- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

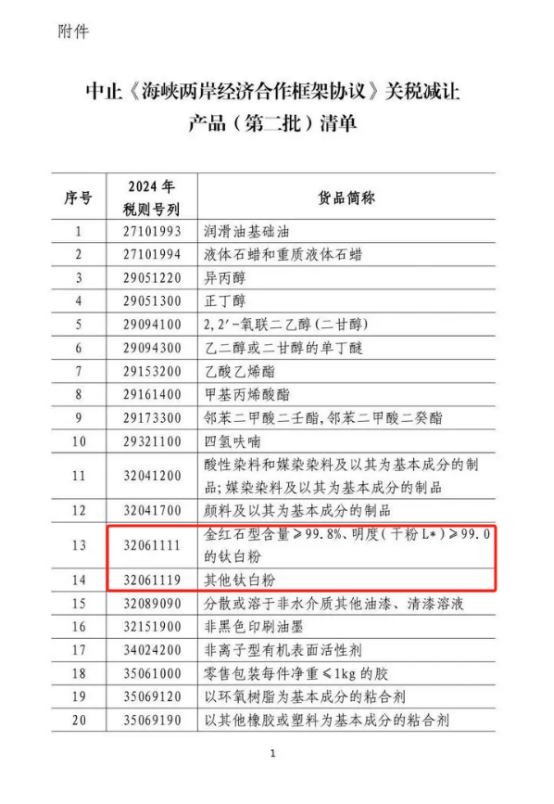

The tariff Commission of the State Council issued a notice on May 30 on suspending tariff concessions for some products (the second batch) of the Cross-Strait Economic Cooperation Framework Agreement (ECFA). Starting from June 15, 2024, the tax rates agreed in the Framework Agreement on Cross-Strait Economic Cooperation shall be suspended for 134 imported products such as lube base oils and other items listed in the annexes originating in Taiwan, and shall be implemented in accordance with the current relevant provisions.

The list involves many organic chemical products, such as isopropanol, n-butanol, ethylene glycol butyl ether, vinyl acetate, methacrylate, DINP/DIDP, Nonionic surfactant, titanium dioxide and so on. Does that have as great an impact on titanium dioxide as we know it?

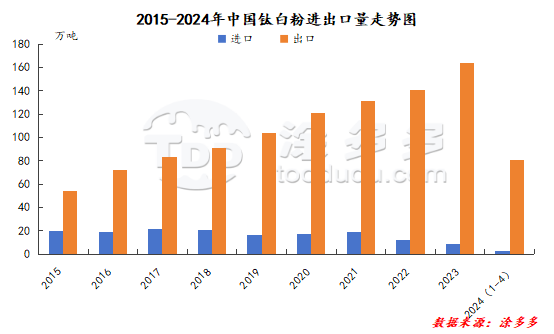

Due to the difference in the quality of domestic and imported titanium dioxide products, China imported more high-end titanium dioxide every year to fill the gap in China. According to the import and export data of titanium dioxide in the past decade, the imported titanium dioxide was 203600 tons in 2015 and only 84500 tons in 2023. The import volume decreased by 59%. With the rapid development of China's titanium dioxide industry and the improvement of the quality of titanium dioxide products of Chinese enterprises, the dependence on the import of titanium dioxide has gradually decreased, but the export share of China's total output has gradually increased. The export volume of titanium dioxide reached 538400 tons in 2015. By 2023, the export volume reached 1.6416 million tons, and the export volume increased by as high as 205%. As a result, the import and export trend formed a big contrast.

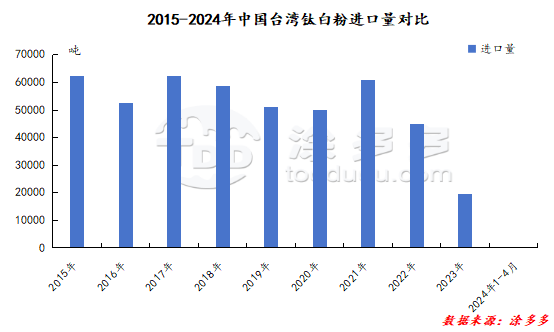

With the suspension of the Framework Agreement on Cross-Strait Economic Cooperation, the cost of most of the chemicals involved will increase, but this incident will have little impact on titanium dioxide. The reason is that the Quan Yin factory in Komu Taiwan shut down the production capacity of 180000 tons in September 2023. Since then, the import volume of titanium dioxide from China and Taiwan has dropped linearly, from an average monthly import of 2000 tons or even 4000 tons to only more than 40 tons in December 2023, while in the first four months of 2024, the total imports of titanium dioxide from China and Taiwan totaled 61.7 tons. Although the suspension of the Framework Agreement on Cross-Strait Economic Cooperation has increased the cost of importing titanium dioxide, the overall impact is indeed relatively small when the annual import volume is only more than 100 tons.

The production capacity of titanium dioxide in China has increased steadily, while the production capacity of international titanium dioxide is gradually decreasing. The following is the announcement of international titanium dioxide enterprises in the past year:

On July 27, 2023, Comu announced its financial results for the second quarter of 2023 and announced the closure of the Guanyin titanium dioxide production plant in Taiwan. "the factory closure is incredibly difficult because it affects talented and hardworking people like our Quan Yin colleagues, who are valuable members of our company, as well as their families and communities. We are working closely with local leaders to help with this transition, "said Denise, president of Chemours Titanium Technologies." Dignam said. The Guanyin factory will stop production on August 1, 2023 and begin to withdraw immediately. Chemours's sales and technical service team will work closely with affected customers to maintain an uninterrupted supply. The company expects that during this transition period, there will be no impact on the quality of products or services, nor will there be supply disruptions.

