Oil sinks again, flight to safety hits shares, dollar

Mumbai: Contrary to popular belief, the fall in crude oil prices could have a negative impact on global stock markets, including India. Weak crude oil prices threaten growth in many oil-producing countries, which could severely impact India’s foreign inflows and exports.

“Crude oil has created huge uncertainty in the global markets, which has negatively impacted India. The recent sell-off in foreign funds could be due to the continued fall in crude oil prices, which has led to a fall in the value of equities and the rupee.” The steep fall in crude oil has created serious problems in the market. ‘

Market sentiment was further shaken after the International Energy Agency cut its 2015 oil demand forecast to 900,000 barrels a day and warned of a possible financial default in Venezuela and Russia. On Friday, the price of Brent crude hit $60 a barrel, down 48 percent from its high in June this year.

Lower crude prices mean lower revenues for oil exporters. This will slow down global demand and affect Indian exports.

“The main sources of funds for Indian investments are sovereign wealth funds, pension funds and insurance funds. If Norway, Saudi Arabia, Abu Dhabi, Qatar and Kuwait do not have surpluses, there will be less capital available for exports.” Mishra, Director and India Equity Strategist, Credit Suisse “Capital inflows to India are not as strong as they used to be.”

Foreign institutional investors have sold shares worth about Rs 18.5 billion in the last four Indian trading sessions. The rupee touched a 10 percent 62.50-month low against the dollar on Friday on fears of a slowdown in foreign capital flows.

In fact, despite the market hitting new highs, the pace of FII capital inflows has reached a critical mass so far, with only $17 billion invested in the Indian stock market. In 2013 2000+, India received 2000+ FII $100 million investment up from last year’s $24 billion.

“Weak global demand will also hurt India’s exports and affect capital flows. We do not believe that lower crude oil prices will improve the currency or balance of payments.

Analysts said demand for the rupee from foreign institutional investors could fall sharply due to the expected rise in US interest rates, leading to a further decline in the rupee.

UTI Asset Company Sanjay Dongre “The depreciation of the rupee has been smaller compared to most countries. However, any significant depreciation in the rupee will have a global impact as capital flows into our markets.” ‘

Benchmark stock index Bombay Stock Exchange Sensex on Friday surged to 27, 350 Recorded the biggest one-week drop of 3.9 points points. More than 3 years percent.

The index lost more than 1,200 points in just six trading sessions. National Stock Exchange Nifty The index closed at 8, 224 on Friday It has fallen in five of the last six trading sessions.

The derivatives market indicated further weakness in the NSEE Nifty index.

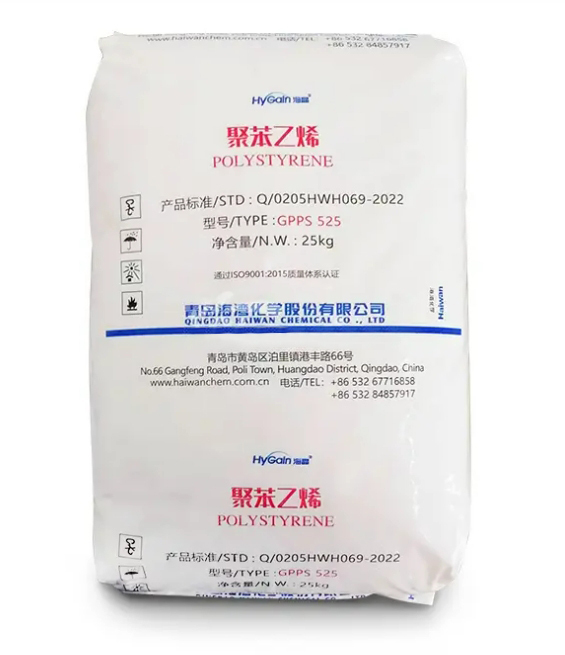

Recommended Suppliers

September 23, 2024

September 23, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024  June 3, 2024

June 3, 2024