RIL: Leveraging on partnership

Reliance Industries Limited (RIL) has been leveraging on partnerships as this is helping the company to grow fast both in O2C and Oil & Gas business segment. This is also helping the company to maximize both its revenue and profitability in the long run.

Recently, Abu Dhabi National Oil Company (ADNOC) and Reliance Industries Limited have signed an agreement to join a new world-scale chlor-alkali, ethylene dichloride and polyvinyl chloride (PVC) production facility at TA’ZIZ in Ruwais, Abu Dhabi.

The agreement capitalizes on growing demand for these critical industrial raw materials and leverages the strengths of ADNOC and RIL as global industrial and energy leaders. The project will be constructed in the TA’ZIZ Industrial Chemicals Zone.

RIL and bp have also announced the start of production from the Satellite Cluster gas field in the KGD6 block off the east coast of India. The Satellite Cluster is the second of the three developments to come onstream, following the start-up of R Cluster in December 2020.

Development activity continued momentum in Ensign JV with RIL. 6 wells were drilled and 10 wells were put on production during the quarter, thus improving production on Q-o-Q basis.

Reliance Industries Limited (RIL) O2C business revenues for 1Q FY22 increased by 75.2% Y-o-Y to Rs. 103,212 crore ($13.9 billion) primarily on account of sharp increase in product prices on the back of higher crude prices. Segment EBITDA for 1Q FY22 improved by 49.8% Y-o-Y to Rs. 12,231 crore ($1.6 billion) primarily on account of rebound in transportation fuel cracks to 4-6 quarter highs.

Total throughput increased from 17.8 MMT to 19.0 MMT on a Y-o-Y basis. Cracker operating rates were at 95%, marginally lower on scheduled shutdown of ROGC.

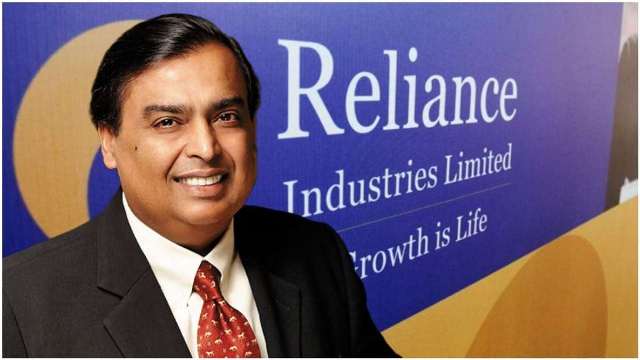

Commenting on the results, Mukesh D. Ambani, Chairman and Managing Director, Reliance Industries Limited said, “In our O2C business, we generated strong earnings through our integrated portfolio and superior product placement capabilities. Along with our partner bp, we commissioned the satellite cluster in KG D6 and continued to ramp up production, contributing to 20% of gas production in India. This will be a major contribution to our country’s energy security.”

“In our O2C business, we generated strong earnings through our integrated portfolio and superior product placement capabilities. Along with our partner bp, we commissioned the satellite cluster in KG D6 and continued to ramp up production, contributing to 20% of gas production in India. This will be a major contribution to our country’s energy security,” commented Ambani.

On the other hand, Oil & gas Exploration & Production Business Segment revenues for 1Q FY22 increased by 153.2% Y-o-Y to Rs. 1,281 crore (US $172 million). EBITDA for the quarter increased sharply to Rs. 797 crore (US $107 million). This was primarily due to smooth ramp up of gas production from R-Cluster and commencement of production from Sat-Cluster field in KG D6 block.

With ramp-up of gas production from R-Cluster and commencement of Sat-Cluster field, the KGD6 production has more than doubled compared to the previous quarter. The combined production from these two fields is now > 18.0 MMSCMD, well ahead of plan.

Register Now to Attend NextGen Chemicals & Petrochemicals Summit 2024, 11-12 July 2024, Mumbai

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024