil prices. The likelihood of a significant contraction in economic activity due to a public health epidemic is unlikely to support ethylene prices, so business analysts expect ethylene prices to remain within a narrow range for the remainder of the year. In terms of calcium carbide, shipment prices at Northwest calcium carbide plants may fluctuate slightly in the near term. Manufacturers are quoting around 2,600-2,700 yuan per ton.

Industry: According to the rabbit price monitoring, as of April 7, 2020, there are seven kinds of rubber and plastic products on the rising list of price increases and decreases. The three raw materials with the highest growth are PET (4.90%), PP (4.44%), PVC (2.54%). Two raw materials declined compared to the previous month. The top declining commodities were PC (-3.19%) and PS (-0.44%). Daily gains and losses were both 0.69%.

Market Forecast:

According to Toodudu analysts, PVC futures prices are currently rising and the spot market is also on an upward trend, with some companies entering spring maintenance. We expect favorable support on the supply side and expect the PVC trend to remain strong in the near term and is expected to rise further.

If you have any questions, please feel free to contact toodududu at tdd-global@toodudu.com.

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024