Polyester: What is the falling market like?

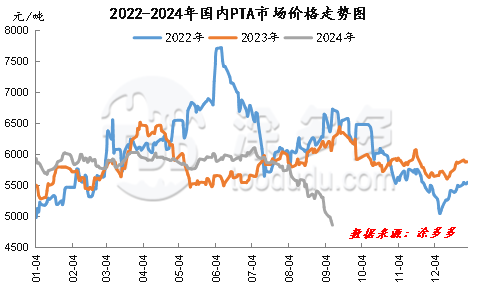

Since July, polyester raw materials PTA spot market began to shake down, market prices continue to refresh the year's new lows, to now have fallen to nearly three-year low. The closing price of the main contract of PTA fell from 6096 yuan on July 3 to 4926 yuan on September 9. The spot market price of PTA fell 19.19% from 6110 yuan / ton at the beginning of July to 4840 yuan / ton now, a market drop of 20.79%. Market bears have been suppressed all the way, and the external macro, cost-side and PTA's own weak supply and demand fundamentals have contributed to the second round of decline.

Over the weekend, after the release of US non-farm payrolls data in August, the dollar fell and international oil prices rose in intraday trading amid speculation of a sharp cut in interest rates by the Federal Reserve. But in the end, fears that the economic downturn would lead to weak demand for oil, coupled with a cut in the official selling price of crude oil exports by Saudi Arabia, led to speculation that the physical market was oversupplied. WTI and Brent crude erased gains in 2024, WTI fell to a 15-month low and Brent crude futures fell to a 33-month low. Upstream PX prices have continued to fall to US $840 / tonne (CFR China), and prices are also approaching a three-year low. With the decline of the international crude oil and raw material market, the PTA cost end supports the collapse.

From the point of view of PTA's own supply side, the recent changes in PTA enterprise devices have decreased, PTA enterprises have started to maintain a high level around 84%, the market supply is sufficient, and PTA continues to be in a stock-accumulating cycle. Zhuhai Ineos 1.1 million ton PTA device stopped for some reason on Sept. 7, and is expected to be near a week. Affected by the typhoon, a total of 4.5 million tons of PTA units in Yisheng Hainan dropped to 50% operation last weekend, and the load was recovering at the beginning of the week. Ningbo Taihua 1.2 million ton PTA plant was overhauled as planned and restarted to be determined. Hengli Petrochemical (Dalian) carried out annual overhaul of the 4.7 million-ton PTA plant from August to September as planned, of which the 2.5 million-ton production line began to stop and repair on August 17, and the restart time has yet to be determined.

From the point of view of polyester demand, in July, under the pressure of high cost, polyester enterprises began a new round of production restriction and quotation measures, and the reduction and suspension of production gradually increased, and the start-up of the polyester industry dropped to around 83%. After August, with the decline of the cost end, the pressure on polyester production costs has been reduced, the polyester production reduction and shutdown equipment began to recover gradually, and the industry started to pick up slightly and has now rebounded to the level around 87%. But it has not yet reached the high point of the same period in previous years.

At present, during the traditional textile season cycle, the overall textile market "Golden Nine Silver Ten" atmosphere is gradually heating up, boosting market buying confidence, autumn and winter demand continues to heat up, market inquiry atmosphere picks up, downstream and middlemen continue to prepare goods. The start-up load of the weaving industry continued to rise narrowly. As of last week, the start-up load of Chinese weaving enterprises rebounded to around 76%, while that of texturing enterprises rose to a high around 91%, which was at the normal level in the same period in previous years. The overall order volume of the market continues to increase, the shipment situation in the factory is stable and getting better, and the grey fabric inventory of weaving enterprises continues to shrink.

Taken together, the current PTA market has fallen to a three-year low, and the market continues to fall to release short sentiment. From a future point of view, PTA market prices may be revised by shocks, and the market does not recommend that the market continue to pursue short too much. Through the continuous decline of polyester raw material PTA, the production profits of Chinese polyester enterprises have continued to recover. But at present, the polyester market is still in a downward channel, suppressing market confidence, terminal procurement enthusiasm is low, only rigid demand for stock-based. In the later stage, we should pay close attention to the changes of the raw material market and the supply and demand of polyester itself.