Daily Macro Economy News 21th April

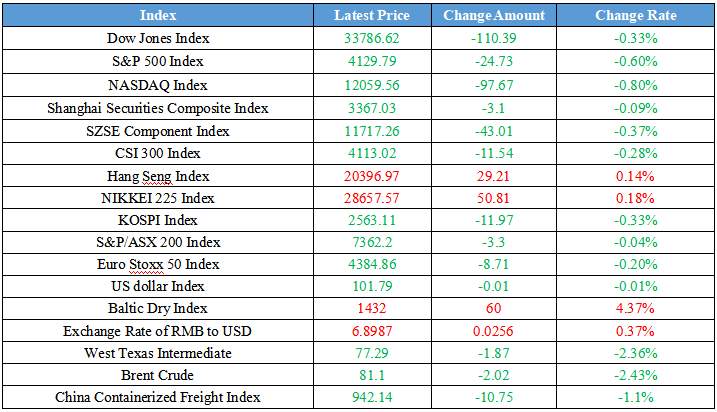

Latest Global Major Index

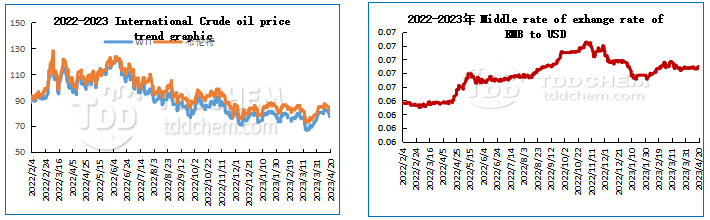

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. CPCIF: Petrochemical industry emission peak implementation plan will soon be released.

2. NDRC and U.S. Multinational Enterprises Roundtable Meeting was held in Guangzhou.

3. PBC: Broad money growth rate is related to the effective implementation of the financial system and other factors

4. MIIT: Initiatives were launched on new energy vehicles, smart home appliances and green building materials in rural areas

International News

1.New Zealand inflation runs weak more than expected in Q1, price pressures may have peaked

2.The Eurozone recorded a quarterly adjusted current account of â¬24.32 billion in February, which is the

largest surplus since July 2021

3.Pakistan places first discounted crude oil order with Russia

4.Germans PPI decreased by 2.6 percent month-on-month, an expected rate for next month

decreased by 0.5 percent, and the previous rate decreased by 0.3 percent

Domestic News

1. CPCIF: Petrochemical industry emission peak implementation plan will soon be released

The Honeywell Green Development Summit 2023 was held in Tianjin. At the summit, Pang Guanglian, the member and deputy secretary general of the China Petroleum and Chemical Industry Federation (CPCIF), talking about the green development of the petrochemical industry, indicates that Environment, Social and Governance (ESG) will promote the green transformation and high-quality development of China's petrochemical industry, while the green development of the petrochemical industry has also brewed a lot of investment opportunities. "Our petrochemical federation has been advocating that the whole industry should actively be at the forefront of the work of carbon peaking and carbon neutrality, and we also actively cooperate with the national carbon peaking and carbon neutrality system. In response, the implementation plan of our whole industry's emission peak will be released soon."

Resource: National Business Daily

2. NDRC and U.S. Multinational Enterprises Roundtable Meeting was held in Guangzhou

NDRC and U.S. Multinational Enterprises Roundtable Meeting was held successfully in Guangdong-Hong Kong-Macao Greater Bay Area. Li Chunlin, the vice minister of the National Development and Reform Commission (NDRC), attended the meeting and addressed notes. He expresses his hope that the roundtable meeting will actively promote exchanges between the Chinese and U.S. business communities and welcome multinational enterprises, including U.S.-funded enterprises, to invest in the Guangdong-Hong Kong-Macao Greater Bay Area, carry out more practical cooperation in such fields as science and technology innovation, green energy, ecological protection, marine economy, and biomedical industry, and take the Greater Bay Area as the starting point to deepen the market in China, achieve mutual benefits and win-win results, and create and share a better future.

