PE Spot Market Decreases (March. 25)

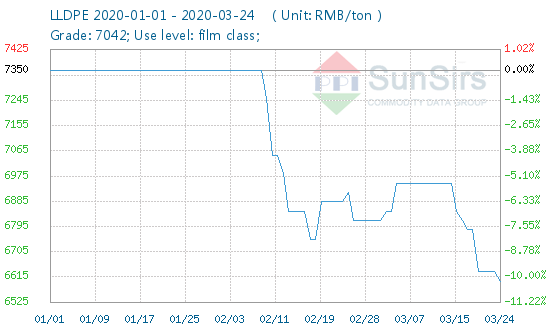

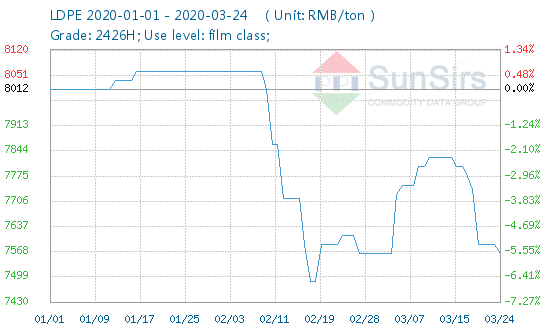

Todudu: PE spot market fell (March 25) the overall trend of the domestic PE market was multi-party decline, the overall market trading atmosphere is poor. As of March 24, East China LLDPE 7042 ex-factory average price of 6600 yuan / ton, down 0.5% from the previous day. LDPE in East China 2426H ex-factory average price of about 7562.5 yuan / ton, down 0.33% from the previous trading day. HDPE 5000S ex-works average price in East China was RMB 7,000/mt, down 1.87% from the last trading day. The downward adjustment range is between RMB 50/ton and RMB 200/ton.

/p

/p

On March 24, the PE market as a whole still showed a downward trend, and most of the petrochemical product prices fell by about 50~200 yuan per ton. Market cost support weakened. Early (March 24) oil prices rebounded slightly and then fell back, and linear futures also showed weakness. There is some pressure on the market mentality, and many enterprises are pessimistic about the market. The whole market is in a downward trend. On the downstream side, fewer inquiries flowed into the market. Except for some factories supplying on demand, people's wait-and-see attitude has become more cautious. The current market sentiment is weak.

Aftermarket: Traders' sentiment weakened as futures market continued to fall on March 24th. Polyethylene futures L2005 opening price of 6330 yuan / ton, the highest price of 6330 yuan / ton, the lowest price of 6065 yuan / ton, closing price of 6270 yuan / ton, the former settlement price of 6250 yuan / ton, settlement price of 6195 yuan / ton, 65 lots, down 1.04%, turnover of 310,925 lots, the volume of 168,342 lots of warehouses, the daily rate of increase of-16,822 (market unit: yuan / ton) .

Data: As of February 27, the total output of domestic polyethylene enterprises was 1.41 million tons, a decrease of 252,300 tons over January. HDPE output was 578,900 tons, LDPE output was 206,800 tons, and LLDPE output was 624,300 tons.

Market forecast: International oil prices rebounded in early trading, the market has eased. Although petrochemical inventories are now falling and supply pressure has eased, linear futures continue to fall, dampening downstream enthusiasm to enter the market.

In the petrochemical industry, most companies lowered their ex-factory prices. The market cost support weakened and the downstream market was less active. Factories maintain on-demand purchasing strategy and mainly wait and see. Therefore, the market is expected to remain weak in the short term.

If you have any questions, please feel free to contact toodududu (tdd-global@toodudu.com).

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024