In early February 2024, the new board of directors and management of Venator announced a transformative business plan after the bankruptcy restructuring of the company-following the closure of the 80,000 tons / a capacity in Scalino, Italy, the continued closure of the titanium dioxide plant in Duisburg, Germany (50,000 tons / a), and the reasonable adjustment of the remaining 130000 tons of titanium dioxide production capacity in Europe. President and CEO Simon Turner said that the dismantling of the titanium dioxide production line in Duisburg would be completed in the second quarter, focusing on the operation of other additives, while the special titanium dioxide business would be transferred to Juerdingen, Germany.

On May 10, 2024, ISK (Ishihara, Japan) announced plans to restructure its inorganic chemicals business. ISK announced today that its board of directors has approved plans to restructure its inorganic chemicals business and will permanently close its sulfate production business at Yokkaichi of Japan by the end of March 2027. ISK has been studying how to restructure its inorganic chemicals business, and we face fierce competition with Chinese companies in this area. As a result, while we continue to fulfill our supply responsibilities as the only chlorinated titanium dioxide (TiO2) product supplier in Japan, we will significantly transform our production structure to functional materials such as electronic component materials. In order to minimize the possible inconvenience caused by the suspension of sulfate production, we will continue to operate the plant until the end of March 2027, while we will also study the possibility of cooperation with other companies.

On May 31st, 2024, Chemours (Chemours ") global chemical company Altamira (NYSE: CC) announced that it would comply with the government's request to temporarily reduce water intake, resulting in the suspension of production of its Altamira titanium dioxide production line as a result of a severe drought affecting much of Mexico. Titanium dioxide is a water-saving production facility for the surrounding community. Due to the uncertainty of uncontrollable factors, Comu is currently unable to predict the duration of the event.

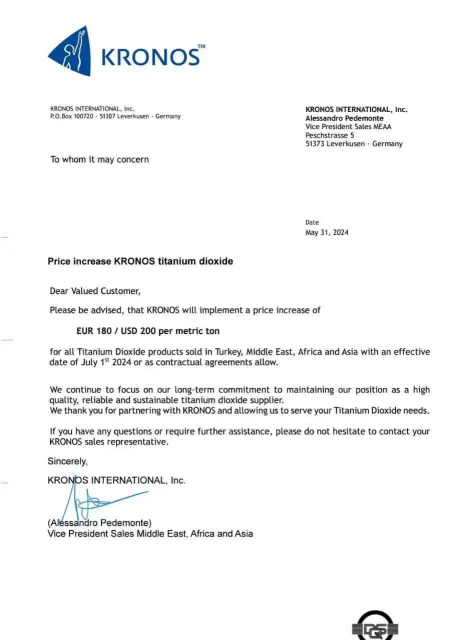

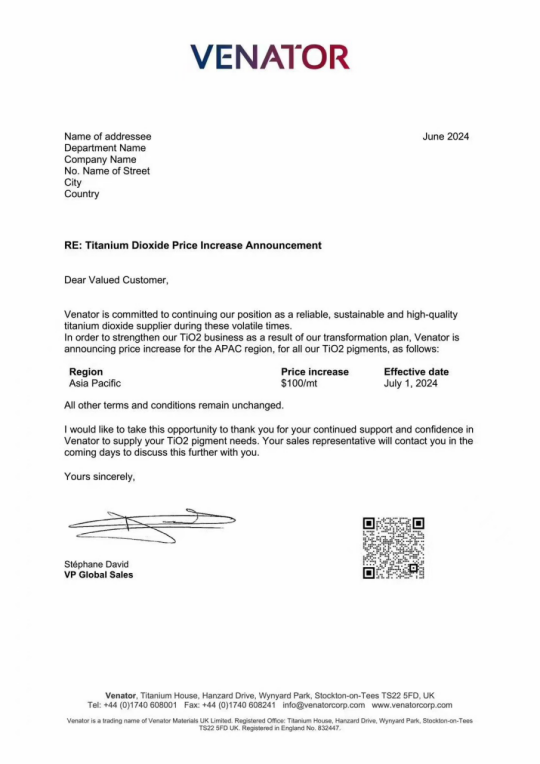

This week, the titanium dioxide export market due to the reduction of titanium dioxide supply in the Comu Mexican factory, imported Komo titanium dioxide is temporarily supplied by the United States factory, under the increase in freight costs such as logistics, coupled with the recent sharp rise in sea freight prices, the international titanium dioxide market set off a new round of price increase letters, Komu, Konos, and Pontos have sent letters one after another that the price of titanium dioxide in the Asia-Pacific region / Asia will rise by 100-200 US dollars / ton from July 1. However, at present, the Chinese titanium dioxide market is in the off-season, and after the price of titanium dioxide in China has been lowered one after another, the market transaction sentiment has improved slightly, while under the high operating rate, the terminal demand is still weak, the market digestion is under pressure, and market participants are more bearish on the aftermarket, so the impact of the international titanium dioxide price increase on Chinese prices remains to be seen. The market is weak, the attention of enterprises in the maintenance plan has also increased from June to July, and the price is discussed one by one, and the titanium dioxide market is expected to continue to be weak in the later period.