- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

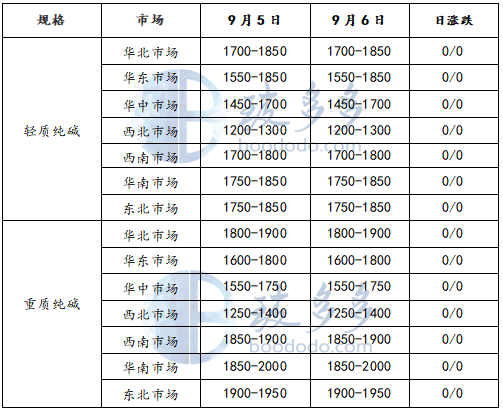

Analysis of soda ash market

Today, the price of soda ash in China has temporarily stabilized. As of now, the price of light soda ash in Northwest China is 1,200 - 1,300 yuan/ton, and the price of heavy soda ash is 1,250 - 1,400 yuan/ton; the price of light soda ash in East China is 1,550 - 1,850 yuan/ton, and the price of heavy soda ash is 1,600 - 1,800 yuan/ton. Recently, soda ash companies have started at a low level, and their output has decreased in the short term due to maintenance. However, soda ash stocks are high and the market supply is sufficient; while downstream companies have still limited procurement, and demand is still weak, mainly with low prices and small amounts of replenishment; supply is strong and weak, the soda ash market is weak.

Futures dynamics

According to Boduo data, the opening price of SA2501, the main contract for soda ash, on September 6, was 1458 yuan/ton, and finally closed at 1430 yuan/ton, an increase of-2.12% within the day. The highest intraday session was 1459 yuan/ton, the lowest was 1413 yuan/ton, with a total position of 1214547 lots, a month-on-month period of-25544 lots.

Today, soda ash futures prices opened high and went low, hitting a new low in the intraday session. The high opening of soda ash prices last night was mainly due to the fact that the US "small non-agricultural" data was significantly lower than expected, which led to an increase in the market's interest rate cut in September. It was driven by overall market sentiment. As for the problem that equipment failure in a large factory affects output, it is only an announcement based on previous behavior, not a new problem, and the actual impact is limited. The core problem currently facing soda ash is that the maintenance season is coming to an end, while various downstream glass industries are experiencing the problem of accelerating capacity removal. The rapid widening gap between supply and demand is the biggest suppression facing soda ash prices. If soda ash prices continue to follow this script in the future, there may still be room to bottom out. In the future, we need to pay attention to whether there can be a corresponding reduction in production on the supply side and whether macro sentiment can stabilize again, thus temporarily providing support for soda ash prices.

market outlook

The units of the soda plant under early maintenance have gradually resumed operation, and the market starts have increased; the downstream market demand is generally enthusiastic, and more purchases are made on demand. The market wait-and-see attitude remains unchanged. It is expected that the soda ash market will continue to operate in a weak manner in the short term.