- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Sinopec Inventory: The polyolefin inventory of the two oils was 800,000 tons, unchanged from yesterday.

Analysis of PP Futures: 9Opening price of PP2501 on June 11th: 7275, highest price: 7293, lowest price: 7204, open position: 485048, settlement price: 7244,Yesterday's settlement: 7300, down: 56.

Mainstream quotes for wire drawing in the PP market:

Propylene market price list

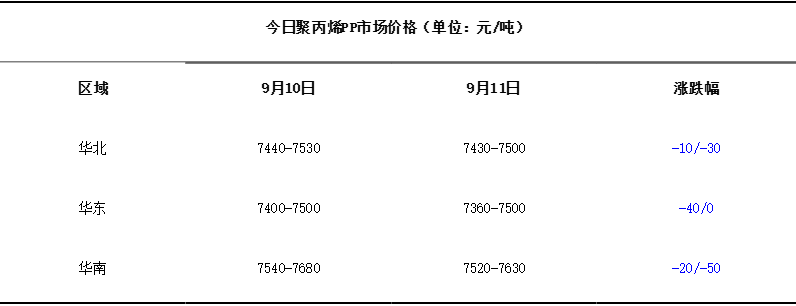

PP China Spot Market Analysis: Today, the overall weakness of China's PP market is declining. The price reductions in various regional markets range from 10 to 50 yuan/ton. In terms of price: China's mainstream polypropylene prices range from 7,360 to 7,630 yuan/ton. On the cost side, international oil prices fell again, setting a new low in the past year and a half. On the supply side, the removal of polyolefins from the two oils has slowed down. Today's inventory remains at 800,000 tons, unchanged from yesterday, and pressure on on-site supply still exists. On the demand side, demand in the terminal peak season has not improved, and the purchase of raw material PP remains in firm demand. Overall, the market sentiment is weak, traders have given concessions to ship goods, on-site transactions are not good, futures fell first and then rose, and the spot market is weak.。

