Float glass market is weak

Float glass market is weak

Float glass market price

Analysis of float glass market

The overall price of 5mm float glass in China today was temporarily stable compared with yesterday, but some regions continued to fall. Among them, prices in Southwest and East China have been lowered by 10 yuan/ton as a whole, and manufacturers 'mentality of supporting prices is still weak; the North China market is generally trading, and prices in the Beijing-Tianjin-Tangshan region have continued to be lowered, falling by 10 yuan/ton to 1200 yuan/ton. Downstream willingness to stock goods is not high; the price of 5mm large plates in East China and Shandong weakened, falling by 30 yuan/ton to 1270 yuan/ton. The weak demand situation has not improved; the quotations of manufacturers in other regions have temporarily stabilized. At present, the supply side of the float glass market continues to shrink, and some production lines are temporarily released for cold repairs; downstream deep processing orders are still lacking. Some glass manufacturers are affected by typhoon weather and have poor shipments, and production and sales have further declined. It is difficult for the float glass spot market to achieve rapid recovery.

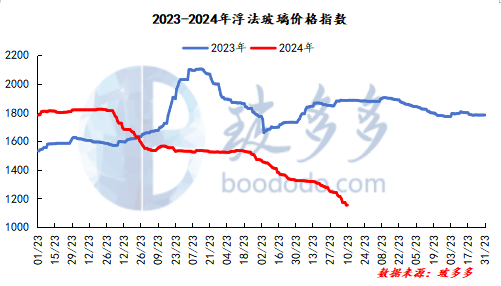

Float Glass Index Analysis

According to data from Boduo, the float glass price index on September 10 was 1,151.54, down 2.33 from the previous working day, with a range of-0.20%.

Futures dynamics

Futures dynamics

According to data from Boduo, the opening price of FG2501, the main glass contract, on September 10, was 1121 yuan/ton, and finally closed at 1086 yuan/ton, an increase of-2.25% within the day. The intraday high was 1123 yuan/ton, the lowest was 1086 yuan/ton, holding 1141165 lots, a month-on-month +36755 lots.

Today, glass futures prices are mainly downward as the market environment continues to be weak. Glass itself is still operating around the main logic of weak demand peaking and falling. Although the supply side has simultaneously experienced continuous de-capacity behavior, the current efforts are still unable to make up for the gap between supply and demand, and price suppression is still strong. However, in the future, we need to pay attention to whether the supply side will accelerate clearing after prices continue to fall and demand expectations are hopeless, so as to suspend the growth slope of the supply and demand gap, so as to form a phased support for prices and tell a new story. In the short term, negative feedback on glass will continue, but the downward trend does slow down with the decline in the supply side, but glass prices may still not see any reason to increase before the new story begins.

market outlook

The float glass market is in a downturn and has a strong wait-and-see atmosphere; downstream demand continues to weaken and terminal orders continue to decrease. It is expected that the float glass market will continue to operate weakly in the short term.