Polyester bottles and tablets: Futures listings help new market development

On August 30, bottle chip futures were officially listed for trading on the Zhengzhou Commodity Exchange. So far, polyester "four brothers": PX (p-xylene), PTA (refined terephthalic acid) and polyester staple fiber, polyester bottle chips gathered in Zhengzhou Commodity Exchange. By the close of trading on the 30th, the trading volume of bottle chip futures was 168599 lots, the position was 26506 lots, and the trading volume was 16.653 billion yuan. After listing, bottle chip futures can form an effective linkage with the existing varieties such as PX, PTA, ethylene glycol and staple fiber, further enrich the supply of futures in the polyester industry chain, and accelerate the formation of "polyester-beverage" industry risk management closed loop. Relying on China's strong polyester industry chain, the futures market matches the perfect polyester plate, provides a wealth of risk management tools for the industry, and promotes the formation of international price influence matched with volume in China's polyester industry.

Polyester bottle chip is a kind of polyester PET, its full name is polyethylene terephthalate, which is a high polymer, which is derived from the dehydration condensation of ethylene terephthalate. The main raw materials are PTA and ethylene glycol. Polyester bottle chips are mainly used in beverage and non-beverage packaging, of which the soft beverage industry accounts for a high share of 43%, sheet chemicals and others reach 17%, edible oil packaging reaches around 5%, of which 35% of bottle-grade PET is used for export.

The bottle chip futures contracts listed by Zheng Shang are the far-moon contracts of 2025, and the first batch of bottle chip futures contracts listed on the market are PR2503, PR2504, PR2505, PR2506, PR2507 and PR2508. The first major contract is 2503 contracts, reflecting forward market price expectations. On the first day of listing, the low price of bottle chip futures well reflects the market's judgment on the price of bottle chips in the future under the pressure of oversupply; in addition, from the perspective of price difference structure, the forward curve of bottle chip futures shows a near low and far high Contango structure, which is a typical buyer's market type.

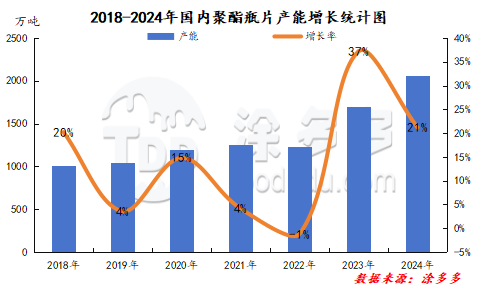

From the point of view of the supply and demand of polyester bottle chips, in recent years, China's polyester bottle chip industry has re-entered a period of rapid production capacity growth. In 2023, the production capacity of polyester bottle chips increased by 4.6 million tons, with an increase of 37.17%. In 2024, the main manufacturers of polyester bottle chips are still actively expanding new production capacity, and enterprises such as Yisheng, Sanfang Lane and Yizheng chemical fiber are still expected to put into production. At that time, the production capacity of major manufacturers will continue to expand, and the distribution of enterprises will be more concentrated. The share of leading enterprises in the market continues to expand. This year, with the entry of new enterprises such as Xinjiang Yipu and Anhui Haoyuan, the number of polyester bottle and chip enterprises will continue to increase, and in the later stage, China's polyester bottle and chip industry may enter a new round of competition and reshuffle cycle. Up to now, the production capacity of polyester bottle chips has increased by 3.6 million tons in 2024, an increase of 21.21%.

On the demand side, in recent years, due to the sustained development of China's economy and the enhancement of consumer spending power, the growth and demand of the beverage market has remained relatively strong. The consumption of polyester bottle chips in China is growing rapidly and has become the largest consumer of bottle chips in the world. In 2023, the apparent consumption of polyester bottle chips in China is 8.66 million tons, with a growth rate of 26%. Polyester bottle chips are mainly used in the packaging of beverages, edible oils and other daily necessities, and the consumption is seasonal. With the warmer weather, polyester bottle chips enter the traditional peak season from May to September every year.

In terms of import and export, China imports a small amount of bottle chips, and ChinaThe import quantity of polyester bottle chips is maintained at about 40-60, 000 tons all the year round, and 50300 tons in 2023.It has little impact on the supply and demand of Chinese bottle slices. China is the largest in the world.Polyester bottle chipExporting country. In recent yearsPolyester bottle chipThe export volume continues to show a substantial growth trend. In 2023, the export volume of Chinese bottle chips reached 4.55 million tons, with an export dependence of 34.7%. From January to July 2024, the cumulative export volume of polyester bottle chips was 3.2646 million tons, accounting for 37% of the total output, and nearly 40% of the output was concentrated in foreign trade exports, which greatly alleviated the sales pressure of Chinese polyester bottle chip manufacturing enterprises. it has also opened up the share of products in the global market.

In the current environment of oversupply of polyester bottle chips, the listing of polyester bottle chip futures can provide more channels for bottle chip manufacturers to lock in profits. The bottle chip trading market is active, and traders have a high enthusiasm to participate in futures. For downstream enterprises, raw material risk management is carried out through bottle chip futures to avoid the risk of rising production costs caused by rising raw material prices or the risk of substantial depreciation of inventory goods caused by the fall of raw materials.