- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

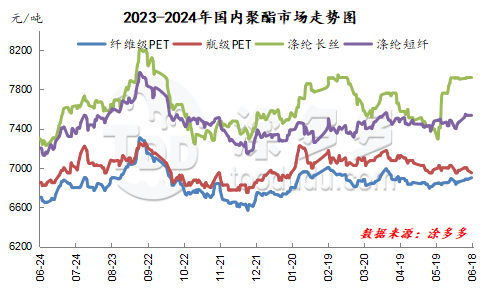

Since June, Chinese polyester companies have shown strong intention to ship at high prices. Although the market trend of polyester raw materials PTA and ethylene glycol is weak and the cost side has insufficient support for the polyester market, the polyester companies 'own supply and demand side performance is strong. In addition, the company's processing fees have been low for a long time, and the company's willingness to repair cash flow has increased. Therefore, polyester companies continue to ship at high prices without greater inventory pressure.

In mid-to-late May, the polyester raw material market was firm, the cost side's support for the polyester market increased, the preferential margin for polyester factory shipments narrowed, and the focus of market negotiations increased within a narrow range. Downstream demand actively followed up, and market production and sales improved. Mainstream polyester manufacturers mainly cut prices and delivered profits, and the focus of market transactions has been adjusted back within a narrow range. Downstream buying enthusiasm increased, local market transactions increased, and market production and sales rebounded. Entering June, inventory in some polyester factories was tight, and offers from polyester companies rose slightly. The downstream just needs to follow up, and some production and sales are okay. Under the wave of promotional shipments by polyester companies, the inventory of polyester companies continues to be in a state of de-warehousing, and the inventory of individual specifications of some companies has begun to appear tight. As of the end of last week, the average inventory of polyester chip production companies dropped to 7-8 days, the average inventory of polyester POY factories was 26-27 days, the average inventory of polyester FDY factories was 21-23 days, and the average inventory of polyester DTY companies was 26-28 days. The average inventory of polyester staple fiber factories is 6-8 days. Lower inventory levels also allow polyester companies to have a greater say in market pricing and no longer simply passively adjust based on costs.

Since the beginning of this year, the polyester raw materials PTA and ethylene glycol markets have maintained high fluctuations. Due to high production costs and weak market demand, the polyester market has been weak. Therefore, the production and processing costs of polyester companies have remained low for a long time. In the first half of the year, the average theoretical production profit of polyester chip companies is-25 yuan/ton, the average theoretical production profit of polyester bottle chip companies is-249 yuan/ton, and the average theoretical production profit of polyester filament companies is-108 yuan/ton. The average theoretical production profit of polyester staple fiber enterprises is-116 yuan/ton. Faced with the pressure of continued losses, polyester companies have also begun to seek new production restriction quotation plans, and no longer blindly pursue price reduction promotions in exchange for a temporary improvement in production and sales.

At present, the support brought by the positive fundamentals of the international crude oil market is still continuing. The traditional peak consumption season in the United States has entered its peak period, and the market is optimistic about U.S. gasoline and crude oil consumption this summer. Many oil-producing countries have expressed support for OPEC+ production cuts, and the market believes that tight supply will continue. In the short term, there is a high probability that oil prices will remain a high and volatile trend. The cost side still provides certain support for the polyester market. Driven by the supply and demand sides of the polyester raw materials PTA and ethylene glycol markets, the market is expected to remain weak and volatile in the short term. Under the support of strong supply and demand sides, polyester companies continue to mainly ship at high prices. The downstream just needs to follow up, and market production and sales have turned weak. Short-term polyester market prices are expected to fluctuate within a narrow range. In the later period, we will pay close attention to changes in the raw material market and the supply and demand side of polyester itself.