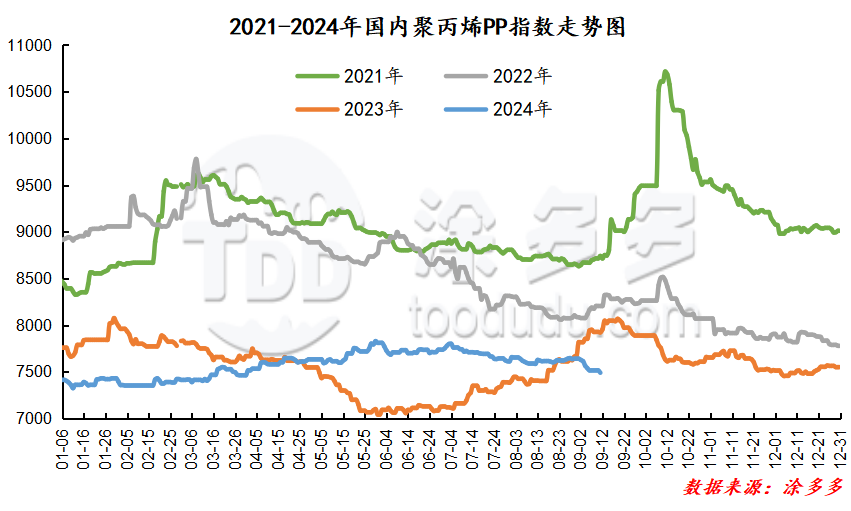

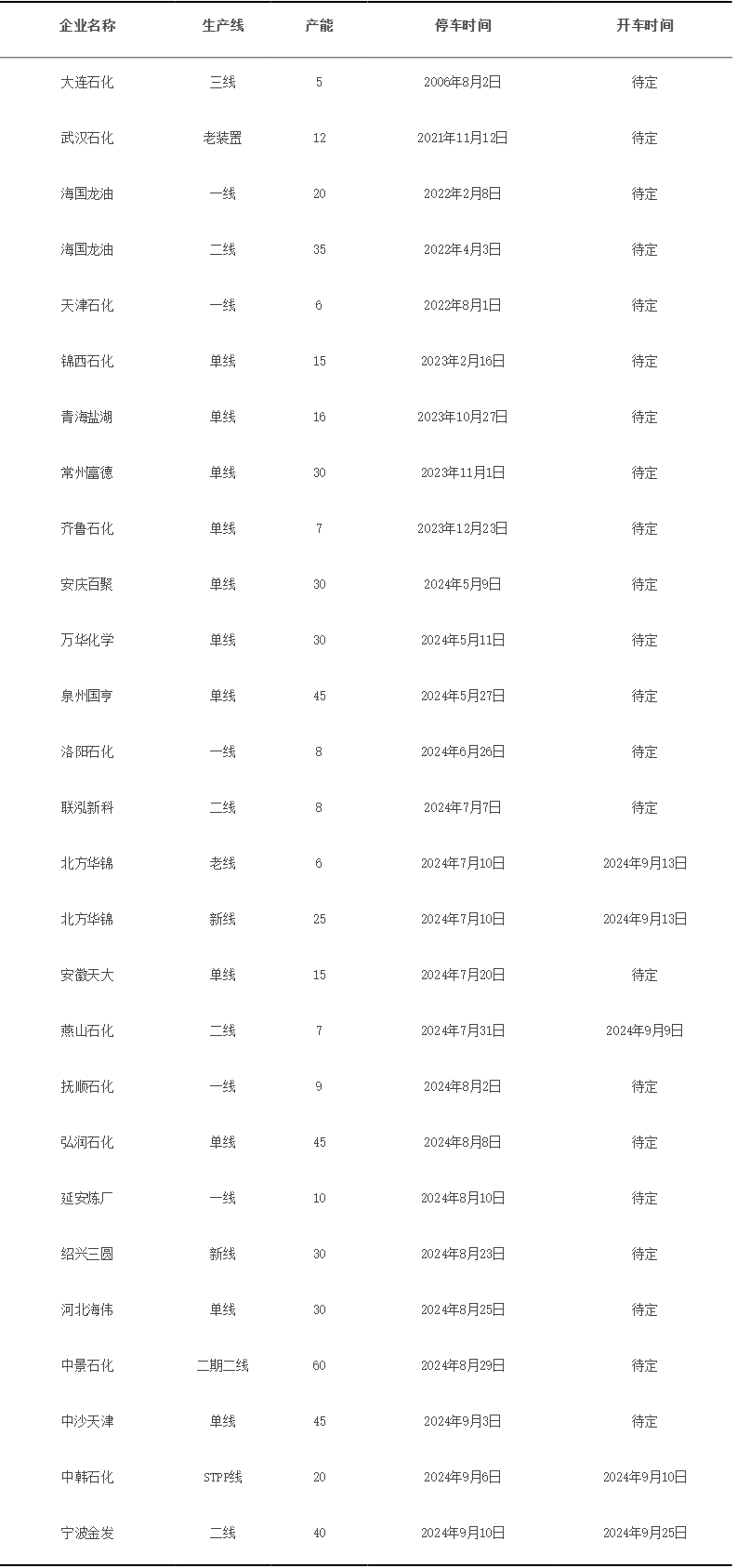

PP spot trend forecast: In terms of raw materials, OPEC's monthly report data shows that the forecast for global crude oil demand has been lowered again, and the report released by the EIA also shows that the forecast for global liquid fuel demand has been lowered. International oil prices have continued to hit lows in the past one and a half years, which has cost to the PP market. Support continues to weaken, and we also need to pay attention to the EIA inventory data to be released this evening. In terms of supply, although there is the possibility of temporary shutdown of PP units, based on the current situation, there are few known PP units planned for maintenance, and PP units that were stopped in the early stage are expected to resume driving, so supply may increase. On the demand side, although it has entered the traditional peak season in September, terminal demand has recovered slowly, and the PP market lacks strong drivers to support price increases. It is also necessary to pay attention to the terminal stocking situation on the eve of the Mid-Autumn Festival. Overall, it is expected that the polypropylene market may fluctuate in the short term.

China PP Index: According to Tdd-global data, China's PP spot index on September 11 was 7,490.00, down 25, or 0.33%.

Summary of installation parking in China:

Shenhua auction transaction status: Shenhua Coal Chemical's auction volume today was 2883 tons, an increase of 2.85% from yesterday; the transaction volume was 969 tons, a decrease of 40.52% from yesterday, and the transaction rate was 33.61%, an increase of-24.51% from yesterday.