- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

In recent days, heavy rainfall has been frequent in North China, Northeast China and other places, and the hot and muggy weather in the south has increased. With the deepening of the off-season atmosphere in summer, the terminal textile demand continues to weaken, weaving enterprise order production is dominant, domestic and foreign trade new orders are insufficient, only individual enterprises can accept foreign trade orders in autumn and winter, the market is not enough to buy gas, and the factory is still under pressure. Coupled with the high cost of raw materials, the profits of weaving enterprises have been compressed, and the overall start-up load of enterprises is expected to continue to weaken.

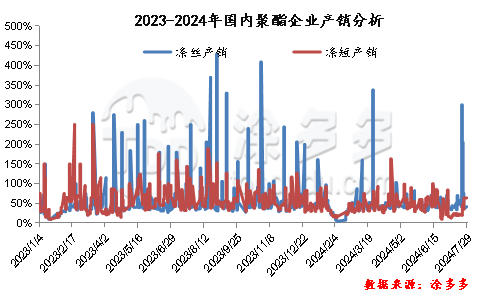

Under the weak pressure of terminal demand, the production and marketing of polyester enterprises will continue to face a light situation, only under the stimulation of substantial price reduction and promotion of polyester enterprises in 23-24 days, a large number of weaving enterprises replenish the stock, and most of the production and sales of large polyester factories are between 400 and 500%. The high inventory of polyester enterprises can be effectively reduced. At present, there are 19-20 days in polyester POY factory equity database, 18-20 days in polyester FDY factory equity database, and 20-21 days in polyester DTY factory equity database. The rights and interests database of polyester staple fiber factory exists around 12-14 days. And then the polyester factory began to adjust prices, enterprise production and sales once again return to dull, enterprise inventory pressure is expected to continue to return to the upward channel.

With the drag on the weak terminal demand, coupled with the high cost of polyester raw materials, the processing fee of polyester enterprises is low, the cash flow of enterprises is still at a loss, and the enthusiasm of domestic polyester enterprises to start work is low. At present, the overall start-up of polyester enterprises is maintained around 84-85%, which is lower than the level of the same period in previous years. Since July, polyester bottle chip enterprises have begun to focus on parking or reducing production due to increased losses. At the end of the month, the production reduction scale of polyester staple fiber enterprises increases, so the load of polyester enterprises will remain low.

For polyester raw material PTA, with the inspection and repair of Jiatong Energy and Pengwei petrochemical plant, the start-up of PTA enterprises has dropped slightly, and the start-up of the industry as a whole has dropped to below 80%. Jiatong Energy's 3 million-ton PTA plant was overhauled on July 25 and restarted to be determined. The 900000 ton PTA plant of Pengwei Petrochemical Company was shut down on July 25th. PTA itself is still in ample supply. From the demand side, the polyester industry starts to reduce, polyester enterprises limit production and price protection measures, the late polyester enterprises still have production reduction plans. With the deepening of the off-season atmosphere in summer, the terminal textile demand weakens, and the demand side suppresses the market. The supply and demand side is insufficient to support the market.

From the polyester raw material ethylene glycol supply and demand side, although the recent increase in ethylene glycol plant parking maintenance, industry start-up decline, but mostly temporary parking, later with the resumption of maintenance, industry start-up will pick up. Shanxi Yangcoal 220000 tons of ethylene glycol plant stopped on the 29th for some reason, and the restart time has yet to be determined. Anhui Hongsifang 300000 ton ethylene glycol plant was stopped for overhaul on the 28th and is expected to be overhauled for 4-5 days. Fujian United 400000 tons of ethylene glycol plant is expected to resume operation in early August. Inner Mongolia Rongxin 400000 ton ethylene glycol plant was stopped for maintenance on July 19th and is expected to take about 20 days. The 200000-ton chemical plant in northern Liaoning was overhauled on July 10, and the overhaul is expected to take about a month. Shanxi Woneng 300000 ton ethylene glycol plant was stopped and overhauled for about 20 days near July 24. East China main port glycol storage is expected to continue to degrade, and the supply side forms a certain support to the market; in terms of demand: the downstream polyester load is reduced, coupled with the off-season impact of terminal textile demand, buying to maintain rigid demand, demand is a drag on the market.

Although tensions remain in the Middle East, concerns about supply have eased, market participants continue to worry about weaker demand, international oil prices have fallen to their lowest level since early June, and Brent crude oil futures have fallen below $80 a barrel. The support of the cost side to the market has weakened. At present, the supply end of polyester raw materials will gradually pick up, while the demand continues to weaken, the market pressure is obvious. As the processing fee level of each variety of polyester industry chain is low, its own supply and demand drive is limited, mainly following the cost fluctuation, so the short-term polyester chain may adjust slightly with the cost. Pay close attention to the promotion of international crude oil and market supply and demand to the market.