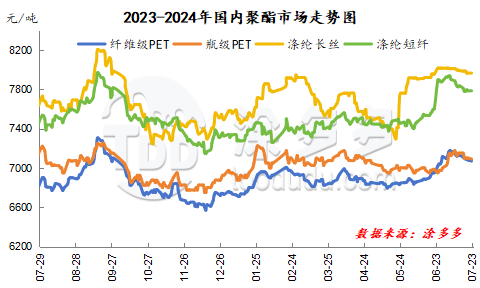

Polyester: Lack of market driving short-term range shocks

The domestic polyester raw material PTA market has been fluctuating and falling since July 5. The market of ethylene glycol, another raw material for polyester, has been fluctuating and falling since the 15th. After a period of correction, the market downward trend has slowed down. Market concerns about the demand outlook still exist, and the geopolitical situation has eased slightly. International oil prices have maintained a downward trend, and the cost side has insufficient support for the market. However, judging from the supply and demand side of the polyester market itself, there is currently no obvious signs of improvement in the fundamentals of the market and insufficient promotion of the market. Therefore, the polyester market remains volatile without obvious driving.

From the perspective of PTA's own supply side, with the restoration of maintenance equipment in Hengli Petrochemical, Pengwei Petrochemical and Sanfangxiang, the start-up of PTA enterprises has steadily rebounded. At present, the overall start-up of the industry has rebounded to a high of around 83%. Yisheng's 6-million-ton PTA plant in Dalian was temporarily stopped for a short time on July 22 and is currently recovering. PTA's own supply pressure is rising, and inventories are expected to accumulate. From the demand side, the polyester industry has started to decline. Under the measures of limiting production and ensuring prices by polyester companies, polyester companies still have plans to reduce production in the later period. As the summer off-season atmosphere deepens, terminal textile demand weakens, and the demand side has put pressure on the market. The supply and demand sides have insufficient support for the market.

Judging from the ethylene glycol supply side, Fujian United's 400,000-ton ethylene glycol plant was stopped last weekend for some reason, and it is expected to be stopped for 1-2 weeks. Inner Mongolia Rongxin's 400,000-ton ethylene glycol plant was stopped for maintenance on July 19, and the maintenance is expected to take about 20 days. A 900,000-ton ethylene glycol plant in East China is scheduled to restart in late July. The load on some ethylene glycol units rebounded, so the overall industry started to remain at around 60%. Recently, ethylene glycol stocks in the main port of East China are expected to continue to be depleted, and the supply side has formed certain support for the market; demand: The recent decline in downstream polyester loads, coupled with the impact of the off-season of terminal textile demand, buying remains dominated by demand, and demand has become a drag on the market.

Under the pressure of weakening terminal textile demand, the enthusiasm for stocking raw materials has been low. The production and sales of polyester companies have remained light. The production and sales of polyester filament companies have remained at around 4- 50%, and the production and sales of polyester staple fiber companies have remained at around 2- 3%. The pressure on corporate inventories is increasing. Recently, with the increase in production reduction or maintenance of polyester companies, the overall start of the polyester industry has dropped to around 84%, which is lower than the level of the same period in previous years. In addition, the processing costs of polyester companies are low, the company's cash flow is still at a loss, and the company's enthusiasm for starting work is relatively low. Polyester companies will continue to maintain a production reduction model.

In summary, there is currently no sign of improvement on the supply and demand side of polyester raw materials, and there is insufficient support for the market. The international crude oil market is still operating in a volatile range at the high level, the bottom support is still solid, and there is no significant upward or downward trend. Costs are driving the market. The polyester raw materials PTA and ethylene glycol markets lack sustained driving force, and the short-term market will still maintain range fluctuations. Due to the low level of processing fees for various varieties in the polyester industry chain, polyester companies continue to maintain a stable price state, with small fluctuations following the cost end. Therefore, the short-term polyester market may be mainly adjusted in a narrow range. Pay close attention to the promotion of international crude oil and market supply and demand to the market.