Daily Macro Economy News on 23th,April

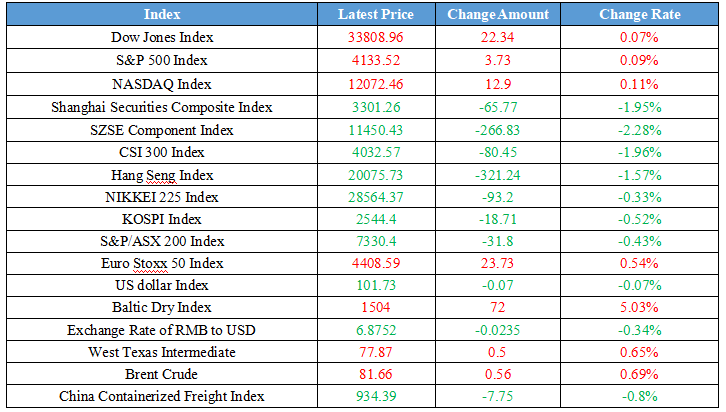

Latest Global Major Index

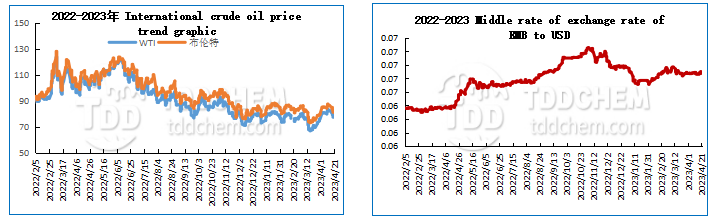

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. MIIT Industrial Internet core industry scale exceeds RMB 1.2 trillion

2. MIIT: 7 industry enterprises in steel, coking, ferroalloy, etc., to carry out special inspections on industry mandatory energy consumption limit standards

3. SFEA: Banks' accumulated foreign exchange settlement of 373.62 billion yuan from January to March

4. SFEA: China's foreign exchange market gets off to a steady start, the RMB exchange rate appreciates slightly.

International News

1. Japan's manufacturing PMI rises to six-month high, but remains in contraction intervals.

2. The BRICS New Development Bank issues 1.25 billion dollars in green bonds

3. UK consumer confidence rises to the highest level since the Russia-Ukraine conflict began

4. Emergency loans to banks from the Fed increase for the first time in five weeks as the financial stress

1.MIIT Industrial Internet core industry scale exceeds RMB 1.2 trillion

This year is the last year of the implementation of the Industrial Internet Innovation and Development Action Plan (2021-2023). The plan aims to achieve a leap in the overall development of the industrial Internet in these three years. The Ministry of Industry and Information Technology (MIIT) revealed that the scale of China's industrial internet core industry exceeded 1.2 trillion yuan, an increase of 15.5% year-on-year. So far, the industrial Internet has covered 45 national economic categories and more than 85% of the major industrial categories. In the first quarter, the MIIT released 218 industrial Internet pilot demonstration projects, including 5G factories, industrial Internet parks, and public service platforms, to create several application practice models and accelerate digital transformation.

Resource: CCTV News

2.MIIT: 7 industry enterprises in steel, coking, ferroalloy, etc., to carry out special inspections on industry mandatory energy consumption limit standards

The People's Republic of China Ministry of Industry and Information Technology (MIIT) Office issued a notice on the inspection of the 2023 annual industrial energy-saving work. The notice requires that, based on the work in 2021 and 2022, special inspections will be carried out for enterprises in iron and steel, coking, ferroalloys, cement (with clinker production lines), flat glass, construction and sanitary ceramics, non-ferrous metals (electrolytic aluminum, copper smelting, lead smelting, zinc smelting), oil refining, ethylene, paraxylene, modern coal chemical industry (coal to methanol, coal to olefin, coal to ethylene glycol), synthetic ammonia, calcium carbide, caustic soda, soda ash, ammonium phosphate, and yellow phosphorus. In principle, in the first three years of the 14th Five-Year Plan, enterprises in the above-mentioned industries in the region should be fully covered by energy-saving supervision.

3.SFEA: Banks' accumulated foreign exchange settlement of 373.62 billion yuan from January to March

State Foreign Exchange Administration (SFEA) statistics show that in March, banks settled RMB 129.56 billion in foreign exchange and sold RMB 140.53 billion. From January to March 2023, banks settled RMB 373.62 billion in foreign exchange and sold RMB 384.17 billion in foreign exchange. In dollar terms, banks settled USD$187.8 billion and sold USD$203.7 billion in March. From January to March 2023, banks settled a cumulative USD$546 billion and sold a cumulative USD$561.3 billion in foreign exchange.

