Carbon Black Market Analysis on September 9

1. Carbon black market analysis

Today, China's carbon black market remains stable. As of now, the mainstream price of N330 in the carbon black market remains at 8,200 - 8,800 yuan/ton.

Cost aspect:Today, coal tar maintained its high trend last week, but the increase has narrowed. The reason is that as the coking auction price in Linhuan, Anhui Province fell in the early stage, the negotiation atmosphere on the venue dropped, and the rising trend of coal tar was slightly weak; However, in the short term, favorable factors in the market still dominate, and the overall supply is still tight. Coal tar is expected to continue to operate at a high level in the near future, and carbon black cost support remains unchanged.

Supply:Most enterprises in China started operations smoothly, and the overall operating rate in the field was relatively low; enterprises in Shanxi and Shandong still had maintenance plans, while other enterprises started operations at normal levels, and carbon black sample enterprises started operations slightly lower.

Demand side:The downstream demand side has recently taken more goods and continued to pick them up as they are used. The overall shipment has shown a stable trend. The main demand is just taking goods, and on-site transactions are limited. Carbon black has recently been affected by the maintenance of some enterprises, and on-site prices are expected to be large. Steady and small.

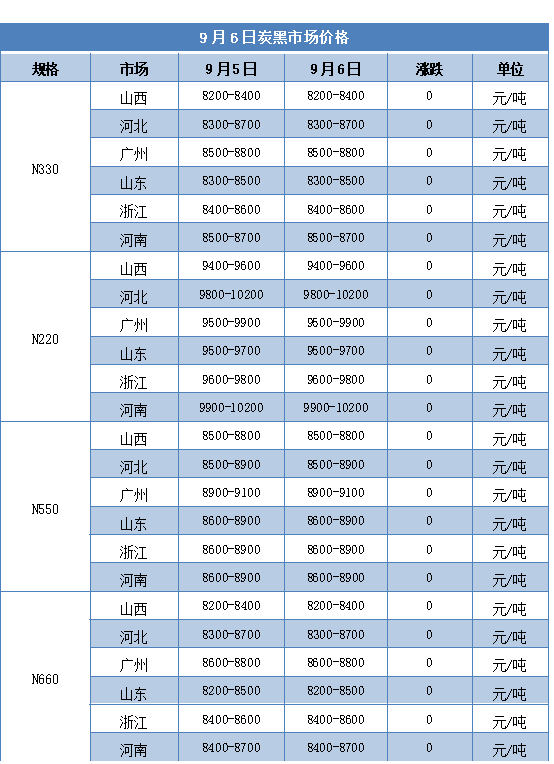

2. Carbon black market price

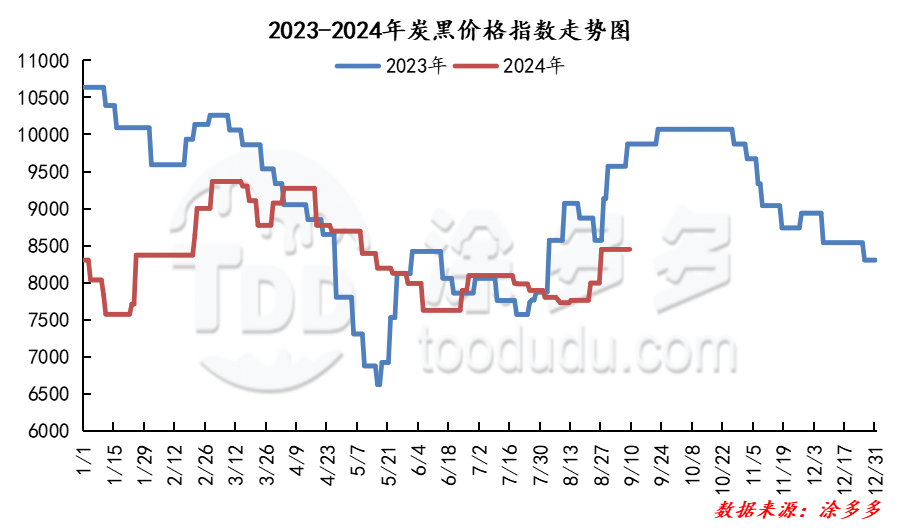

3. Carbon black index analysis

According to Tu Duoduo's data, the carbon black price index on September 9 was 8449, which remained stable compared with the previous working day.

4. market outlook

Today this week, the upstream coke enterprises on the raw material side are still in a state of limited production and difficult to change. The starting load of downstream deep processing enterprises has declined. Expectations for subsequent increases in coal tar have weakened, and cost support has been limited. The demand side has remained stable, new orders on the site are limited, and some enterprises have been overhauled. The impact on starting up has declined, cost-positive factors still dominate, and on-site prices are expected to stabilize significantly and slightly change.