PVC: Short futures dominated the market without a bottom line, breaking the previous low, and the spot fell on the first day

PVC Futures Analysis:V2501 contract opening price: 5330, highest price: 5362, lowest price: 5159, position: 1045525, settlement price: 5235, yesterday settlement: 5378, down 143,daily trading volume: 1325595 lots, precipitated capital: 3.807 billion, capital inflow: 110 million.

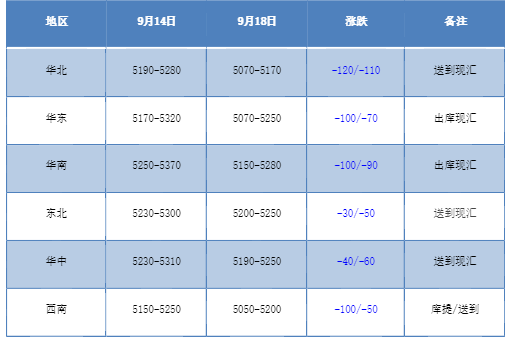

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of China's PVC market began to fall on the first day after the festival, and the market operation atmosphere was weak. Compared with the valuation, it fell by 110-120 yuan / ton in North China, 70-100 yuan / ton in East China, 90-100 yuan / ton in South China, 30-50 yuan / ton in Northeast China, 40-60 yuan / ton in Central China and 50-100 yuan / ton in Southwest China. Upstream PVC production enterprises some stable prices wait and see, some began to reduce 50 yuan / ton, in order to promote transaction consumption plant inventory. The futures market opened high and went low again, refreshing the low point again, and the quotations of various merchants in the spot market were lowered one after another compared with those before the festival. although one price and point price coexist, the reference significance of one price becomes smaller, and the market tends to base offering. among them, East China basis offer 01 contract-(100-160-200), South China 01 contract-(0-80), North 01 contract-(200-280-330) Some low-cost sources in southwest China have heard of 01 contract-(500). Although post-holiday spot prices fell slightly, but the market transaction is not good, in the face of low prices in the downstream excluding the rigid demand replenishment part, there is no redundant purchase intention.

From the perspective of futures:The PVC2501 contract opened high and went low after the holiday, and the opening price could still stay in the high range, but then it fell all the way down, and the weak market in the afternoon did not improve, and closed at a low in late trading. 2501 contracts range from 5159 to 5362 throughout the day, with a spread of 203. 01 contracts with an increase of 53896 positions, with 1045525 positions so far, 2505 contracts closing at 5460 and 139613 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2501 contract showed an obvious decline on the first day after the festival, and the low point of the futures price was before the refresh, and the lowest point was 5159, which was much lower than that before the main link. On the one hand, the fluctuation range of the futures price expanded today, with a range of 203 throughout the day. On the other hand, the low point of the futures price fell below the undertrack support, and the technical level showed that the opening of the three tracks of the Bollinger belt (13, 13, 2) turned downward, the KD lines at the daily level crossed, the MACD lines showed a dead-fork trend, and there was a trend of short selling at the technical level. and in terms of trading, the short opening is 27.1% compared with 24.5% more, and the short trend is obvious. In the short term, the operation of futures prices may continue to test the low range and observe the performance of the low range of 5150-5200.

Spot aspect:After the festival, first of all, the price of futures opened high but went low depressed the mentality of the participants in the spot market. Although the quotation in the morning could still maintain the early stage, but in the face of the market that continued to fall, the spot market broke stability and began to fall by noon, and the basis of the spot market adjusted slightly. Even if there is a price decline, regional transactions and traders feedback also did not appear a better shipping rhythm, downstream rigid demand procurement. The macro mood of commodities was bearish, and the main contracts of Chinese futures were up and down at midday. In terms of decline, Container Europe fell by more than 6%, caustic soda by more than 5%, iron ore by more than 4%, PVC silicon by more than 3%, PTA, PX, lithium carbonate by more than 2%, rebar, soda ash and glass by more than 1%. On the whole, the current PVC fundamentals are weak, coupled with poor commodity sentiment, the spot market continues to be low and narrow, expected to be strangled.