4.SFEA: China's foreign exchange market gets off to a steady start, the RMB exchange rate appreciates slightly

Wang Chunying, deputy director and the spokeswoman of the State Administration of Foreign Exchange (SAFE) said at a press conference that in the first quarter of 2023, with the downside risks in the global economy increasing, monetary policy tightening in the major developed economies, and uncertainties still existed in the international financial market. In the face of the complex external environment, under the strong leadership of the Party Central Committee with Comrade Xi Jinping at its core, China adhered to the general keynote of seeking progress stably and focused on promoting high-quality development, with the main domestic macroeconomic indicators stabilizing and the economy showing a recovery to a positive trend. China's foreign exchange market got off to a stable start, with the RMB exchange rate appreciating slightly and cross-border capital flows becoming more balanced.

1.Japan's manufacturing PMI rises to six-month high, but remains in contraction intervals

Japan's preliminary manufacturing PMI rose to 49.5 in April from 49.2 in March, contracting at the slowest pace in six months as a slump in sales slowed while the service sector remained solid, suggesting an uneven recovery in the wake of the corona virus epidemic. The index was below the entrepreneurs confidence threshold index for the six consecutive month in April. On the other hand, the survey showed that service sector activity expanded for the eight consecutive month in April, supported by an increase in new orders and new export business. Annabel Fiddes, associate director of economics at S&P Global Market Intelligence, said: "According to the latest data, Japan's private sector continued to expand solidly at the start of the second quarter, with the recovery in the services economy helping to offset the weaker performance of the manufacturing sector. While service providers expect demand and operating conditions to improve further as the impact of the corona virus pandemic recedes, many manufacturers are concerned about the economic outlook, rising costs and component parts shortages."

2.The BRICS New Development Bank issues 1.25 billion dollars in green bonds

The BRICS New Development (NDB) successfully priced a US$1.25 billion in green bond with a 3-year maturity, priced at 125 basis points above the Median Swap Rate (MS). The bond is the NDB's first US dollar-denominated green bond issuance and will provide financing or refinancing support for green projects that meet the definition of the NDB's sustainable financing policy framework. The bond was subscribed by 78% of central bank investors, with the rest being bank treasurers, asset managers, and others. Over 50 investors are from Asia, Europe, and the Americas.

3.UK consumer confidence rises to the highest level since the Russia-Ukraine conflict began

The UK Gfk consumer confidence index rose to -30 in April, signaling a continued recovery in consumer confidence and reaching the highest level since the Russia-Ukraine conflict began. However, the index remains well below zero, indicating that most respondents are pessimistic about their personal finances and the broader economic situation. The index is closely watched and reflects British people's views on their personal financial situation and the overall economic outlook. Ashley Webb, a British Economics at Capital Economics said that the increase was due to "a tight labor market results in a rapid wage growth, and government subsidies to support nominal household income". Joe Staton, director of the client strategy at GfK, said: "There is a sudden surge in optimism with significant improvements across the board." Households were less pessimistic about their financial situation over the next 12 months, with the indicator's sub-index rising eight points to -13.

4.Emergency loans to banks from the Fed increase for the first time in five weeks as the financial stress

The US banking sector increased emergency loans from the Federal Reserve for the first time in five weeks, signaling lingering stress in the financial sector following a series of bank failures last month. In the week ended April 19, the Fed provided $143.9 billion in outstanding loans to financial institutions through two backstop lending instruments, compared with $139.5 billion last week, according to data released Thursday at local time. The Fed's weekly balance sheet data showed that loans from the Fed's traditional backstop lending program, known as the discount window, were $69.9 billion, compared with $67.6 billion the previous week and a record $152.9 billion last month. Loans to the Bank Term Funding Program (BTFP) also climbed to US$74 billion, compared to US$71.8 billion the previous week.

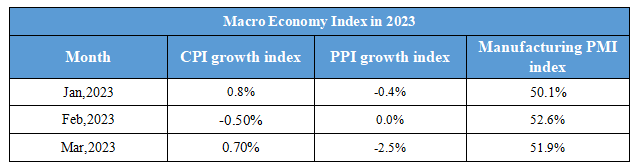

Domestic Macro Economy Index