Polyester: Lack of effective support Polyester dives after the holiday

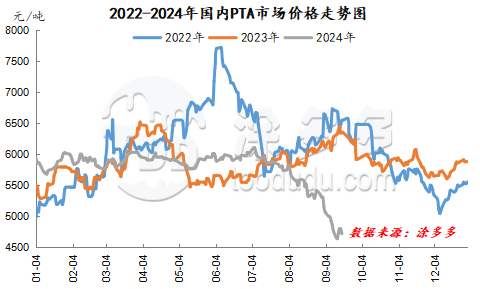

With the return of the Mid-Autumn Festival holiday, the international crude oil futures market opened low, the atmosphere of China's commodity market weakened, and the polyester industry chain futures market plunged at the same time. Although the rise in international crude oil and cost prices before the festival and the improvement of market mentality have brought some repair to the polyester market, the reality of weak supply and demand of polyester raw materials continues to depress the market, and the market returns to a weak pattern after the festival. Polyester raw material PX futures are down 2.82%, mainly down 2.50%, ethylene glycol futures are down 1.13%, polyester staple fiber futures are down 1.77%, and polyester bottle chip futures are down 1.97%. China's PTA market price down, negotiate near reference 4720. September delivery and warehouse receipt offer 01 discount 80-90, October delivery offer 01 discount 65-70, spot basis slightly stronger, market negotiations light.

From the point of view of the supply side, the equipment of PTA enterprises has changed frequently recently, and the start-up of PTA enterprises has dropped to the level near 80%, while the market supply is still sufficient, and PTA continues to be in a stock-accumulating cycle. Under the influence of the typhoon, the 1.2 million-ton plant in Sanfang Lane was suspended during the holiday and is currently recovering. Jiangyin Hanbang 2.2 million ton PTA device temporarily stopped during the holiday and restarted to be determined. The 3.75 million-ton PTA plant is scheduled to drop to around 50% in recent days and is expected to last around a week. A set of 1.5 million-ton PTA plant in Jiaxing Petrochemical Company will be overhauled from September 10th and is expected to last for about 2 weeks. Zhuhai Ineos 1.1 million-ton PTA device stopped for some reason on September 7 and restarted on the 13th. Ningbo Taihua 1.2 million ton PTA plant was overhauled as planned and restarted to be determined.

From the demand side, with the decline of the cost side, the pressure on the cost of polyester production has been reduced, the polyester reduction and shutdown plant has begun to recover gradually, and the start-up of the industry has begun to pick up slightly, rising to the level of around 88% at present, but it has not yet reached the high point of the same period in previous years. Terminal procurement is cautious, polyester enterprise production and marketing overall decline, the average production and marketing in 4-60% or so.

Although the terminal textile and weaving industry begins to enter the peak season, the recovery of demand is limited, and the demand side supports the market in general. The current autumn and winter orders belong to the gradual start-up stage, the overall order increment of the market starts slowly, and the opening rate of large factories in the weaving industry is maintained, but small factories take into account profits and orders are relatively poor, so the factory start-up enthusiasm is not high. More implementation of low start-up and low-inventory production mode. The start-up load of the weaving industry remained stable, and the start-up of the weaving industry remained at 76% last week. For the time being, there is no obvious increase in the overall order of the market, and the weakening of the raw material market is a drag, the factory shipment is weak and stable, and the grey fabric inventory of weaving enterprises is only narrowly reduced. The macroeconomic drag on raw materials continues to suffer setbacks, the market is becoming more cautious about future expectations, downstream users have more rigid demand for raw materials, taking into account the financial pressure of weaving manufacturers, factory finished product inventory to maintain a relatively low shock operation. In the short term, it is difficult to have a large recovery expectation on the demand side, and the operating rate of the weaving industry remains stable for the time being.

On the whole, although the outlook for international crude oil demand is still not optimistic, the Federal Reserve will cut interest rates in September, boosting market confidence to a certain extent, supporting international oil prices, and cost driving the market. The fundamentals of weak polyester raw materials have not yet been substantially improved, the end demand has not been separated from the weak reality, and the market driven by downstream improvement may be less than market expectations. Short-term polyester market is still difficult to get rid of the weak pattern. Pay attention to the promotion of international crude oil and market supply and demand to the market.