- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

1. Carbon black market analysis

Today, China's carbon black market is still operating smoothly. As of now, the mainstream price of N330 in the carbon black market has remained at 8,200 - 8,800 yuan/ton.

Cost aspect:Today, the price of carbon black raw materials has increased, coke companies have suffered losses and limited production, and the operating rate has been low. The overall supply of coal tar in the market is relatively tight. Therefore, in the subsequent auctions in the main producing areas, downstream factories are still more enthusiastic about obtaining goods, thus driving prices to continue to rise., boosting carbon black cost support.

Supply:Most enterprises in China started operations smoothly, and the overall operating rate in the field was relatively low; maintenance plans for enterprises in Shanxi increased, and the start-up fluctuations of other enterprises were limited, and the start-up of carbon black sample enterprises declined slightly.

Demand side:The start of construction of downstream demand-side tire companies is mainly with slight fluctuations. The main tire companies have expectations of resuming production. The main tire companies have recently been affected by the mentality of "buy up but not buy down", and their enthusiasm for inquiries has increased. The carbon black market is currently dominated by positive factors, and the future trend in the market is expected to be stable and small.

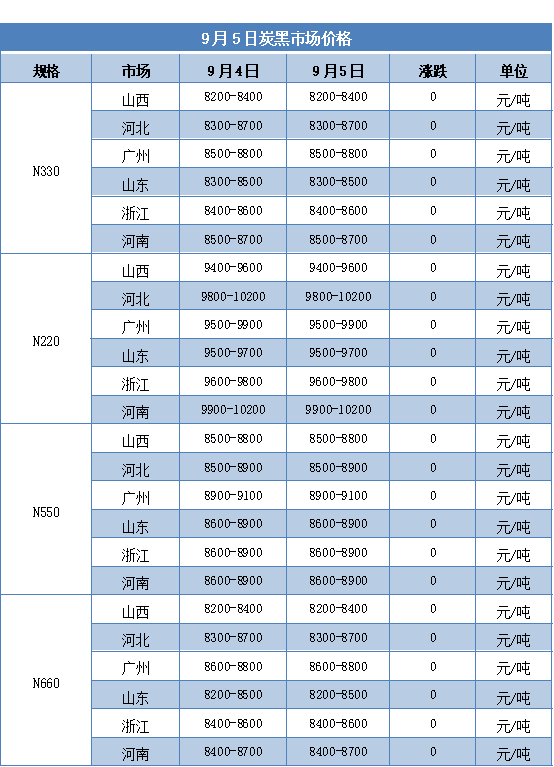

2. Carbon black market price

3. Carbon black index analysis

According to Tdd-global's data, the carbon black price index on September 5 was 8449, which remained stable compared with yesterday.

4. market outlook

Today, raw material auction prices have flowed out one after another, and market prices have risen, boosting cost-side support. The main downstream demand-side companies have just recently needed to obtain goods, and on-site transactions have been limited. In the near term, the cost side of carbon black in the market is still supported and the price mentality is affected, and prices are expected to stabilize slightly.