Weakness Was Difficult to Change, the PE Market Continued to Fall

Price trend

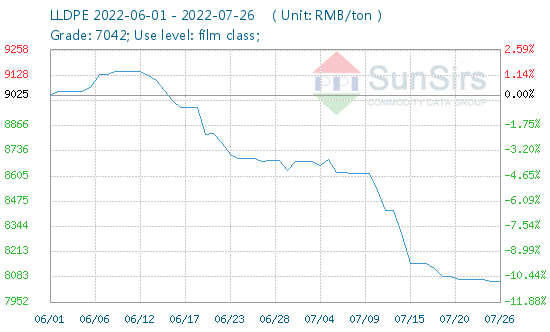

According to the data monitoring of toodudu, the domestic price of LLDPE (7042) was 8,154.29 RMB/ton on July 17, and the average price on July 26 was 8,061.43 RMB/ton. During the period, the decline was 1.14%, and which was 10.68% lower than that on June 1.

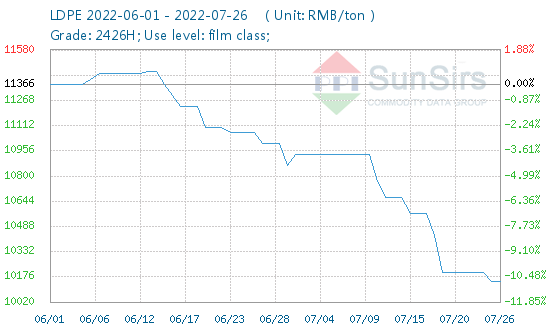

According to the data monitoring of toodudu, the average ex-factory price of LDPE (2426H) on July 17 was 10,566.67 RMB/ton, and the average price on July 26 was 10,150.00 RMB/ton, with a decrease of 3.94% during the period, and which was lower 7.04% than that on June 1.

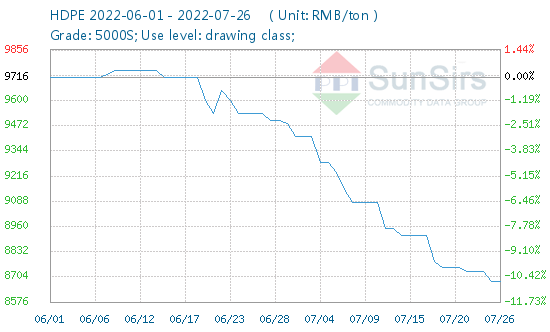

According to the data monitoring of toodudu, the average ex-factory price of HDPE (5000S) on July 17 was 8,916.67 RMB/ton, and the average price on July 26 was 8,683.33 RMB/ton, a decrease of 2.62% during the period, which was lower 10.63% than that on June 1.

Analysis review

This week, the domestic PE market price was weak and difficult to change. The three spot varieties continued to decline, and their prices fell. LDPE fell the most during the week, falling by nearly 4%. Both LDPE and HDPE were also lowered, the market lacked obvious positives, and the industry’s mentality was general. Recently, the international crude oil price fluctuated and fell, and the cost brought a certain negative to the market. Most petrochemical companies lowered their ex-factory prices by 100-300 RMB/ton. The downstream operation hadnot changed much, the operating rate was not good, and the enthusiasm for entering the market was limited. The mentality of merchants was weak, and the price fluctuated down.

On July 26, the opening price of PE futures 2209 was 7,865, the highest price was 7,955, the lowest price was 7,785, the closing price was 7,906, the previous settlement price was 7,808, the settlement price was 7,860, up 98, the trading volume was 418,607, the open interest was 319,436, and the daily Masukura was -14,677. (quotation unit: RMB/ton)

Market outlook

At present, the overall trend of international crude oil is still weak, the support for the market in terms of cost is insufficient, the ex-factory prices of petrochemical enterprises are mostly lowered, the market mentality is bearish, the downstream construction has not changed much, the operating rate is not as good as in previous years, and the market rebound is insufficient. It is expected that in the short term The PE spot market may continue to fall.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024