Resource: Securities Times

3. PBC: Broad money growth rate is related to the effective implementation of the financial system and other factors

The People's Bank of China (PBC) indicates that the relatively high growth rate of broad money is mainly due to the effective implementation of the financial system, which strengthens the funding support for the real economy, and the corresponding increase in derivative money. The collective asset management recycling statement is also an important reason for the rise in broad money. Since the second half of last year, the financial market has fluctuated, the risk preferences of the real sector have declined, asset management including financial products have been shown in the statement, and the balance sheet of banks has expanded, which pushes up the growth rate of broad money.

Resource: CCTV News

4. MIIT: Initiatives were launched on new energy vehicles, smart home appliances and green building materials in rural areas

The Information Office of the State Council held a news conference on the development of industry and information technology in the first quarter of 2023. At the conference, Zhao Zhiguo, the spokesman and general engineer of the Ministry of Industry and Information Technology (MIIT), indicates that it will accelerate the recovery of domestic demand. To achieve this purpose, they will deeply promote the "Three Products" action in consumer goods and raw materials, which is providing green construction materials, green consumer goods, and green services. Carry out new energy vehicles, smart home appliances and green building materials in rural areas and other activities, and vigorously cultivate the local food industry, to promote consumption with high-quality supply. Remained firm in promoting the major projects in the field of industry and information technology set out in the 14th Five-Year Plan. Stepping up technology-oriented upgrades to industrial enterprises, providing guidance to financial institutions on increasing medium- and long-term loans in manufacturing, and actively expanding effective investment.

Resource: China Internet

International News

1. New Zealand inflation runs weak more than expected in Q1, price pressures may have peaked

New Zealand's inflation runs weak more than the economists expected in this Q1, suggesting price pressures have peaked and the New Zealand Fed may not need to continue to raise rates so aggressively. The New Zealand Fed has been raising the official cash rate at a record pace to tame inflation, unexpectedly raising rates by 50 basis points to 5.25% this month and suggesting the process may not be over. Weaker inflation data may not dissuade policymakers from raising rates by 25 basis points at the May meeting."The number is not bad for the New Zealand Fed, but the caveat is its concentration on a handful of items, mainly tradable goods," said Craig Ebert, senior economist at the Bank of New Zealand. "The slowdown in the core indicators will be much smaller, so caution is still needed. But this is a step in the right direction."

2. The Eurozone recorded a quarterly adjusted current account of â¬24.32 billion in February, which is the largest surplus since July 2021

3. Pakistan places first discounted crude oil order with Russia

Minister of Pakistan State for Petroleum indicates that the country would receive its first consignment of discount crude oil from Russia next month based on a new agreement between Pakistan and Russia, with one shipment due to dock at port of Karachi in May. According to the agreement, Pakistan will buy only crude oil, not refined fuel, and if the first deal goes through, imports are expected to reach 100,000 barrels per day. Pakistan Refineries Ltd. will be the first refinery to refine Russian crude, and other refineries will join soon after the trial run, he said. The Russian energy minister previously led a delegation to Islamabad in January to hold talks on the deal. After the talk, he said that oil exports to Pakistan may start after March.

4. Germans PPI decreased by 2.6 percent month-on-month, an expected rate for next month decreased by 0.5 percent, and the previous rate decreased by 0.3 percent

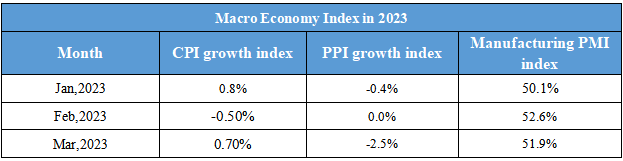

Domestic Macro Economy Index

- Petroleum Coke Market Analysis Analysis of domestic petroleum coke index(December 23, 2024)719

- Titanium Market Overview(December 23, 2024)477

- Caustic soda: The liquid caustic soda market has both ups and downs, 50 caustic soda continues to rise, and the market has increased positions upward(December 23, 2024)565

- Polyethylene PE: Spot prices weakened overall, and the market has a strong pre-sale sentiment(December 23, 2024)663

- Polypropylene PP: Spot prices are weak, and downstream orders are limited(December 23, 2024)477