Polyester: Short-term negative oil pressure polyester market trend weakened

The OPEC+ meeting officially came to an end on June 2, and the postponed production reduction was finally implemented, in line with market expectations. There were other terms in this meeting that attracted market attention and brought short-term negative sentiment. The statement stated that it is planned to phase out the production reduction of 2.2 million barrels per day from October 2024 to September 2025, which means that output will gradually increase from the third quarter. Compared with postponing production cuts, the market's reaction will be more intense., European and American crude oil futures fell sharply.

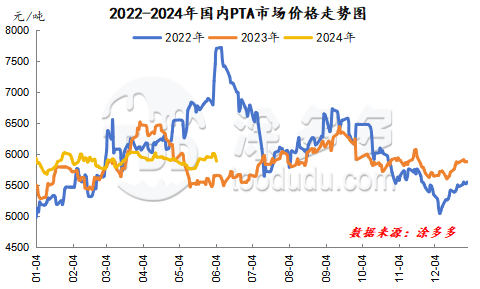

Under the pressure of falling international crude oil, China's commodity market generally fell. Since Monday, the polyester raw material PTA futures market has begun to fluctuate and fall back. So far, the East China PTA spot market has dropped to 5890 yuan/ton. This week and next week, the main port and warehouse receipt delivery 09 contracts were traded and negotiated near the premium of 30-40, and the spot basis was strong. At present, China's PTA supply and demand side is weak, which has put a certain pressure on the market. From the supply side, Hanbang's 2.2 million-ton PTA unit resumed operation in early June, and the unit was stopped in January 2021. Yisheng New Materials No. 2 3.6 million-ton PTA unit was overhauled on May 15 and is expected to restart 50% on June 5, with the rest delayed. Although the short-term PTA start-up load has rebounded slightly, PTA processing fees are still at a low level, and companies are less motivated to start construction. There are still plans for storage and maintenance of multiple units in mid-June, and the start-up of PTA companies will temporarily remain low. From the demand side, the production and sales of polyester companies have been sluggish recently, and the inventory pressure of enterprises will increase. In addition, polyester companies have maintained a loss in production recently, and polyester companies still have plans to reduce production in the later period. With the emergence of the off-season atmosphere in summer, new foreign trade orders in terminals have begun to weaken, follow-up on raw material stocking has slowed down, and the demand side has put pressure on the market. At present, the market is intertwined with bad news. In the short term, China's PTA market still has a slight weakening trend.

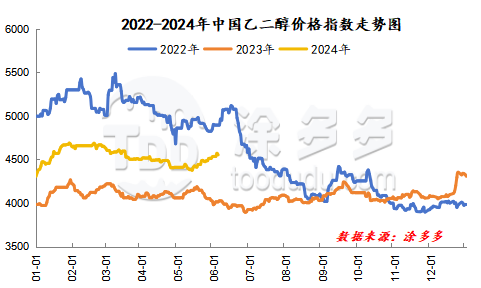

Under the pressure of macro-negative conditions, although China's ethylene glycol market has also declined, the overall decline is limited, mainly because the supply and demand side of the ethylene glycol market itself remains tight, which has formed certain support for the spot market. Recently, shipments of ethylene glycol from the main port have remained high, inventories from the main port in East China have continued to be depleted, and supply and demand have continued to be tight, providing support for the market. The downstream polyester load remains high, terminal antifreeze is gradually entering the peak season for production and sales, and the market is just in need of stability. The supply and demand sides maintain the pace of destocking, which has formed positive support for the market. However, the restart of some ethylene glycol maintenance equipment, coupled with the macro side being short, has greater market resistance, and the ethylene glycol market will mainly fluctuate within a narrow range in the short term.

As the most important event in the crude oil market in the near future, the OPEC+ meeting will give priority to guiding oil prices. The negative sentiment triggered by this meeting in the short term may not last long. The atmosphere of production reduction will still form a positive support for oil prices in the first three quarters. Coupled with the fact that the peak season of traditional fuel consumption in the United States will gradually increase, high international oil prices are expected to remain a high probability event. The cost side still provides certain support for the polyester market, and there is no big negative on the supply and demand side of the polyester market itself. Therefore, in the medium and long term, the space under the market will be limited. In the later period, we will pay close attention to changes in the raw material market and the supply and demand side of polyester itself.