China PE Market Review and Forecast for2023 and 2024

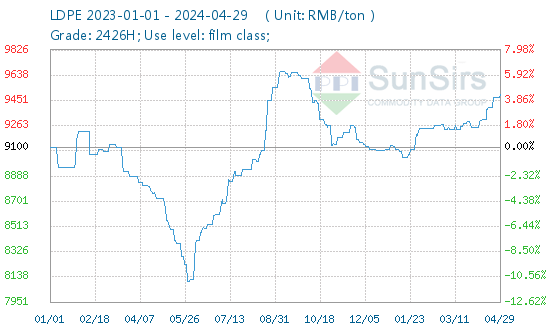

The average price of LLDPE at the beginning of 2023 was RMB 8,392 per ton, and the average price at the end of the year was RMB 8,237 per ton, a decrease of 1.86% from last year. The average price of LDPE at the beginning of 2023 was RMB 9,100 per ton, and the average price at the end of the year was RMB 9,082 per ton, down 0.19% from last year. The average price of HDPE at the beginning of 2023 was RMB 8,466/ton, and the average price at the end of the year was RMB 8,500/ton.

2023 Market Review

Fluctuations and declines from January through May were reflected in LLDPE and LDPE products. HDPE product trends were relatively independent, with HDPE equipment requiring more maintenance. Quotations rose sharply due to supply shortages. In March this year, the international financial crisis triggered strong pessimism in the macro market. In the second quarter, domestic PE supply pressure eased due to the centralized maintenance period of equipment. However, it is now in the traditional agricultural film off-season, downstream factories shut down for maintenance, resulting in a drop in spot prices.

After June, LDPE first rose and then fell. Compared with LLDPE and HDPE, it is more resilient and has less room to fall. In June, the Fed stopped raising interest rates and the news of domestic interest rate cuts boosted macroeconomic sentiment. Because of the supply shortage of some brands of PE, crude oil prices remained high in August. Agricultural film enterprises seasonal orders are expected to continue to recover, market demand is expected to improve, market sentiment is expected to improve. Since September, enterprises parking maintenance equipment gradually restarted, PE supply increased. Due to low front-end utilization, market demand is lower than expected, gold and silver prices have not yet been determined.

Cost side: oil prices have remained low for a long time, and oil prices in 2023 are more variable. Average oil prices are expected to remain slightly higher in 2024 than in 2023, but prices are not expected to rise significantly due to demand constraints. Supply side: by the end of 2023, domestic PE capacity was 31.228 million tons. New PE capacity is expected to increase by 8.78% to 2.52 million tons in 2023 compared with last year. Polyolefin is in a capacity expansion cycle. Domestic PE new capacity is expected to be about 6.13 million tons in 2024, with a growth rate of 19.62%. The burden of investment and production in the first half of the year is not large, but the second half of the year needs to pay more attention to the production rate. On the import side, in the past 24 years, with the domestic production capacity increasing year by year, PE's dependence on imports has been decreasing. On the demand side: in 2023, most downstream PE starts will be at the lowest level year-on-year, and market demand will be lower than expected. Over the past 24 years, the global economic situation has not been optimistic, China's policy is moving in a positive direction, and expectations of interest rate cuts in the US have risen. The mix of long and short positions may limit the growth of market demand.

In the second half of October 2023, the PE market declined sharply, crude oil also fell, and downstream starts were lower than expected. Lower than expected market demand curbed the weak decline in the PE market. At the end of 2023, spot prices of linear products rose slightly, led by futures. Domestic supply-side pressure is expected to be higher in the first half of 2024, and the second half of the year should focus on the production rate. PE demand was limited in January-February, with prices mainly fluctuating in a narrow range. March-April is the peak season for plastic films, market demand may increase, prices may rise, but the rise is limited. Overall, the PE market is expected to see a slight pullback in the short term.

If you have any questions, please feel free to contact toodududu (tdd-global@toodudu.com).

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024