- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

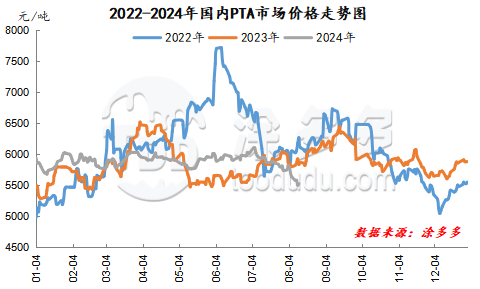

The polyester raw material PTA futures market has been falling all the way since the beginning of July, and gradually broke through the previous low on the 12th, setting a new low in nearly a year. The East China PTA spot market dropped from 6110 yuan/ton on July 4 to 5500 yuan/ton on July 9, down 610 yuan/ton, or 9.98%. On the one hand, the external macroeconomic environment is short, European and American markets are strongly expected to have a recession, global stock markets have fallen, international crude oil has continued to fall, and commodity sentiment has generally been sluggish. On the other hand, PTA's own supply and demand side is weak. After the terminal textile industry entered the off-season, market demand continued to weaken, and the overall start-up of the downstream polyester industry continued to fall. However, PTA companies maintained a high level of around 80%, and their own supply was sufficient. PTA continued to be in a trend of accumulating stocks. Driven by the supply and demand sides, the market was intertwined with negative market, so the spot market continued to decline during the PTA period.

Since last week, concerns about economic recession in the international crude oil market have eased, while the risk that a larger war in the Middle East may disrupt production and transportation hangs over the market. A direct confrontation between Iran and Israel may occur, threatening Middle East crude oil exports and triggering tensions in the oil market. International oil prices rose for the fifth consecutive day, and WTI exceeded US$80 per barrel. Driven by positive cost-side benefits, the main market for PTA futures started to fluctuate and rebound from a low point on Monday.

From the perspective of PTA's own supply side, PTA companies have undergone frequent changes in equipment recently, with an increase in maintenance and restart equipment, and PTA companies have maintained a level above 80%. Ningbo Taihua No. 2 1.5 million-ton PTA unit was restarted last weekend and the unit was stopped on May 23. Hengli Petrochemical (Dalian) will conduct annual maintenance of 4.7 million tons of PTA units from August to September as planned; among them, the No. 5 production line will start shutdown for maintenance on August 17, involving a production capacity of 2.5 million tons, and the restart time is to be determined. Jiangyin Hanbang's 2.2 million-ton PTA unit was temporarily suspended for an unplanned period on August 12, and the restart time is to be determined. In the later period, with the maintenance of the constant force device, the market supply will be slightly reduced.

Recently, downstream polyester demand has rebounded slightly, and the current start of polyester companies has rebounded to a level of more than 85%. Some polyester staple fiber factories have increased production cuts, so there is limited room for polyester load to continue to rise in the later period. As the atmosphere of the off-season in summer deepens and the high temperature weather continues to affect, most weaving production bases implement off-peak power consumption, most manufacturers shut down for holidays, and the weaving operating rate continues to decline. Currently, the start of weaving enterprises has dropped to 59%. In addition, the current situation of issuing new orders in autumn and winter is weak, and the market transaction atmosphere is not good. Although foreign trade is just in need of issuing, the quantity is limited, so there is still room for decline in the weaving start load in the later period.

For the PTA market, where the market is highly transparent and the pace changes rapidly, although there are many negative factors in the PTA market, with the rebound of international crude oil and the positive promotion of cost, the PTA market will usher in a phased rebound in the short term. Pay attention to the promotion of international crude oil and market supply and demand to the market.