PE Market Continued to Be Sideways

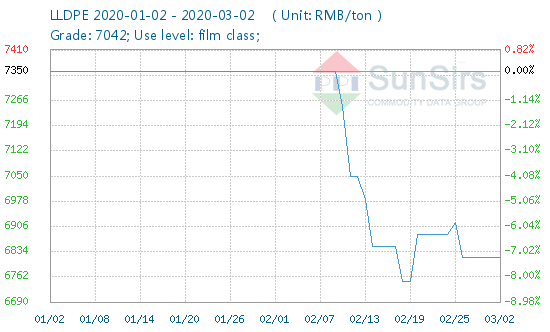

On February 28, the LLDPE commodity index was 65.28, unchanged from the previous day, down 44.47% from the cycle high of 117.56 (2013-December-11), and up 0.99% from the low of 64.64 on February 19, 2020 (Note: Cycle refers to 2011-Septmber-01 till now).

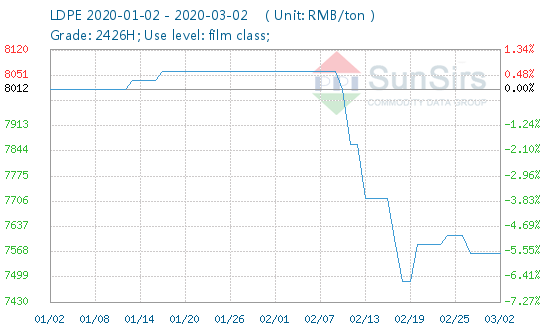

The LDPE commodity index stood at 58.85 on February 28, unchanged from the previous day, down 48.07% from the cycle high of 113.33 (2013-December-08) and up 1.00% from the low of 58.27 on February 19, 2020 (Note: Cycle refers to 2011-Septmber-01 till now).

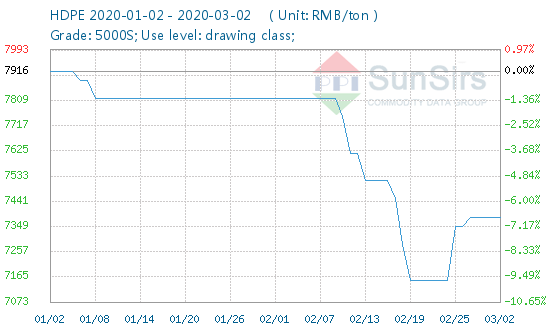

The HDPE commodity index stood at 59.84 on February 28, unchanged from the previous day, down 41.52% from the cycle high of 102.33 (2014-July-24), and up 3.26% from the low of 57.95 on February 24, 2020 (Note: Cycle refers to 2011-Septmber-01 till now).

On February 28, the polyethylene market continued to be weak, showing a sideways trend, in which the average price of LDPE 2426H in east China was about 7526.5 RMB/ton. The average price of HDPE 5000S is around 7,383.33 RMB/ ton. The average price of LLDPE 7042 is around 6816.67 RMB /ton. Up to February 28, east China LLDPE, LDPE, HDPE prices are stable. International crude oil continued to fall in a larger range. The market offer fell on the 28th, and the overall trading atmosphere is still weak. Futures markets fell, and international crude oil continued to decline. Petrochemical stocks rose slightly, and the strength of the field supply costs is quite fair. Merchants shipment is not smooth with small profit delivery.

Upstream: International oil prices fell for a fifth straight day on Thursday, hitting their lowest level in more than a year. U.S. crude hit a 13-month low at $47.84 as concerns about the economy and slowing demand continued to dominate the oil market. Light crude for April delivery fells by $1.64, or 3.37%, to settle at $47.09 a barrel on the New York mercantile exchange on Feb. 27. Brent crude for April delivery in London fell $1.25, or 2.77 per cent, to settle at $52.18 a barrel.

Futures Trend: On February 28, the opening price of the main contract of polyethylene futures L1905 was 8635, the highest price was 8635, the lowest price was 8555, the closing price was 8580, the former settlement price was 8655, the settlement price was 8590, down 75, down 0.87%. `the trading volume was 222262, the open position was 413566, the daily increasing position was -2846 (Quotation unit: yuan/ton)

Market Forecasting: International oil prices continue to be weak. The cost support is limited, and downstream factories resume work slowly. Currently, settlement is more based on demand. Market atmosphere is relatively light. It is expected to continue to be weak in the short term.

If you have any questions, please feel free to contact toodudu with tdd-global@toodudu.com.

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024