Carbon Black Market Analysis on September 4

1. Carbon black market analysis

Today, China's carbon black market is still operating smoothly. As of now, the mainstream price of N330 in the carbon black market has remained at 8,200 - 8,800 yuan/ton.

Cost aspect:The carbon black raw material side is still maintaining a rising trend, with upstream coke prices falling by a cumulative decline of 350-385 yuan/ton. In addition, coke companies have suffered losses and limited production, and coal tar supply in the field is low. Deep processing companies have strong intention to push up product prices, and favorable factors occupy the top., coal tar prices will maintain upward movement, which in turn will boost carbon black cost support.

Supply:Most enterprises in China started operations smoothly, and the overall operating rate in the field was relatively low; maintenance plans for enterprises in Shanxi increased, and the start-up fluctuations of other enterprises were limited, and the start-up of carbon black sample enterprises declined slightly.

Demand side:The start of construction of downstream demand-side tire companies is mainly with slight fluctuations. The main tire companies have expectations of resuming production. The main tire companies have recently been affected by the mentality of "buy up but not buy down", and their enthusiasm for inquiries has increased. The carbon black market is currently dominated by positive factors, and the future trend in the market is expected to rise steadily.

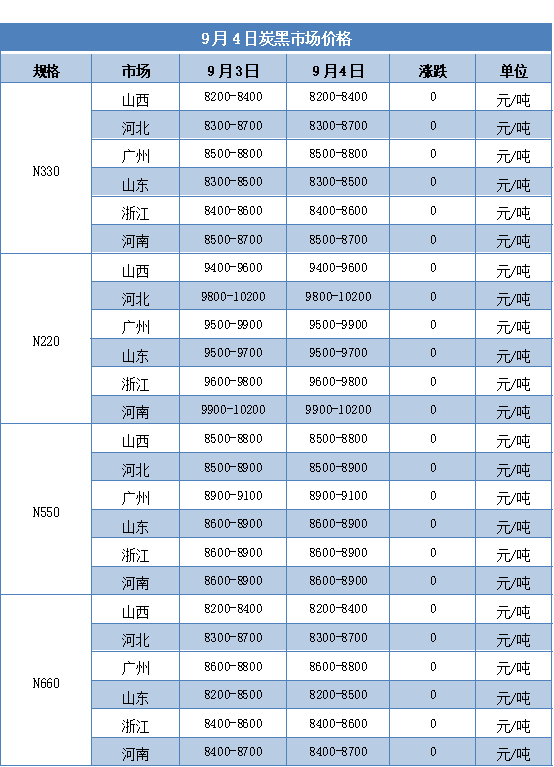

2. Carbon black market price

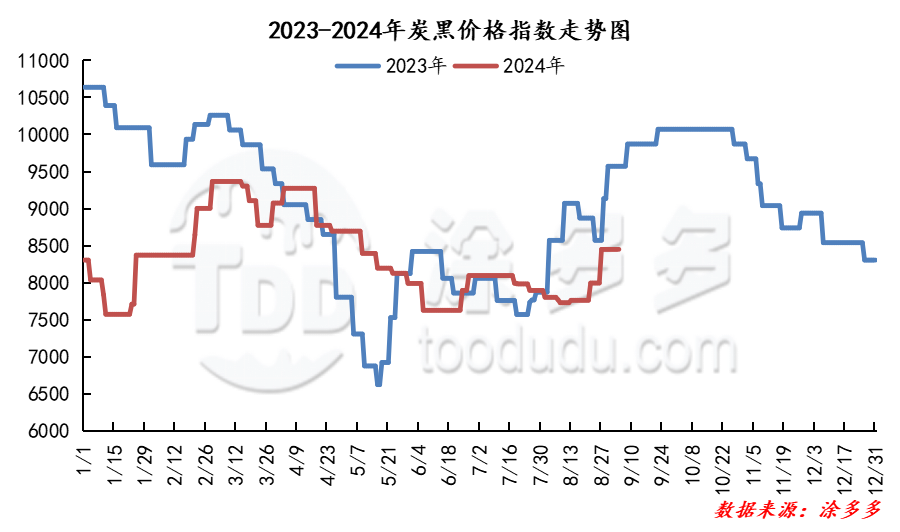

3. Carbon black index analysis

According to Tu Duoduo's data, the carbon black price index on September 4 was 8449, which remained stable compared with yesterday.

4. market outlook

Coal tar on the raw material side is expected to continue to rise in the near future, and the cost side is expected to continue to increase; downstream companies are expected to start storage and raise expectations, and recent inquiries are acceptable. Overall, driven by costs, the carbon black market still has higher expectations.