Can China Plastic Industry Take Advantage of the Coming Sales Season?

In September this year, the domestic general plastics market stopped falling and rebounded. According to the comprehensive plastics index monitored by Toddu, it was 851 points as of September 9, up 6 points from 845 points earlier this month. Demand for downstream products improved with the arrival of the peak sales season and the Mid-Autumn Festival holiday. Meanwhile, rising prices of ethylene and propylene and apparent positive cost support are the main reasons for the price increase.

PE market performed well. The price trend of the three major spot varieties has improved. Since September, the overall increase of 50-400 yuan / ton. Among them, LDPE rose the most, up 2.28%, LLDPE rose 0.81%. Although international crude oil prices weakened due to the recent shock, the market benefited from the rise in ethylene and coal prices. In addition, with the release of demand during the peak selling season, the start rate of agricultural film in the downstream industry has also increased. Meanwhile, market trading volume increased as the Mid-Autumn Festival approached. Petrochemical companies plant prices rose, operators' mentality improved, and business forecasts are also rising.

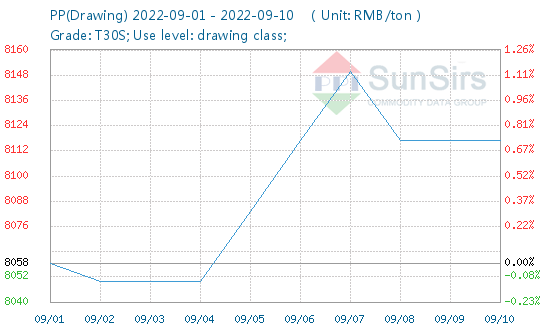

There is no significant change in the recent start rate of PP polymerization enterprises, accounting for the proportion of the entire domestic industry remains at about 77%. However, due to the raw material end of the propylene price increase, PP strong further strengthening. With the gradual increase in demand during the peak season, the terminal enterprise part of the downstream factory power restrictions lifted, the overall load increased. Among them, plastic weaving enterprises, BOPP enterprises started to pick up significantly, the need for intensive stockpiling of hard products. PP inventory declined due to demand. According to statistics, the total domestic PP inventory has been reduced to around 730,000 tons. Traders reported an increase in orders and strengthened thinking as petrochemical plants started to offer higher prices.

Tududu plastics industry analysts believe that with the end of pre-holiday restocking by downstream companies and the slowdown in market resource consumption during the long holiday period, the pressure on inventories is likely to increase, which may slow down the rise in market prices to a certain extent. Drivers of sustained growth are either limited or consolidation has become a major trend. Pay more attention to the end demand.

Please feel free to contact toodududu (tdd-global@toodudu.com) with any questions.

Recommended Suppliers

June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 17, 2024

June 17, 2024  June 18, 2024

June 18, 2024  June 18, 2024

June 18, 2024