- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

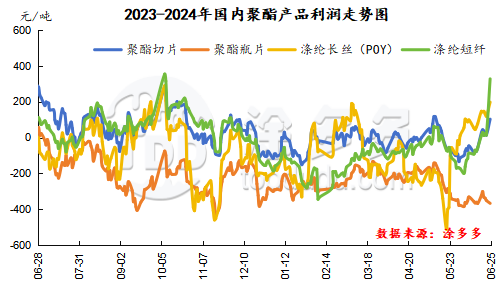

Since the second half of last year, domestic polyester companies have been mired in losses. This year, as production losses have intensified, polyester companies have also begun to gradually change their original sales models. Recently, in order to protect their own processing fees and ensure their production interests, domestic polyester companies have begun to actively price shipments. In particular, polyester filament and staple fiber factories have locked in processing fees based on the pricing method of polyester spot raw material costs + processing fees. Substantial price increases have been made. Polyester companies insist on limiting production and ensuring prices, continue to increase production, and uniformly increase prices. Boosted by the spirit of the weekend meeting, polyester staple fiber futures rose sharply by 170 yuan on Monday, leading the rise in the polyester industry chain.

Relying on the factory's continued price increase, after experiencing an increase in production and sales last Wednesday, the polyester factory raised prices again last weekend, stimulating downstream purchasing enthusiasm, and the company's production and sales once again experienced a pulsed increase in production and sales. The average production and sales of polyester silk in Jiangsu and Zhejiang over the weekend was about 200-300%, with individual companies having higher production and sales.

The overall profitability of domestic polyester companies continues to improve. At present, the production of polyester filament enterprises remains profitable, and the production of polyester chips and polyester staple fibers has begun to turn losses into profits. Only the production of polyester bottle chip enterprises continues to suffer losses. So far, the profit of slice products is 102 yuan/ton, the profit of bottle slice products is-368 yuan/ton, the profit of polyester filament products is 197 yuan/ton, and the profit of polyester staple fiber products is 327 yuan/ton.

Although the domestic polyester market continues to rise, it is difficult for prices to pass downward. It is currently in the off-season of traditional consumption. Most of the terminal grey cloth market has maintained stability, and some products have even experienced price cuts. Therefore, the cost pressure on the terminal textile industry has increased, and the procurement of raw materials has become more cautious. Although the production and sales of polyester companies have experienced a large increase in volume for a while, the production and sales are relatively light most of the time. Therefore, some polyester companies have begun to experience pressure to accumulate their warehouses, and the inventory of enterprises has been seriously divided, especially the inventory pressure of large factories has gradually increased. As of last weekend, the average inventory of polyester chip production companies was 7-8 days, the average inventory of polyester POY factories was 28-30 days, the average inventory of polyester FDY factories was 23-24 days, and the average inventory of polyester DTY companies was 26-28 days. The average inventory of polyester staple fiber factories is 6-7 days.

Recently, international oil prices have continued to be consolidated at high levels, highCost still provides certain support for the polyester market. Hengli's 2.5 million-ton PTA plant is scheduled to be overhauled on June 29. The market supply will be reduced. Coupled with the promotion of capital volume, the PTA market for polyester raw materials may be strong and volatile. Supported by declining port inventories, the ethylene glycol market has experienced a sharp and strong market volatility in the short term. The cost of polyester has promoted the market to a certain extent. The polyester market continues to strengthen in the short term under the support of large manufacturers, but downstream follow-up needs to be followed up. Due to weak demand, the polyester market's growth in the later period will be limited. In the later period, we will pay close attention to changes in the raw material market and the supply and demand side of polyester itself.