The PE market fluctuated slightly

1. Overall trends

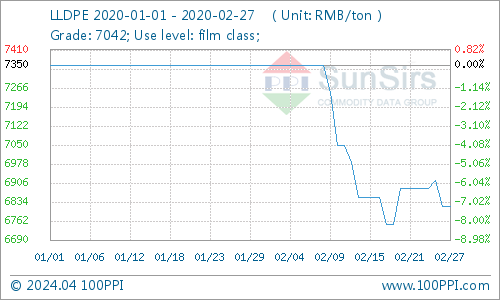

On February 27, the LLDPE Commodity Index was 65.28, unchanged from yesterday, down 44.47% from the cycle high of 117.56 points (2013-12-11 points), and up 0.99% from the February low of 64.64 points. December 19, 2020 (note: the period is from September 1, 2011 to the present)

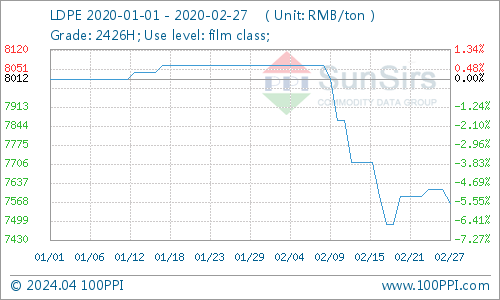

On February 27, the LDPE Commodity Index was 58.85, down 0.39 points from yesterday and down from the cycle high of 113.33 (2013-12-08) down 48.07%, up 1.00% from the February 19, 2020 low. 58.27%. (Note: The period is from September 1, 2011 to the present)

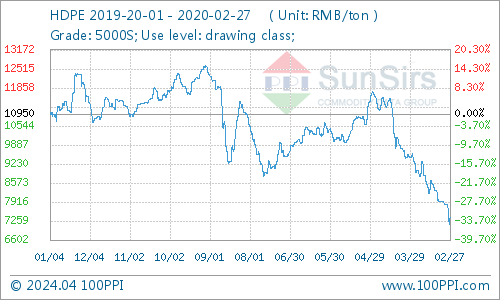

pThe HDPE Commodity Index was 59.84 on February 27, up 0.27 points from yesterday, and up 0.27 points from the cycle high of 102.33 (2014-07-24), down 41.52%, and up 3.26 points from the Feb. 24 low of 57.95.2020 (Note: The period is from September 1, 2011 to the present)

P2. market analysis

On February 27, the polyethylene market oscillated, showing a narrow sideways trend. Among them, todudu monitor, East China LDPE average price of about 7526.5 yuan / ton, 2426H, HDPE 5000S average price of about 783.33 yuan / ton, LLDPE 7042 average price of about 6816.67 yuan / ton. As of February 26, the price trend of LLDPE in East China was stable, the price of LDPE fell slightly, and the price of HDPE rose slightly. International crude oil continued to fall more. Linear futures opened lower and shook on the 27th, eroding the confidence of industry participants to some extent. Ex-factory prices of petrochemical products were basically stable. However, downstream demand is limited, the incentive to enter the market is not high, and the overall market trading atmosphere is poor.

Upstream: on February 26, the U.S. WTI crude oil futures market continued to rise. The last two trading days. Prices continued to fall, falling more. The main contract was reported at $48.73 per barrel, down $1.17 (-2.34%). Prices in the Brent crude oil futures market also continued to fall sharply, with the main contract down $1.45 (-2.77%) to $52.81 per barrel. WTI crude in particular fell to its lowest level in a year. Crude oil continued to tumble on Wednesday, mainly due to the global epidemic.

Futures trend: According to Todudoo monitoring, on February 27, polyethylene futures L2005 opened at 6900, the highest price of 6910, the lowest price of 6845, the closing price of 6890, the pre-settlement price of 6910, the settlement price of 6875, a decline of 20, or 0.29. %, turnover of 140,869, the volume of 30,207, the volume of positions increased by 3396 per day. (Estimated Unit:yuan/ton)

3. Forecast Future

The fall in international oil prices continued to put pressure on market confidence. At the end of the month, spot market prices gradually stabilized. Despite the decline in petrochemical inventories, they remained at a high level. At present, sales pressure remains high. Downstream factories are slow to resume work and the market atmosphere remains sluggish. The outlook is expected to be dominated by weak consolidation in the near future.

If you have any questions, please feel free to contact toodududu (tdd-global@toodudu.com).

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024