- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

White sugar: Zheng sugar futures closed up slightly, and spot prices were stable and strong

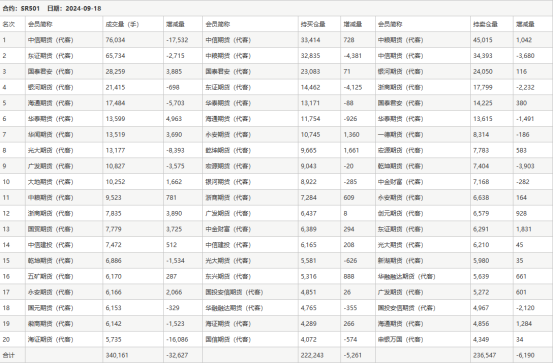

Analysis of white sugar futures:On September 18, the opening price of the SR501 contract: 5746, the highest price: 5785, the lowest price: 5725, the position: 333673, the settlement price: 5754, yesterday's settlement: 5688, up: 66, daily trading volume: 246078 lots.

Comprehensive price list by region: RMB/ton

White sugar spot market:Today, mainstream transaction prices in China's white sugar market are stable and strong. Among them, 6,350 - 6,470 yuan/ton in Northeast China and 6,300 - 6,600 yuan in East China/ton, Central China 6430-6460 yuan/ton, North China 6340-6450 yuan/ton, South ChinaThe region is 6280 yuan/ton, the northwest region is 5,600 - 6,260 yuan/ton, and the southwest region is 6,030 - 6,170 yuan/ton. White sugar company quotation:

Nanhua Kunming first-grade white sugar quoted at 6060 yuan/ton, an increase of 10 yuan/ton. Nanhua Xiangyun and Dali first-grade white sugar are quoted at 6010 yuan/ton, an increase of 10 yuan/ton. The price of first-grade white sugar in Yun County in Nanhua is 5970 yuan/ton, an increase of 10 yuan/ton. Nanhua Guangxi first-grade white sugar is quoted at 6,160 - 6,210 yuan/ton, an increase of 10 yuan/ton. Yingmao Kunming first-grade white sugar quoted 6050 yuan/ton, an increase of 10 yuan/ton. Yingmao Dali's first-grade white sugar price is 6000 yuan/ton, an increase of 10 yuan/ton. COFCO (Tangshan) Sugar Co., Ltd. quoted 6350 yuan/ton for imported processed sugar, an increase of 30 yuan/ton. COFCO (Liaoning) Sugar Co., Ltd. quoted 6350 yuan/ton for imported processed sugar, an increase of 10 yuan/ton.

White sugar market outlook forecast:On the external side, raw sugar futures rose sharply on Tuesday, hitting a high in the past two months. In the second half of August, central and southern Brazil produced 3.258 million tons of sugar, a year-on-year decrease of 6.02%, boosting sugar prices. China's white sugar futures return after the holiday. The white sugar 2501 main contract price weakened in a narrow range from the highest position of 5785 until the end of the late session. The technical level shows that the three-track openings of the Bollinger Band (13, 13, and 2) continue to open, and the candle diagram shows a longer shadow column on the upper shadow line, penetrating the upper track position. The daily MACD line and the gold fork on the KD line continue, and the disk surface is slightly reduced. The position is slightly reduced and the position is opened by 21.8% more than the opening is 17.7%. There are no holidays on the demand side of the spot market to support weak demand. Data from the General Administration of Customs shows that China's sugar imports in August were 770,000 tons, a year-on-year increase of 109.6%. Overall, the sugar market is mainly boosted by external markets combined with China's weak fundamentals and positive and bearish games. It is expected that the room for growth in China's white sugar futures prices may be limited in the short term and remain weak.

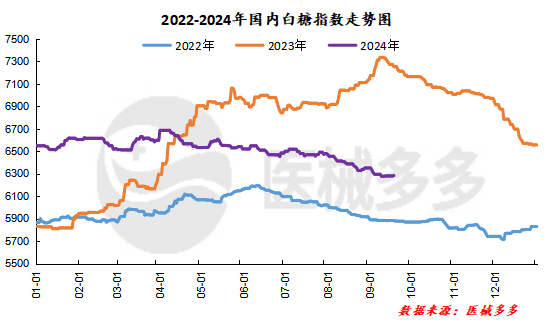

China White Sugar Index:According to calculations from medical equipment,September 18China's white sugar spot index was 6,284.14, up 4.00 or 0.06%, while the white sugar index rose slightly.

Position Dragon and Tiger List

The information provided in this report is for reference only.

Original: Wang Yaoxin 17732561807