China PVC Market Fell in October

During the one month period since the Double Holiday, the plastic industry has been dominated by bearish trends. On the macro level, the US dollar strengthened in October, and the performance of US economic data was eye-catching. The market is concerned that the Federal Reserve still has expectations of raising interest rates as a result. In terms of cost, due to the strengthening of diplomatic efforts in international geopolitical conflicts, the tension has been partially alleviated. Venezuela’s export restrictions have also eased, with expectations of increased market supply and a weakening of crude oil prices due to pressure fluctuations. At the same time, downstream plastic enterprises are not actively willing to stock up, their consumption follow-up is lagging, and the market momentum is weak. Under the influence of declining consumption and cost fluctuations, the price performance of plastic futures has significantly declined.

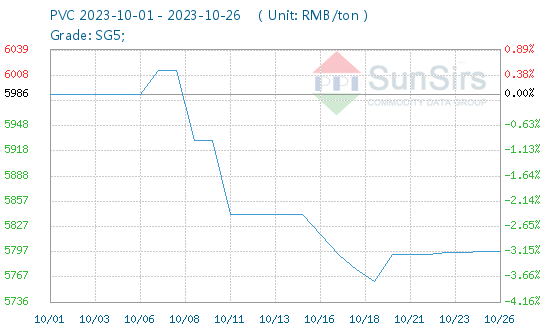

According to the Commodity Market Analysis System of toodudu, as of October 26th, the average monthly increase in spot prices of various products, from low to high, is PP (wire drawing) -3.13%, PVC-3.14%, and LLDPE-3.17%.

According to the Commodity Market Analysis System of toodudu, the average price of PVC carbide method SG5 on October 26th was 5,798 RMB/ton, with a month on month increase or decrease of -3.14%. The domestic PVC industry began to decline from a high level in mid September, and the October market continued to be weak in the previous period, resulting in poor confidence in the spot market. Entering October, the upstream calcium carbide market prices have stabilized and consolidated. In terms of demand, the downstream market procurement is not active after the holiday, and the trading atmosphere on the market is weak. Many people are cautious and wait, and the overall transaction situation is weak, with just the need for replenishment being the main focus. However, the futures market has been relatively strong recently. On October 26th, PVC2311 closed at 6,000 with a settlement price of 5,959, which provides sufficient support for spot prices. It is expected that the PVC market may experience a narrow recovery in the short term due to a basis boost. It is recommended to closely monitor changes in the news.

The spot market of October plastic futures and three materials weakened simultaneously. Macroscopically, the improvement of the external economic environment is limited. In the future, there may be expectations of an increase in crude oil supply, and the cost support effect of plastic far end may decline. At present, the construction of aggregation enterprises is relatively high and stable, and the supply of goods is abundant. The trend of plastic during the peak season has rapidly cooled down, and terminal enterprises are stocking around just in need. In summary, the current bearish outlook for plastic futures is mainly focused on weak costs and lagging demand. It is expected that in the short term, the guidance for the PE and PP plastic markets remains unchanged, and the market may continue to be weak. PVC may have the opportunity to recover due to the boost from futures.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com.

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024