Daily review of urea: The market operation is weak and the price is stable after the holiday (September 18)

China Urea Price Index:

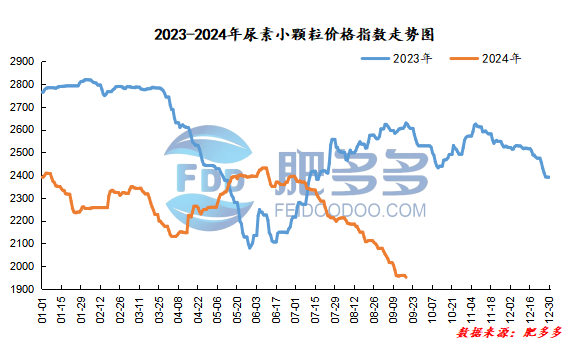

According to Feiduo data, the urea small pellet price index on September 18 was 1,951.05, a decrease of 8.18 from yesterday, a month-on-month decrease of 0.42% and a year-on-year decrease of 25.79%.

Urea futures market:

Today, the opening price of the urea UR501 contract is 1771, the highest price is 1774, the lowest price is 1750, the settlement price is 1762, and the closing price is 1755. The closing price is 34 lower than the settlement price of the previous trading day, down 1.90% month-on-month. The fluctuation range of the whole day is 1750-1774; the basis of the 01 contract in Shandong is 95; the 01 contract has increased its position by 5091 lots today, and so far, it has held 195881 lots.

Today, urea futures prices fluctuated mainly downward. The fundamentals of urea itself still revolve around the logic of strong supply and weak demand, and the rebound driven by overall market sentiment in the early stage lacked sustainability. At present, the supply of urea continues to rise, downstream demand is difficult to continue to follow up, manufacturers 'inventories continue to rise sharply, companies mainly reduce prices and collect orders. After market prices weaken, downstream purchases are more cautious, and negative feedback from the overall market continues to form a strong rise. In the short term, it is necessary to pay attention to whether terminal demand can increase market sentiment and whether the overall futures market can stabilize again.

Spot market analysis:

Today, China's urea market is stabilizing and consolidating downward. After the holiday, manufacturers continue to advance shipments in advance. Quotes fluctuate and have not changed much, and quotations have been lowered by 10-50.

Specifically, prices in Northeast China have stabilized at 1,950 - 1,970 yuan/ton. Prices in East China have been lowered to 1,840 - 1,900 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,850 - 2,080 yuan/ton, and the price of large particles has been lowered to 1,930 - 2,020 yuan/ton. Prices in North China have been lowered to 1,770 - 1,970 yuan/ton. Prices in South China are stable at 2020-2050 yuan/ton. Prices in the northwest region are stable at 1,930 - 1,980 yuan/ton. Prices in Southwest China have been lowered to 1,950 - 2,300 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers are shipping orders in advance before the holiday, but are reducing their orders. However, the follow-up of new orders is not good. The market shows no signs of improvement. Factory orders are under pressure, and quotations continue to be stable before the holiday. The price is reduced to a small margin. In terms of the market, the atmosphere in the market is sluggish, the market is weak and volatile, and the benefits are limited. It is difficult to boost prices significantly in the short term. Companies are waiting for a new round of replenishment to follow up, and prices may rise by then. On the supply side, Nissan continues to pick up, and the supply continues to be sufficient. Just as it needs to weaken, corporate inventories continue to rise, mainly accumulating stocks for a short period of time. On the demand side, agricultural demand is in the off-season, and market procurement is generally sustainable, and the main focus is to maintain a small amount of follow-up on demand; compound fertilizer factories are cautious in following up, and corporate inventories are high. The demand for raw materials is weakened, and follow-up and purchase are not good.

On the whole, the current post-holiday transaction atmosphere in the urea market in China is flat, downstream enthusiasm for making up orders is poor, and the market is stable and weak. It is expected that the urea market price will continue to be weak in the short term, making it difficult to move upwards.