Falling futures weighed significantly, PE spot market continued its downward trend

1. Price trend

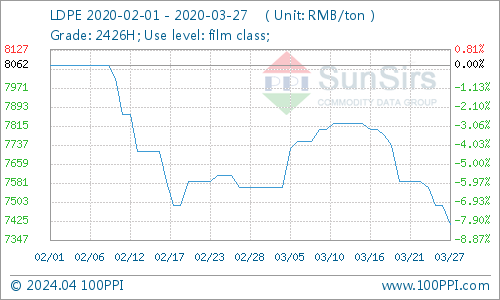

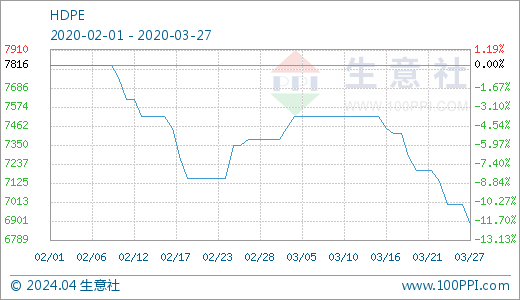

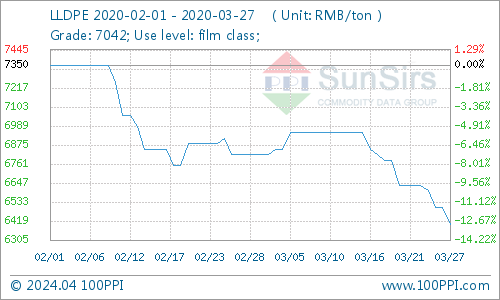

According to the monitoring of toodudu, the overall trend of the domestic PE market continued to decline this week, and the overall transaction atmosphere in the market has not improved. As of March 24, the average ex-factory price of LLDPE 7042 in East China was 6,400 yuan / ton, down 3.52% from the beginning of the week; the average ex-factory price of LDPE 2426H in east China was about 7412.5 yuan / ton, down 2.31% from the beginning of the week; HDPE in east China The average ex-factory price of 5000S was 6883.33 yuan / ton, down 3.5% from the beginning of the week; the major PE varieties on Wednesday fell by 50-400 yuan / ton.

2. Market Analysis

PEThe PE market as a whole continued its downward trend this week. Petrochemical continued to lower its ex-factory prices, and market cost support has weakened. The plastics futures market fell sharply this week, which significantly suppressed the market mentality. Merchants continued to be blocked from shipping. The downstream side continued to wait and see attitude, except for some factories to fill in on demand, there are fewer inquiries into the market, and the current market atmosphere continues to be weak.

According to the monitoring of toodudu, Liansu has fallen as a whole this week. On March 27, polyethylene futures L2005 opened at 5795, highest price at 5820, lowest price at 5560, closing price at 5650, previous settlement price at 5890, settlement price at 5685, down 240, down 4.07%, trading volume 418489, and holding position 152270, daily Masukura-18223. (Quotation unit: Yuan / ton)

As of February 27, the total output of domestic polyethylene companies was 1.41 million tons, a decrease of 252,300 tons from January. Among them, the output of HDPE is 587,900 tons, the output of LDPE is 206,800 tons, and the output of LLDPE is 624,300 tons.

3. Market Forecast

The trend of international crude oil was weak, and futures fell sharply, suppressing the market mentality. For petrochemicals, most of them have lowered their ex-factory prices, and the market cost support has weakened. At present, the downstream is cautious, with the exception of factories just waiting to pick up goods. At present, petrochemical inventory is at a medium to high level, and pressure on sales still exists. It is expected that the market outlook may continue to be weak in the short term.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com.

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024