PE Market Fluctuated Down on February As Slow Recovery of Downstream

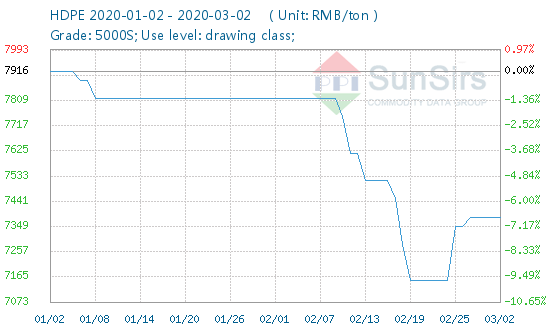

In February this year, the overall decline of the three major domestic PE markets. The LLDPE and LDPE curves in East China experienced twists and turns, while the HDPE curve fell and then rebounded.

LLDPE 704 fell to RMB 6,816.67 per ton at the end of February. LDPE 2426H fell to $7,562.5/mt at the end of the month. In addition, HDPE end of February reported 7383.33 yuan / ton 5000S. down 500 ~ 600 yuan / ton.

The overall price focus in the PE market is declining this February. Volatility in linear futures declined during the month. Despite a rebound in the second half of the year, the overall market remains weak and the spot market is limited. International crude oil also continued to decline, suffering significant damage from public health events. In particular, WTI crude fell to a one-year low.

Earlier this month, the spot market was affected by the outbreak. The Chinese New Year holiday was extended, downstream resumption of work was relatively slow, and the market was trading in a better atmosphere.

Petrochemicals inventory attracted a lot of money and only fell slightly in the middle of the month. Due to the high inventory level of petrochemical products, sales pressure is also higher. In the middle of the month, a few downstream industries gradually resumed work as the epidemic eased. Traffic also eased, and market demand increased compared with the previous period. Corporate inventories declined slightly and spot prices recovered. However, crude oil prices have fallen sharply since then, and futures prices have also fallen sharply, and the downstream has not yet fully recovered, with limited market demand. With the completion of phased replenishment, inventory consumption tended to be ideal, and the market trading atmosphere weakened again. As far as the attitude of traders is concerned, it is estimated to have eased. Among them, LLDPE, LDPE rebounded and then fell slightly, HDPE performance was weak, a sideways trend.

Crude Oil: By the end of this month (February 26), the international crude oil market is expected to be in a panic like the COVID-19 incident two days ago. After the outbreak in China, many organizations lowered their expectations for global oil demand growth in 2020. At the beginning of the year, this figure is usually more than 1.2 million barrels, or an average of 300,000 barrels per day, or an average of 30 million barrels per day.

Meanwhile, Goldman Sachs on Wednesday reduced crude demand from 1.2 million barrels to 1 million barrels, as the organization once again lowered its growth forecast following global outbreaks in Japan, South Korea, Italy and Iran. 600,000 barrels per day. As we can see, the pessimistic expectations have put further pressure on oil prices than ever before. Todudu believes that crude oil prices will remain low for the foreseeable future and that market risk factors will lead to a spike in crude oil prices. An overreaction in the market further increases the risk of a bull market. The market will fluctuate at lower levels going forward and a sustained decline cannot be ruled out. However, demand for crude oil is expected to rebound as the COVID-19 situation deteriorates and supply risks are stimulated.

Ethylene: Ethylene as a whole was on a downward trend at the end of October. In terms of ethylene prices in Asia, CFR Northeast Asia closed at $703 to $709/mt and CFR Southeast Asia closed at $696 to $704/mt as of 27th. Ethylene prices fell slightly in the European market. As of 27th, ethylene FD price in Northwest European market was $886 to $895/mt, and European CIF price was $782 to $790/mt. Ethylene prices fell in the US. As of 27th, the price was between $273-291/mt. Overall, the ethylene market in Europe and the United States has continued to decline recently, especially the lowest ethylene prices in the United States.

Futures: At the beginning of 2005, the main contract of UNIPLAS opened at RMB 6740/tonne and closed at RMB 6725/tonne on the 28th, with a low of RMB 6500/tonne. Monthly decline was 6.01%. Volume of about 2,947,000 hands, positions of 297 million hands, the overall downward trend.

Import and export situation: In December 2019, PE imports were 1,526,300 tons, of which 482,400 tons were imported by LLDPE, 737,900 tons were imported by HDPE, and 306,000 tons were imported by LDPE. Total PE exports in December 2019 were 26,400 tons.

Market Forecast: Currently, linear futures and international crude oil are weak, which inhibits confidence to some extent. Petrochemicals inventory is high, the market trading atmosphere is weak. Selling pressure, market cost support weakened. Meanwhile, downstream construction resumed slowly and market demand was limited. Some major purchases were demand-driven. In March this year, with the recovery of transportation, downstream enterprises have resumed production. However, the overall market was pessimistic and demand growth was limited. The contradiction between supply and demand in the market still exists. There will be no significant improvement in the short term. PE spot market is expected to continue to be weak.

If you have any questions, please feel free to contact toodududu (tdd-global@toodudu.com).

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024