Prospects for China PE Market in 2024

In recent years, global economic growth has slowed down. Meanwhile, global issues such as inflation and geopolitical conflicts are limited, and raw material business risks have increased. In addition, the PE industry as a petrochemical, coal chemical downstream products, facing many negative factors such as OPEC Production reduction policy led to rising crude oil prices and so on. The market situation faces many obstacles in 2023. Can PE price regain its glory in 2024? This analysis guides PE trends in 2024.

Currently, the Korean PE industry is still in a period of rapid growth. According to statistics, the total number of new PE equipment will be about 5 million tons/year in 2023, and the growth rate of production capacity is expected to exceed 20%. After last year, we entered the peak production period. By 2024, the capacity expansion is expected to exceed 8.8 million tons/year. By then, China's annual PE capacity will reach 48.57 million tons/year, and the capacity growth rate will continue to hit a record high.

As a result of the expanding production facilities, domestic production has also increased significantly. Compared with the total domestic production of about 29.7 million tons in 2022, domestic PE production is expected to increase by 8.38% to 32.19 million tons in 2023. As suppliers continue to build strength, the spot price market has slowed down for a long period of time, making it difficult for suppliers to find favorable conditions.

On the other hand, domestic PE production capacity recorded a high growth rate of 20%, so the 8.38% annual production growth rate does not seem appropriate. This phenomenon occurs because under the cycle of rapid expansion of PE industry, the internal adjustment of the industry is inevitable due to the surplus of local resources. In 2023, the industry consensus is to rotate, reduce the production load of equipment, squeeze marginal capacity and share the supply pressure. Indeed, refineries have increased their cyclical production reduction efforts since 2022. In 2023, PE companies started at a record low last year, and reducing the burden on companies has become an important means for the industry to avoid business risks.

Not only is the growing demand for PE struggling to keep up with the ultra-high supply growth, but investment opportunities are shrinking due to a lack of willingness to expand long-term businesses in the current macro backdrop of a slowing global economy. In addition, downstream PE companies are worried about the future and have joined the low-load operation team due to the downturn in consumption of finished products.

Last year, China actively introduced a series of policies to promote consumption. Among them, policies such as home appliance subsidies and new energy vehicle purchase tax exemption directly benefited PE consumption, but PE downstream enterprises generally operated in a stable manner, with weak market credibility. It is expected that the average PE downstream start rate of plastic weaving, injection molding and BOPP film will be 41.65%, 57% and 61.80% respectively in 2023. Limited growth in factory orders greatly reduced PE demand.

With the continuous increase in domestic production equipment, PE industry diversified layout gradually deepened, industrial integration process accelerated and gradually improved. The voice of China's PE industry in the international arena is getting louder and louder. Combined with the domestic PE price advantage and the gradual fulfillment of domestic consumer demand, a good foundation has been laid for expanding PE exports. However, due to the lack of overseas purchasing capacity, exchange rate, tariffs, transportation costs and other factors, it is expected that the growth rate of PE export will slow down in 2023, and the annual export volume will be limited to about 1.37 million tons. The export window period is generally short and scattered, making it difficult to realize a significant increase in volume. It is expected that China's PE export market in 2024 will continue the pattern of last year.

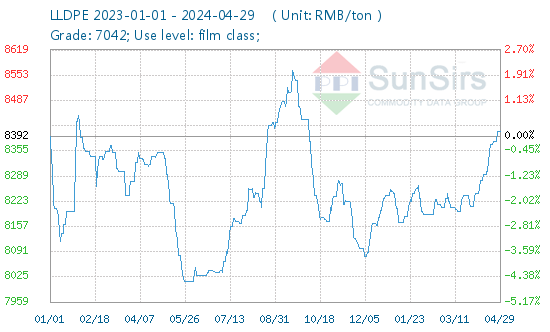

According to Todudoo Product Market Analysis System, the PE market experienced a decline in 2023, followed by signs of recovery. As of December 31 last year, the mainstream price of T30S (drawing) was RMB 7,650 per ton, down 2.65% from the average price at the beginning of the year.

Although the economic recovery is expected to be strong in the first half of the year, PE prices have fallen to the lowest level due to weak realities such as the energy recession. China will digest all the negative news by the end of the year. The market rebounded sharply in the third quarter due to the traditional peak season and recovery in the energy sector. However, due to weak long-term support on the supply and demand side, the PE market has more upside resistance in the fourth quarter, and the overall performance is slightly volatile.

In recent years, various international forces have disrupted the energy market and smooth transportation, the pace of global deflation is slow, and the macroeconomic environment still needs time to recover. Due to various factors, it is difficult to find a favorable situation in the PE market. Meanwhile, the biggest resistance in the domestic PE market comes from the mismatch between supply and demand and the increasingly fierce competition among domestic companies. It is expected that PE prices will be difficult to rise or fall in 2024.

If you have any questions, please feel free to contact toodududu (tdd-global@toodudu.com).

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024