- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

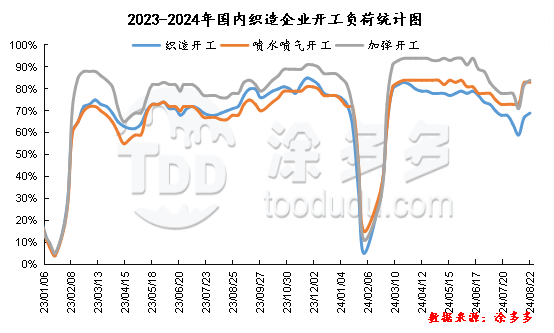

As the impact of hot weather across the country gradually recedes,Currently, the terminal textile market has begun to enter the end of the off-season,Autumn and winter ordersseasonalWarm up,With the arrival of the traditional peak season of Jin Jiu, the terminalDomestic and foreign trade orders have been issued one after another. Since the middle of the month, the start of the textile industry has increased within a narrow range. The start of the textile industry has increased from a low of 59% to 69% so far, an increase of 10 percentage points. As new orders are followed up one after another, the number of orders in the weaving factory has increased within a narrow range. Shipments from weaving companies were relatively stable, and the inventory of grey cloth in weaving companies decreased slightly.Downstream demand shows signs of recovery, and demand is still in the recovery stage, and end users are mostly replenishing their stocks on an order basis, and the market's cautious expectations still exist. With the issuance of new textile orders one after another and the consumption of production, the raw material inventory of weaving enterprises has decreased within a narrow range.

In terms of orders, the inquiry atmosphere in the textile market has gradually warmed up. Orders have been issued one after another in autumn and winter, and the number of orders in weaving factories has increased slightly. The current average level of terminal weaving order days is around 11-12 days. The textile peak season is about to usher. Although support is just needed, the market's cautious mentality still exists, and new weaving orders are weakened again. There is limited room for continuous improvement in the construction of weaving enterprises in the short term.

At present, the comprehensive operating rate of Chinese polyester enterprises has rebounded to around 86%. With the recovery of some polyester overhauls and production reduction units, the overall start of the polyester industry rebounded slightly. However, under the recent decline in the polyester market, the production and sales of polyester companies have been sluggish, while the production and sales of polyester companies have mostly remained at around 3- 4%. As order shipments slowed down, inventory pressure on polyester companies rose again. At present, the equity inventory of polyester POY factory is 19-20 days; the equity inventory of polyester FDY factory is 20-22 days; and the inventory of polyester DTY is 21-23 days. The equity inventory of polyester staple fiber factory is 13-14 days.

The Federal Reserve has sent a strong signal that a rate cut is imminent. At present, the rate cut in mid-September is basically certain, which will help strengthen the economy and boost oil demand. In addition, the traditional fuel season in the United States has not yet ended, boosting market confidence. In addition, after the Palestinian-Israeli peace talks reached a deadlock, the potential risks brought by the instability in the Middle East have also increased. International crude oil prices have room to rise. The overall atmosphere of Chinese commodities has warmed up. Boosted by this, the PTA market for polyester raw materials has begun to rebound, and costs have provided certain support for the polyester market.

On the whole, boosted by the rise in the international crude oil market, the polyester raw material PTA market rebounded. However, PTA itself is still in a stock-accumulating cycle, supply pressure still exists, and in addition to limited demand promotion, it is difficult for the market rise to form a sustained trend. Driven by the polyester raw material side, polyester market offers will be adjusted slightly based on costs. At the end of the month, polyester companies still have certain promotional shipment expectations and pay attention to the follow-up of terminal demand. Although terminal textiles have begun to improve, the process is slow and it is difficult to release practical support. Therefore, short-term polyester market prices may remain within a narrow range of fluctuations. In the later period, we will pay close attention to changes in the raw material market and the supply and demand side of polyester itself.