Plastics, PE Spot Market Price Increases (January 5-10)

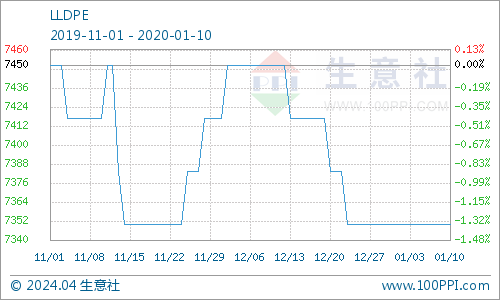

The LLDPE commodity index on January 12 was 70.39, which was the same as yesterday. It was a decrease of 40.12% from the highest point of the cycle at 117.56 points (2013-December-11) and an increase of 0.69% from the lowest point of September 08, 2019 at 69.91 points. (Note: Period refers to 2011-Septmber-01 to present)

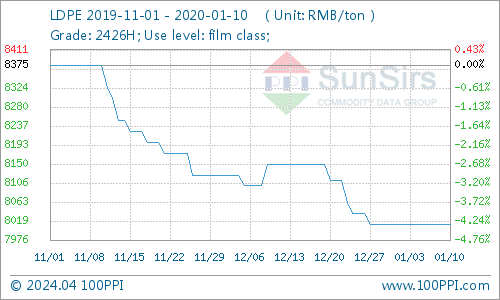

On January 12, the LDPE commodity index was 62.35, which was the same as yesterday, and reached a historical low in the cycle, which was 44.98% lower than the highest point 113.33 on December 08, 2013. (Note: Period refers to 2011-September-01 to present)

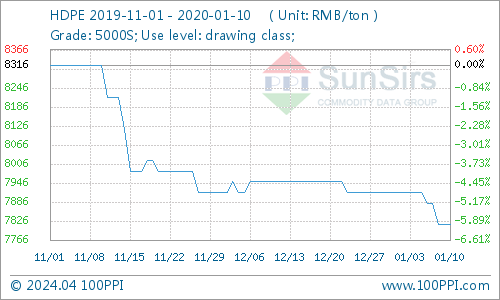

On January 12, the HDPE commodity index was 63.36, which was the same as yesterday, setting a record low in the cycle, and a 38.08% drop from the peak of 102.33 on July 24, 2014. (Note: Period refers to 2011-September-01 to present)

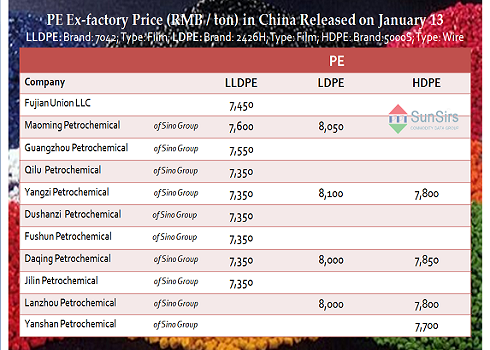

This week (January 5-10) the ex-factory price of polyethylene showed a sideways trend. The average value of LDPE 2426H monitored by the business agency in East China was around 80.25 RMB / ton. The average price of HDPE 5000S was about 7,816.67 RMB / ton. The average price of LLDPE is around 7,350 RMB / ton.

Up to January 10, the prices of LLDPE and LDPE in East China showed a steady trend this week. And the prices of HDPE showed a narrow downward trend this week. Although the ex-factory price of petrochemicals has not changed significantly, the overall market price of PE has fluctuated. And most of them have increased by 50-200 RMB / ton.

Affected by international crude oil early in the week, linear futures rose. The market sentiment was positive, and the prices of merchants’ offers rose accordingly. Later in the week, as international crude oil fell and futures fluctuated, to a certain extent, the downstream market enthusiasm was suppressed. In addition, petrochemicals slightly lowered some HDPE ex-factory prices, which affected the market mentality. The downstream market entry inquiry was significantly reduced. Except for the factory just needing to replenish, players wait and see.

Import and Export: The total PE imports in November 2019 were 1,456,300 tons. Among them, the import volume of LLDPE was 451,900 tons, the import volume of HDPE was 708,600 tons, and the import volume of LDPE was 295,800 tons. The total PE export in November 2019 was 25,900 tons. Among them, the export volume of LDPE was 73,300 tons, the export volume of HDPE was 15,300 tons, and the export volume of LLDPE was 33,300 tons.

Market Forecast aspect, toodudu analysts believe that the Spring Festival holiday is approaching. With the holidays downstream, the factory has gradually entered into a holiday state, and demand will gradually decrease. The petrochemical enterprises in the early Spring Festival will continue to actively destock, and the factory prices are not expected to fluctuate much. It is expected that the market outlook will be adjusted in the short term or sideways.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024