Polyester: The commodity atmosphere is weakening and the downward pressure on the market is increasing

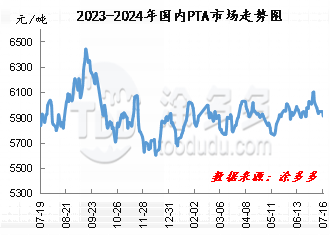

Since July, the polyester raw material PTA market continues to maintain the trend of shock and pullback. The East China PTA market has fallen 3.93% from a high of 6110 yuan / ton at the beginning of the month to 5870 yuan / ton at present. Polyester another raw material ethylene glycol market rose to a high of 4830 yuan / ton last week, this week also began to shake back.

European and American crude oil fell last week after four consecutive weeks of gains as hopes of strong US summer demand were offset by concerns about economic data. Most of the recent economic data were weaker than expected, perpetuating concerns about the outlook for demand. On the whole, international crude oil prices may still have room to fall. With the decline of the international crude oil market, the domestic commodity market atmosphere weakens, suppressing the market mentality, polyester raw materials PTA and ethylene glycol spot market continue to decline.

From the PTA supply side, with the restoration of Dushan Energy, Xinjiang Zhongtai and Hengli maintenance equipment, the start-up of PTA enterprises has rebounded steadily, and the overall start-up of the industry has rebounded to more than 80% of the level. The 900000-ton PTA plant of Pengwei Petrochemical Company stopped on July 12, and a set of 1.2 million-ton PTA plant in Sanfang Lane stopped on July 15, which is expected to resume in the near future. From the demand side, the start of the polyester industry fell slightly, polyester enterprises limited production and price protection measures, the late polyester enterprises still have production reduction plans. With the deepening of the off-season atmosphere in summer, the terminal textile demand weakens, and the demand side suppresses the market. The supply and demand side is insufficient to support the market.

In terms of ethylene glycol supply, some ethylene glycol units in Shaanxi coal resumed after a short stop in mid-July. The 200000-ton chemical plant in northern Liaoning was overhauled on July 10, and the overhaul is expected to take about a month. Shanxi Woneng 300000 ton ethylene glycol plant is scheduled to be stopped and overhauled for about 20 days near July 20. The load of some ethylene glycol units rebounded, so the start-up of the industry as a whole rose to around 60%. In the near future, the ethylene glycol storage in the main port of East China is expected to continue to degrade, and the supply side forms a certain support to the market; in terms of demand: the polyester load in the lower reaches begins to decline recently, coupled with the off-season impact of terminal textile demand, buying to maintain rigid demand is mainly a drag on the market.

Although the polyester raw material market trend fell, but the polyester enterprise price support, the market adjustment range is small, so the overall profit level of polyester enterprises is still relatively maintained. At present, the profit of polyester chip product is 115 yuan / ton, bottle chip product profit is-245 yuan / ton, polyester filament product profit is 90 yuan / ton, polyester staple fiber product profit is 165 yuan / ton. Under the price-to-price model of polyester enterprises, the terminal has a strong resistance to the high market price, the enthusiasm of stock preparation weakens, the market production and marketing maintains a light situation, coupled with the impact of the terminal textile off-season, the market demand decreases, so the polyester enterprise inventory begins to accumulate slowly, and the enterprise pressure increases.

To sum up, at present, the supply and demand of polyester raw materials begin to weaken, which is not enough to support the market. The international crude oil market trend weakens, the cost suppresses the market formation, the polyester raw material PTA and the ethylene glycol market are facing the pullback pressure. Due to the low level of processing fees of various varieties in the polyester industry chain, polyester enterprises continue to maintain the price-up state, with small fluctuations at the cost end, so the short-term polyester market may be mainly adjusted in a narrow range. Pay close attention to the promotion of international crude oil and market supply and demand to the market.